Amazon will most likely disappoint Wall Street with its fourth-quarter forecast, analysts at Goldman Sachs said.

“Investor focus remains on operating income with the view that guidance is likely to fall below sell-side consensus of $1.5bn,” Heath Terry, an analyst at Goldman, said in a note Wednesday.

“We expect the company to guide total revenue +26-34% yoy with $0mn to $1.0bn in GAAP operating profits, as guidance factors in the Whole Foods acquisition, [Amazon Web Services] growth accelerates modestly on an 800bps easier comp, and both revenue and expenses reflect the investments in new fulfillment centers and AWS regions,” Terry said.

The e-commerce giant is set to report third-quarter results on Thursday and its expectations for the final quarter of the year.

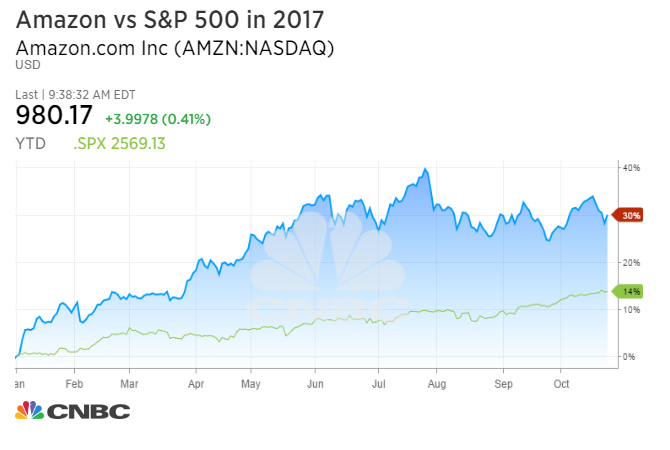

Amazon shares have handily outperformed the broader market in 2017. The company’s stock is up 30.1 percent for the year, while the S&P 500 has risen nearly 15 percent.

It’s unclear what the lowered guidance would mean for the stock. Amazon gave income guidance the last two earnings reports that were short of the consensus Wall Street estimate, but the stock kept climbing anyway.

Despite the expected lower guidance, Terry said investor are “underestimating the potential for organic growth reacceleration as the ~70% growth in infrastructure spend (CapEx and Capital Leases) over the TTM begins to deliver returns and AWS comps ease.”

Terry has a 12-month price target of $1,275 on Amazon — implying a 30 percent upside — and a buy rating.

Source: Tech CNBC

Goldman warns Amazon holders, predicts guidance may miss Wall Street expectations