Despite a relatively robust economy and a markedly low level of unemployment, inflation remains muted both in the United States and around the world. Why?

While granting that demographic shifts are part of the equation, BlackRock’s chief investment officer of global fixed income, Rick Rieder, argues that technological innovation tamps down profoundly on widespread price increases.

“We’re going through an incredibly historic pinpoint in time where you’ve done this amazing downward pressure on inflation coming through technology,” Rieder said Tuesday on CNBC’s “Trading Nation.” “It’s a very, very different dynamic than anything we’ve ever seen before.”

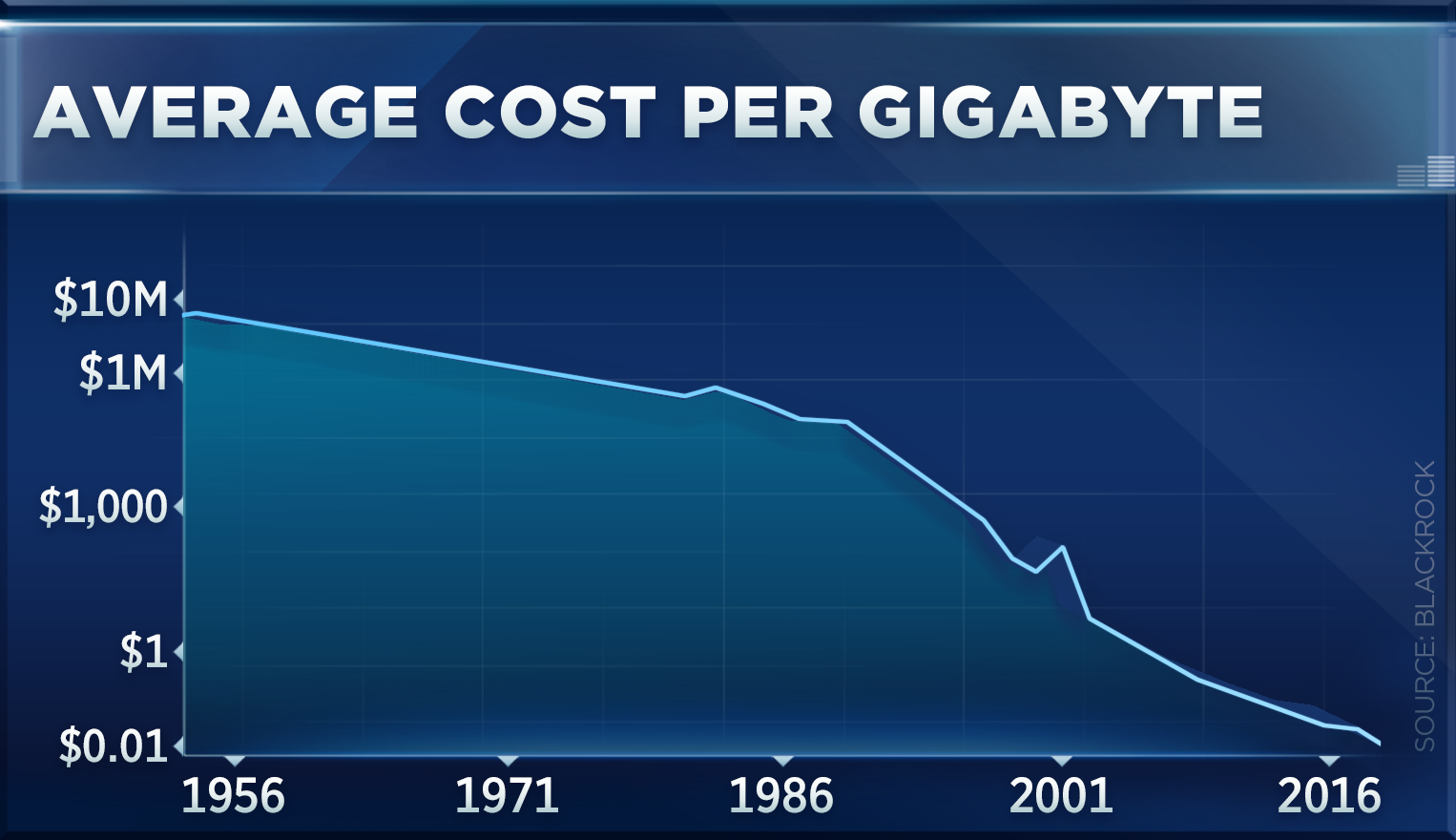

The most direct illustration of this is the fall in prices of computing power and data storage.

“An iPhone in 1991 storage and computing cost dollars would be worth $1.44 million per phone. An iPhone today costs a minuscule portion of that,” he said. “That gives you some sense for this incredible inflationary impact on so many things that are now done via mobile or done through automation.”

Another example is the tumbling cost of wireless telephone services.

Competition among carriers “has resulted in a near 13 percent year-over-year decline in wireless telephone services prices, which at the margins is weighing on recent CPI readings,” Rieder wrote in a recent note.

Indeed, the Bureau of Labor Statistics’ consumer price index to which Rieder refers has shown that prices are increasing by less than 2 percent per year, despite years of stimulative monetary policies from the Federal Reserve as well as an unemployment rate that has fallen to 4.3 percent. Rising employment is generally thought to lead to greater inflation, as supply-and-demand dynamics are expected to boost wages and hence consumers’ ability to spend increasing amounts of money on the same products.

To be sure, it’s not just the prices of technological products and services that are falling. Rieder argues that technological innovation “is disrupting traditional business models of many industries, putting a lid on prices and influencing inflation in the economy overall.”

After all, the consumer who buys an iPhone (or a competing product, of course) is effectively buying not just a phone and a personal computer but a camera, a radio, a television, a clock and more. From the producer perspective, this limits the prices that manufacturers of these more traditional items can charge; from the consumer perspective, this means that an individual can live more comfortably with less money, meaning there ought to be less pressure on employers to pay their workers more.

Going forward, Rieder argues that the Federal Reserve needn’t obsess over its 2 percent inflation target. Given the trend outlines above, inflation “varies radically by industry,” which makes a 2 percent systemwide inflation target “an increasingly challenging paradigm to execute on today in the more modern commerce era we live in.”

“Today, massive technological disruptions and long-term demographic trends are remaking the inflation landscape, and we believe both investors and policymakers need to abandon an overly rigid view of price change,” Rieder wrote.

Source: Tech CNBC

Technology is the hidden driver of low inflation: BlackRock’s Rieder