Wednesday’s stress test results could mark a turning point for financial stocks, which have lagged all year.

The Federal Reserve is set to report at 4:30 p.m., ET, on whether it approves big banks’ plans to pay capital to shareholders. Analysts expect at least several of the big banks to come out of the test with plans to substantially increase returns to shareholders — potentially using cash reserves to pay out more than 100 percent of their profits.

Plans to increase these payouts generally reflect banks’ confidence in their own financial health.

The Fed’s move follows its annual first round of stress tests, the results of which were announced last Thursday. For a third straight year, all 34 banks passed the Fed’s requirements for being able to handle a severe recession. Thursday’s announcement, the second round of tests, only applies to 13 banks, or those with assets of more than $250 billion.

They include Goldman Sachs, JPMorgan Chase, Morgan Stanley, Wells Fargo, Bank of America and Citigroup. This round of the stress tests will also look at five foreign banks: Barclays, Credit Suisse, Deutsche Bank, RBC and UBS. However, the Fed will not report the foreign bank results publicly this year.

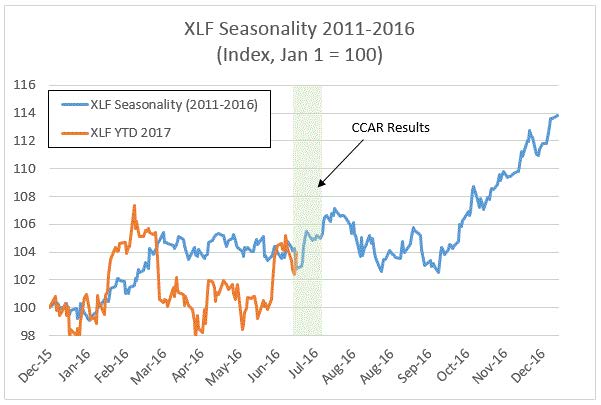

In the last six years, historical analysis shows financial stocks tend to perform well after the results of this second round of testing, officially called the Comprehensive Capital Analysis and Review, or CCAR.

Jim Strugger, managing director, derivatives strategist at MKM Partners pointed out that the Financial Select Sector SPDR ETF (XLF) has tended to reach its lowest point for the year around the second round of the stress tests.

Financial stock performance around the Fed’s capital review results

Source: MKM Partners

The financials ETF jumped 1.3 percent Wednesday morning, on pace for its best day since June 9 and its third straight day of gains.

Encouraging stress test outcomes and higher payouts to shareholders could help the bank sector further, especially if the results help the Trump administration’s case for peeling back some regulation on the industry. Financials have struggled for much of this year even after their post-election bounce last year, briefly falling into negative territory for 2017 and now the third worst performer in the S&P 500.

Goldman Sachs expects Citigroup to announce a payout ratio of 124 percent and at least eight other banks to return more than 100 percent of their profits.

In addition to the payout ratios, Wall Street is watching Wells Fargo and Bank of America.

As for scandal-plagued Wells Fargo, Sandler O’Neill’s principal Jeffery J. Harte said there’s a “fairly high likelihood” the Fed will object to the firm’s request for higher capital return. Harte said he thinks management is making good progress in recovering from last fall’s consumer sales scandal, but he said historical precedence typically means such “incidents” result in the rejection of capital return plans.

If Bank of America raises its dividend above 44 cents, Warren Buffett’s Berkshire Hathaway could become the bank’s largest shareholder. Such an increase would prompt Berkshire to convert its $5 billion of preferred stock into 700 million common shares, Buffett said in his 2017 letter to shareholders. The Wall Street Journal first pointed out the potential change Wednesday.

To be sure, the financial stocks fell about 0.4 percent Friday after the release of the first round of stress tests last Thursday. High hopes ahead of the Wednesday afternoon report could also mute stock gains.

“Our only real concern is that market expectations could be jumping a bit ahead of banks’ willingness to become more aggressive in their return requests,” Harte said.

Financials remain the best performing stock sector since the election, up 22 percent over that time. Analysts expect financial firms will benefit the most from the Trump administration’s proposed tax reform and deregulation, as well as the Fed’s plans to raise interest rates.

—CNBC’s Dawn Giel, Jeff Cox and Gina Francolla contributed to this report.

Stress tests could mark bottom for bank stocks