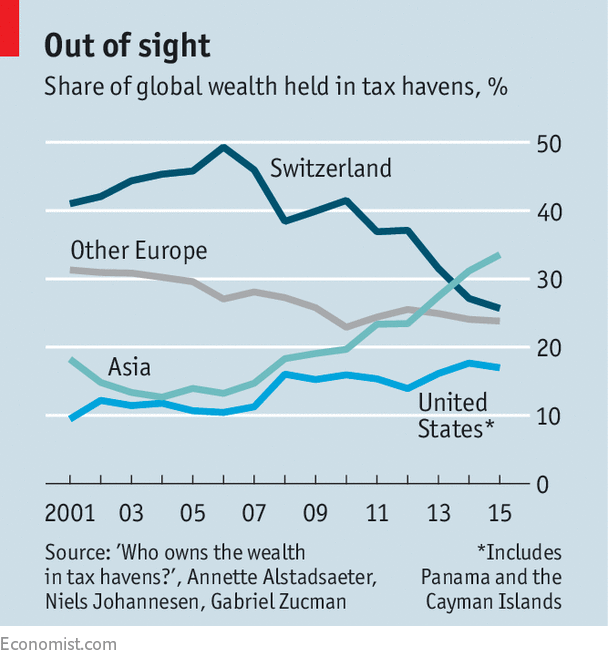

SWITZERLAND, which developed cross-border wealth-management in the 1920s, was once in a league of its own as a tax haven. Since the 1980s, however, tax-dodgers have been spoilt for choice: they can hide assets anywhere from the Bahamas to Hong Kong. The percentage of global wealth held offshore has increased dramatically. But it has been hard to say how much that is, and who owns it.

Few offshore centres used to disclose such data. But in 2016 many authorised the Bank for International Settlements (BIS) to make banking statistics publicly available. Using these data, a new study by Annette Alstadsaeter, Niels Johannesen and Gabriel Zucman, three economists, concludes that tax havens hoard wealth equivalent to about 10% of global GDP. This average masks big variations. Russian assets worth 50% of GDP are held offshore; countries such as Venezuela, Saudi Arabia and the United Arab Emirates climb into the 60-70% range. Britain and continental Europe come in at 15%, but Scandinavia at only a few per cent.

-

Flyers rarely complain even when they have cause to

-

How daughters change the behaviour of influential men

-

What men and women think about their partners’ careers and help at home

-

Who does the most in your household?

-

Latinos have become Chicago’s second-largest ethnic group

-

Kazuo Ishiguro, a Nobel laureate for these muddled times

One conclusion is that high tax rates, like those in Denmark or Sweden, do not drive people offshore. Rather, higher offshore wealth is correlated with factors such as political and economic instability and an abundance of natural resources.

Proximity to Switzerland also remains a good indicator. But assets held there have declined since the financial crisis (see chart), whereas those in Hong Kong grew sixfold from 2007 to 2015. The territory now ranks second behind Switzerland. Mr Zucman attributes this to foreign pressure on Swiss banks following recent scandals, coupled with a surge of wealth in Asia.

Accounting for offshore holdings suggests wealth inequality is even greater than was thought. In Britain, France, and Spain the top 0.01% of households stash 30-40% of their wealth in tax havens. In Russia, most of it goes there. In America, the share of wealth held by the richest 0.01% is as high today as in early 20th-century Europe. Including offshore data increases the wealth share of the super-rich.

Yet plenty of data are still missing. A few big centres, including Panama and Singapore, still do not disclose these statistics. The BIS data also cover only bank deposits, not the securities in which most offshore wealth is held. Researchers made estimates to plug the gap, but their figures are likely to be conservative.

Mr Zucman thinks tax havens should be forced to be more transparent, and that institutions that facilitate tax evasion should face stiffer penalties. Fines are often seen as the cost of doing business and are small compared with profits. Threatening to withdraw banking licences would be a stronger deterrent. “There’s a strong demand from all over the world for tax-evasion services,” he says. “Without large enough sanctions, there will always be a supply to meet that demand.”

Source: economist

A new study details the wealth hidden in tax havens