A fresh bout of volatility could be here for stocks, if history is any indication.

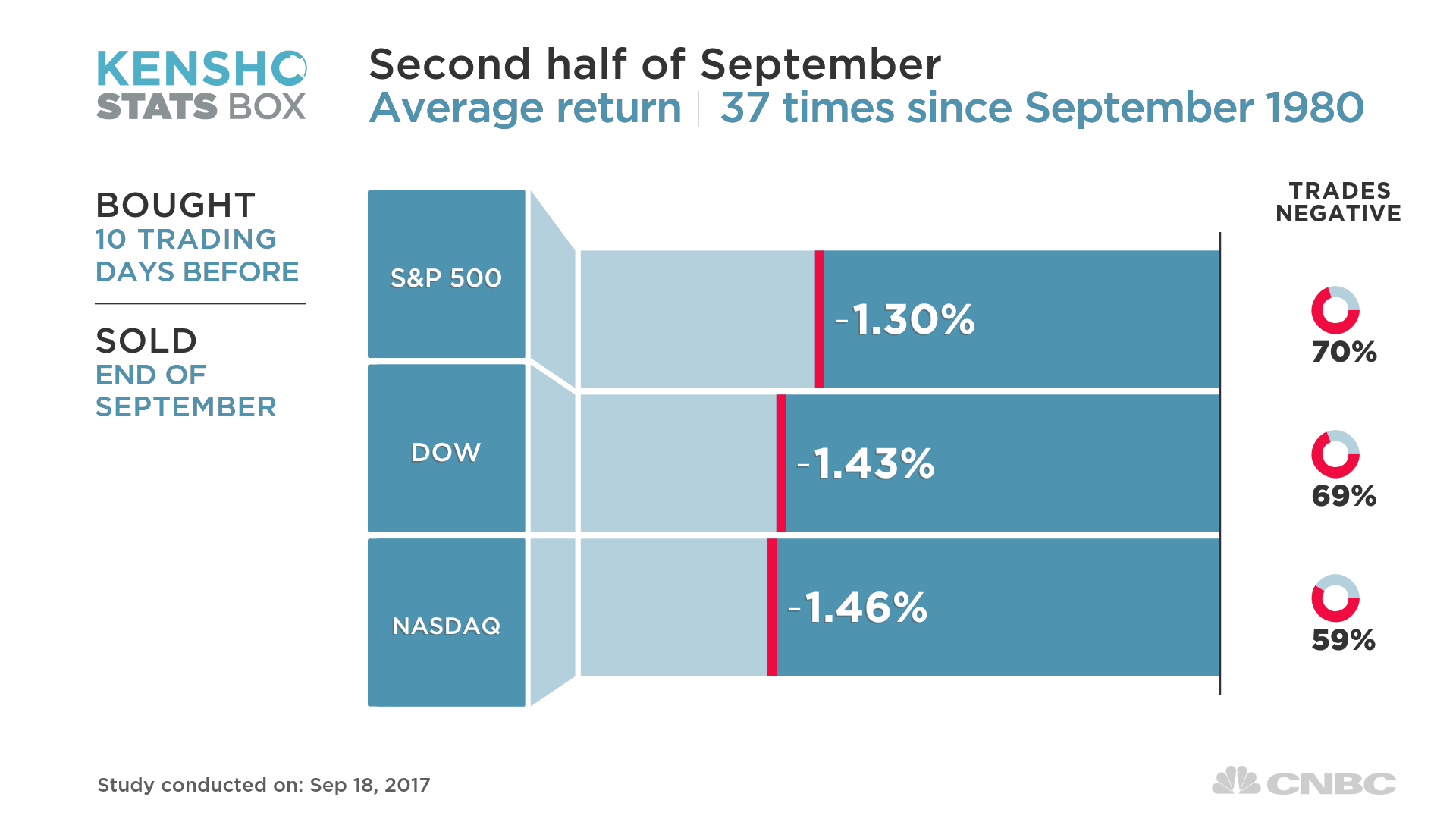

CNBC analysis using Kensho found that the S&P 500 has traded lower 70 percent of the time during the last two weeks of September since 1980. In that time, the index’s average return has been negative 1.3 percent, the analysis found.

“The summer doldrums are coming to an end,” said Ryan Detrick, senior market strategist at LPL Financial, in a phone interview with CNBC. “There’s also a lot of book clearing ahead of the fourth quarter. The fourth quarter is the strongest one on average” for the S&P 500.

The S&P 500 is up 1.4 percent this month and currently sits at a record high. But there are reasons why September could still live up to its dreadful reputation in the stock market.

First, the Federal Reserve will likely start the process of unwinding its $4.5 trillion balance sheet after a two-day meeting this week. The central bank accrued most of its massive portfolio during the financial crisis.

This will be the first time a central bank attempts an unwinding of this magnitude. In the past, smaller balance-sheet reductions have sparked recessions.

“This tightening cycle is about to ramp up with liquidity being drawn each and every month and by another higher increment after 3-month intervals until at some point $50 billion per month of liquidity will suddenly disappear,” said Peter Boockvar, chief market analyst at The Lindsey Group, in a note.

Boockvar also said he “will scream from some mountaintop … that I was dead wrong” if the Fed pulls off its balance-sheet unwinding along with raising rates and the stock market keeps rising.

Another reason September could still be dangerous for investors is tension between the U.S. and North Korea.

Last week, the isolated Asian nation launched a missile that flew over Japan before landing in the sea. The launch took place after the U.N. Security Council unanimously imposed a ban on North Korea’s textile exports and capped its crude oil imports.

“In an environment where markets have scarcely reacted to recent terrorist attacks, the recent string of North Korean news has captured investors’ attention,” said Jack Ablin, chief investment officer at BMO Private Bank.

“The increased frequency, power and pretentiousness exhibited by these tests seem to confirm what governments have long feared: North Korea is closer than ever to its goal of building a military arsenal that can viably target both U.S. troops in Asia and the U.S. homeland,” Ablin said.

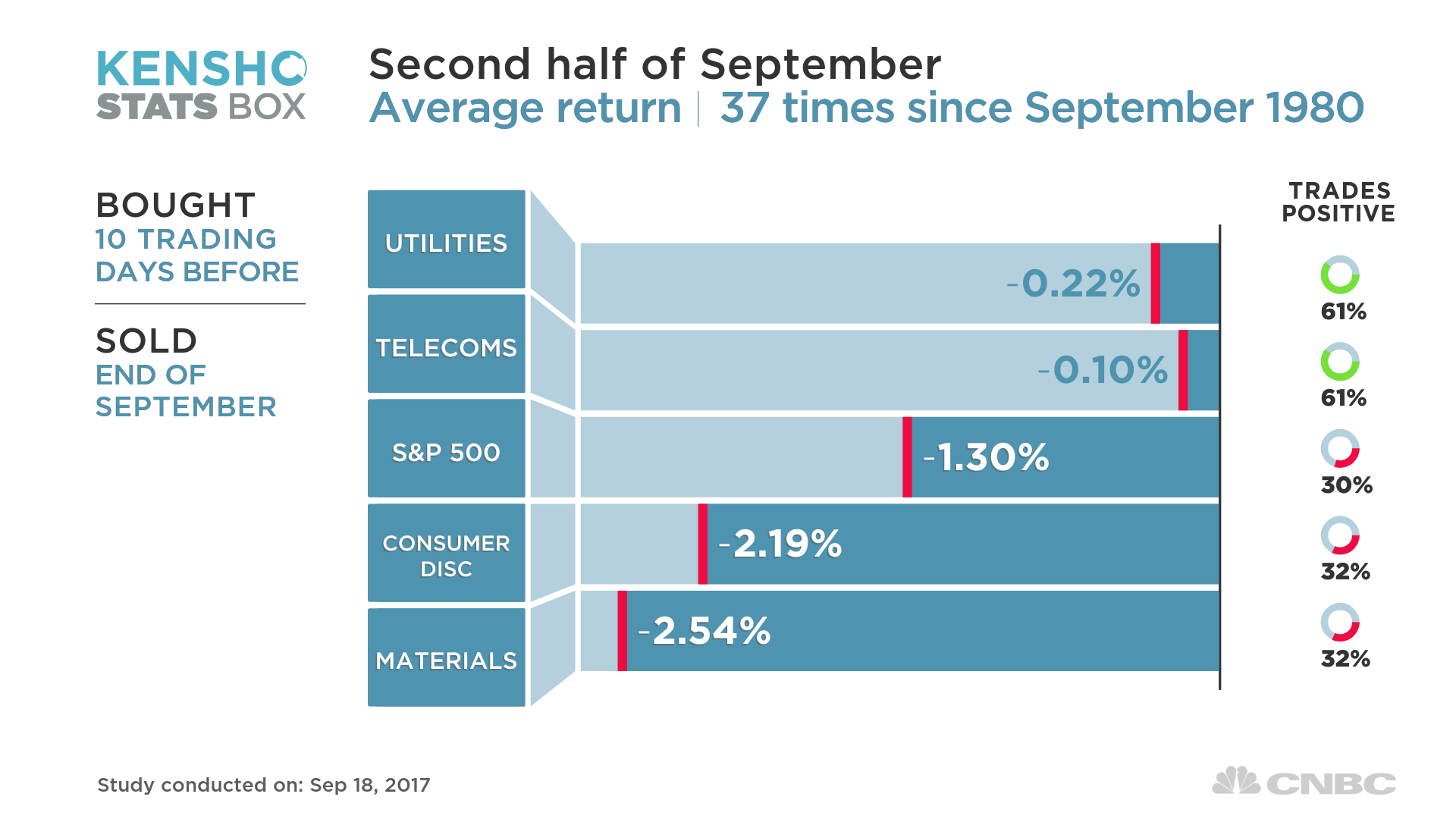

The best-performing sectors during these final two weeks have been defensive safe havens utilities and telecommunications. They both trade positive 61 percent of the time in the final two weeks of September.

However, even those sectors posted average returns in the read, amounting to negative 0.1 percent and negative 0.2 percent for telecoms and utilities, respectively.

The worst performers were consumer discretionary and materials, which averaged returns of negative 2.19 percent and 2.54 percent, respectively. Both sectors also traded positively just 32 percent of the time.

September overall has historically been a terrible month. In fact, the S&P 500 has averaged its worst monthly return during September since 1950. But so far this month, things are going just fine and the market is back up at record highs. Bulls see reasons for this continuing.

On Sept. 25, congressional Republicans are expected to release an outline of their tax reform plan. While it’s not clear how detailed the draft will be, GOP leadership — including House Speaker Paul Ryan and Treasury Secretary Steven Mnuchin — has recently insisted that a tax overhaul would take place before 2018.

“At this point, most people have written off tax reform until spring of next year,” said LPL’s Detrick. “If we get any indication that it could come sooner, that could lift the market.”

Disclosure: NBCUniversal, parent of CNBC, is a minority investor in Kensho.

Source: Investment Cnbc

The stock market just entered a dead zone that sees it drop 70% of the time