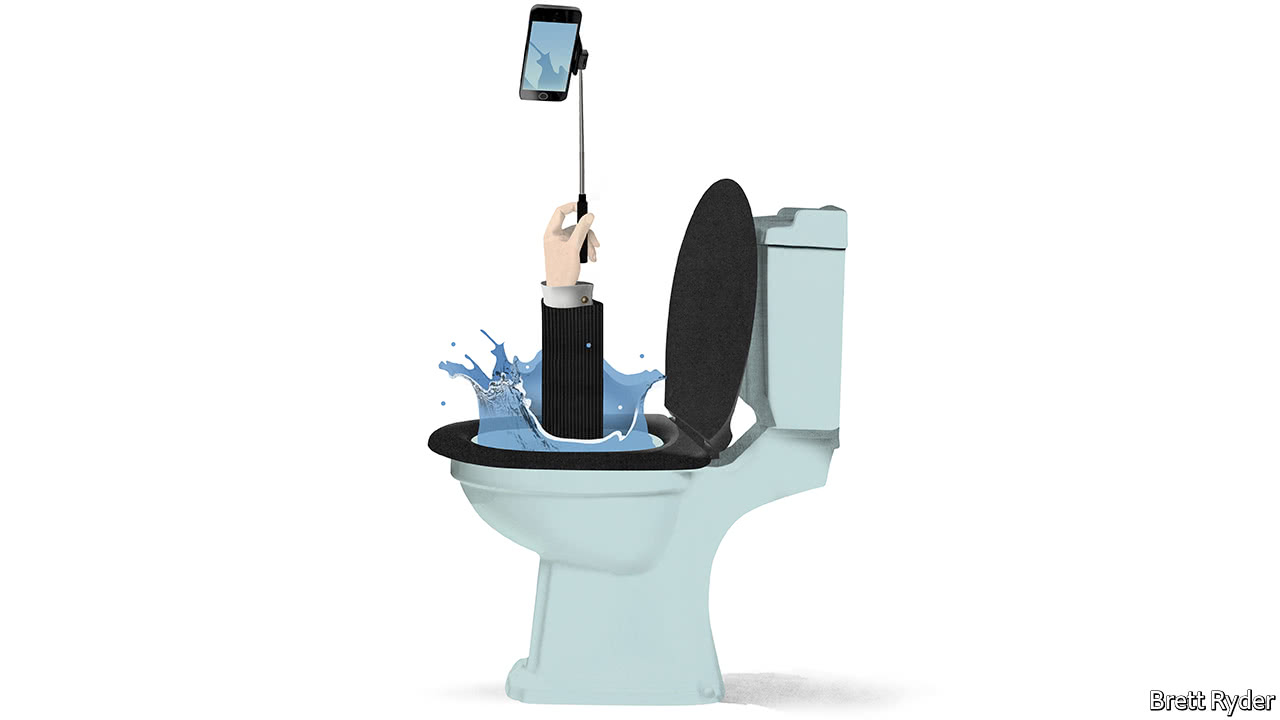

THREE-QUARTERS of Americans admit that they search the web, send e-mails and check their social-media accounts in the bathroom. That is not the only connection between tech and plumbing. The water and sewage industry offers clues to the vexed question of how to regulate the Silicon Valley “platform” firms, such as Alphabet, Amazon and Facebook. The implications are mildly terrifying for the companies, so any tech tycoons reading this column might want to secure a spare pair of trousers.

In America and in Europe a consensus is emerging that big tech firms must be tamed. Their dominance of services such as search and social media gives them huge economic and political clout. The $3trn total market value of America’s five biggest tech firms (Apple and Microsoft are the other two) suggests that investors believe they are among the most powerful firms in history, up there with the East India Company and Standard Oil.

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

How taxes can align the interests of individuals and society

-

The case against shrinking the Fed’s balance-sheet

-

Can companies block employees’ class-action lawsuits?

-

Kenya’s supreme court explains why it annulled last month’s presidential poll

Trustbusters in need of instant gratification want to break up the companies, but this might make their services less useful (imagine having ten social-media accounts), and network effects might mean that one of the tiddlers would grow dominant again. Others want tech firms to license their patents for nothing, as AT&T was required to do in 1956. This might create startups tomorrow, but will not stop firms exploiting monopolies today.

An alternative is to regulate these companies like utilities—monopolies with high market shares that provide an essential service from which it is expensive for consumers to switch. Here, the water industry is relevant, particularly the concept of a regulated asset base (RAB). It emerged in the 1990s when Britain was privatising its water firms, borrowing elements from American regulation. It is an acronym that few in Silicon Valley are aware of. But from these obscure origins RAB frameworks are now common in Europe and Latin America, used to regulate at least $400bn-worth of power, airport, water and telecoms assets.

The idea is that the monopolist’s profits should not exceed the level that a competitive market would allow. That means estimating the cost to an imaginary new entrant of replicating the incumbent’s assets (this is the RAB) and calculating the profits the newcomer would make if its returns matched its cost of capital. The actual monopoly’s earnings should not exceed this amount. Safeguards are added to ensure the utility is run efficiently, keeping costs low. Regulators review the framework every few years.

How might utility-style regulation work for Silicon Valley firms? Consider a thought experiment with Facebook. Its 1.3bn users pay nothing, but give it their data and control over the adverts they see. Facebook then sells advertisers targeted access to its users, pulling in $27bn last year. Imagine that the service were “unbundled”, giving users control. All would own their data and could choose whether to sell them to advertisers. They would also have to pay Facebook a fee to compensate it for the cost of creating and operating the network.

The big question is how much compensation—profits—Facebook and other firms would deserve if they were treated as utilities. It is possible to get a rough idea. Assume a cost of capital of 12%—a high figure to reflect the risk inherent in tech firms’ models. Estimating their RABs is harder. They have some physical assets such as data centres, but unlike utilities their main resources are not pylons, pipes and property, but software and ideas that they create or acquire by buying rivals. Only some of these intangibles appear on their balance-sheets; the vast sums spent on research and development (R&D) do not. But you can reconfigure their balance-sheets as if all their R&D in the past had been recognised as an asset with a 20-year life. Alphabet and Facebook would have a combined RAB of $160bn. If their returns were capped at 12%, operating profits would fall by 65% and 81% respectively.

If their services were unbundled, users would benefit. Using figures from 2016, the average Facebook user would pay $15 a year to the firm for its return on its RAB, but they would pocket $23 from selling advertisers their data and the right to be advertised to. A Google user would pay $37 a year to Google, but collect $45 from advertisers. Those are fairly small sums, but richer users with particularly valuable data could make much more.

Bog standard

Regulating tech like water would cause an outcry among investors and in Silicon Valley. Yet some of the objections do not stack up. Essential investment would still happen—a guaranteed 12% return is a handsome reward. The firms could invest in new technologies that would remain outside the regulated utility. It would be possible to work out which assets sit abroad and exclude them from the RAB, or to reach arrangements with foreign regulators.

This approach would have shortcomings, though. Tech moves at the speed of light compared with conventional utilities. It was only five years ago that investors worried that Facebook would struggle with the shift to mobile phones. Regulators would be clumsy at coping with rapid change. And a RAB methodology would not resolve the incendiary issue of whether tech platforms should be responsible for what they publish.

Despite such problems, tech bosses should view regulation as utilities as a long-term risk. They have two defences. First, to bundle their services so tightly that it is impossible for outsiders to isolate the products that are monopolies and work out their profits and assets. Amazon is a master here. It is unclear how much it makes or has invested in e-commerce (where it is dominant), videos (where it is a challenger), or food (where it is a new entrant).

The second defence is to lobby Washington. The lesson from America’s veteran oligopolists—airline, telecoms and health-care companies—is that you can manipulate and dance around the regulatory system to ensure high profits. For tech firms, financial obfuscation and cronyism are the most effective ways to ensure their monopoly profits do not go down the drain.

Source: economist

What if large tech firms were regulated like sewage companies?