A prominent Wall Street strategist who predicted bitcoin could more than quadruple in value in five years has created five indexes to track digital currencies.

Fundstrat Global Advisors’ Thomas Lee said in a report Friday that the FS Crypto FX indexes are for institutional investors “to better understand the evolution and behavior of crypto-currencies.”

In July Lee, the former chief equity strategist at JPMorgan Chase, boldly predicted bitcoin could be worth more than $20,000 by 2022. It hit a high of $4,417.45 on Friday. He was the first major Wall Street strategist to formally present his views on bitcoin, and remains the only one.

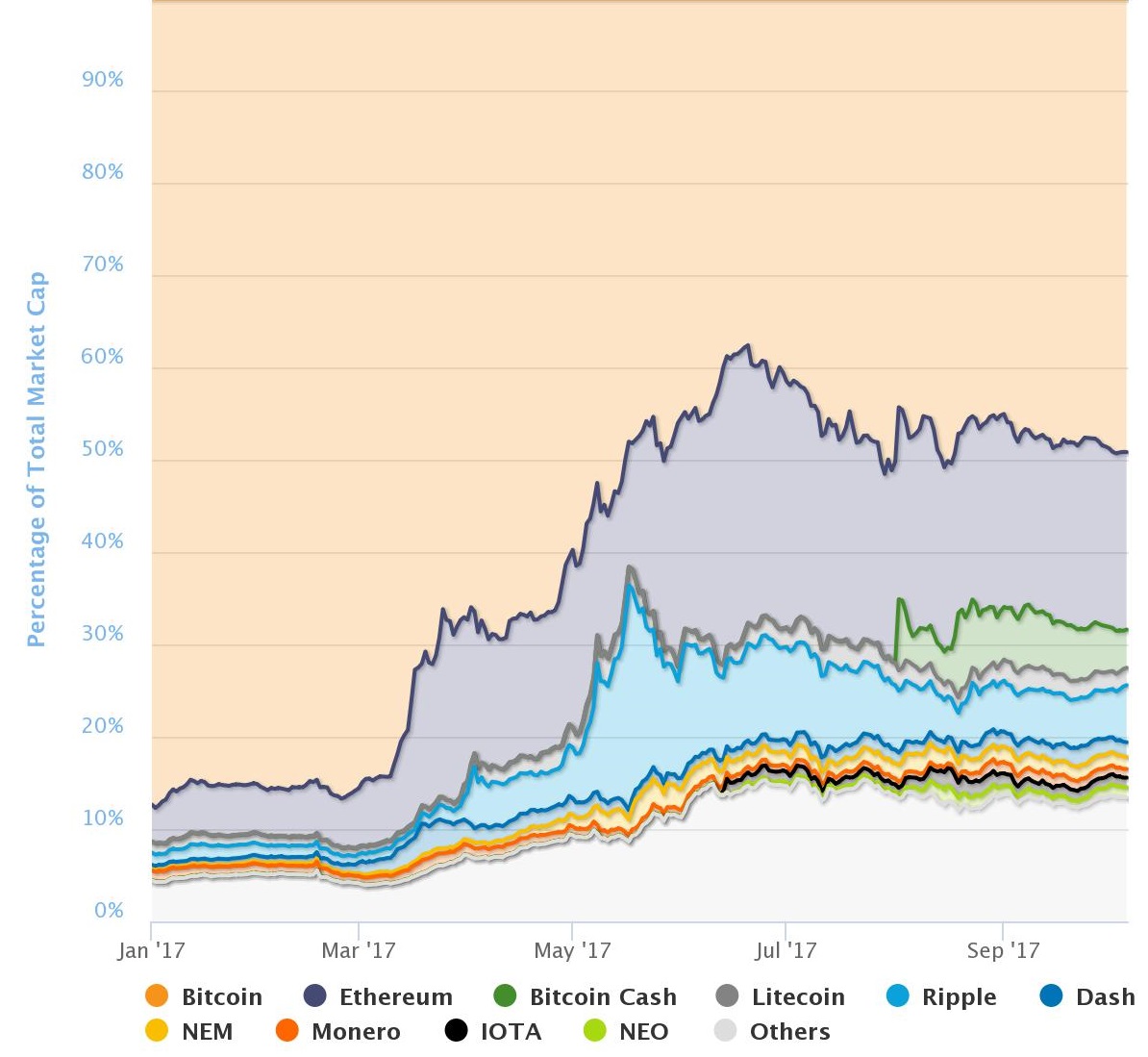

Percentage of total cryptocurrency market capitalization by digital currency

Source: CoinMarketCap

Fundstrat’s indexes track a total 630 digital currencies, divided into five groups by market capitalization and trading volume.

Investors can then analyze the relative performance of different digital currencies within the indexes, similar to how the advance-decline line of the number of S&P 500 stocks rising versus falling on a given day can indicate the health of the market.

The advance-decline line for digital currencies peaked in June, Fundstrat Technical Strategist Rob Sluymer, said. “It gives us a sense that something’s happening in the cryptocurrency move, that you don’t have the same speculative move as you had in the first quarter, second quarter,” Sluymer told CNBC in a phone interview.

The five indexes Fundstrat has created are:

- FS Crypto 10 — tracks the 10 largest and most liquid digital currencies including bitcoin, ethereum, ripple, litecoin, dash, IOTA and monero.

- FS Crypto 40 — tracks the top 11 to 50 digital currencies by market value and liquidity including NEM, BitConnect and Lisk.

- FS Crypto 250 — tracks the top 51 to 300 cryptocurrencies by market value and liquidity including BitcoinDark, Singular DTV and FirstCoin.

- FS Crypto 300 — tracks the 300 largest digital currencies by market value and liquidity.

- FS Crypto Aggregate — tracks the performance of 630 digital currencies.

Fundstrat said it uses a proprietary algorithm to determine the weighting of each coin in an index, which is reconstituted every quarter. The indexes are intended for research right now, rather than supporting any investment products, Sluymer told CNBC

Some digital currency enthusiasts have already created their own indexes. In July, tech entrepreneur Roger Bryan launched the Digital Currency Index, which tracks 30 significant digital currencies. William Mougayar, a venture capitalist who organized the Token Summit in New York this May, announced Thursday he is launching the William Mougayar High Growth Cryptoassets Index, tracking a basket of 15 digital currencies.

The development of the digital currency indexes also reflects the growth of the market to a size that may be increasingly attractive to institutional investors, Fundstrat’s Lee said in the report. He pointed out daily trading volume in the 10 largest digital currencies is a “surprisingly high” $3.5 billion.

In his Friday analysis, Lee also noted that even a 2 percent allocation to digital currencies would have added about 2.29 percent to total return for a traditional portfolio with 60 percent allocation to stocks and 40 percent to bonds.

Digital currencies like bitcoin have soared to record highs this year amid increased interest, particularly from institutional investors.

Bitcoin is up more than four times in value for the year, according to CoinDesk. Ethereum traded mildly higher on Friday near $302, up more than 3,000 percent for the year.

To be sure, digital currencies tend to be highly volatile and the majority have tiny market capitalizations.

Only 11 cryptocurrencies have a market capitalization above $1 billion, according to CoinMarketCap. About 345 digital currencies have a market value between $1 million and $100 million. The largest digital currency by market cap, bitcoin, has a market value of $72 billion, slightly less than that of Adobe.

The Fundstrat report also included technical analysis of some of the largest digital currencies by market cap.

For bitcoin, Sluymer doesn’t expect its price to break above $4,800 to $5,000 before the end of this year. Ethereum also appears to be struggling for further gains, but the price should not fall below $206 or $195, Sluymer said.

Source: Tech CNBC

Fundstrat launches five indexes to track bitcoin and other digital currencies