ALL men are created equal, but they do not stay that way for long. That is one message of a report this month by the OECD, a club of 35 mostly rich democracies. Many studies show how income gaps have evolved over time or between countries. The OECD’s report looks instead at how inequality evolves with age.

As people build their careers, or don’t, their incomes tend to diverge. This inequality peaks when a generation reaches its late 50s. But it tends to fall thereafter, as people draw redistributive public pensions and quit the rat race, a contest that tends to give more unto every one that hath. Old age, the OECD notes, is a “leveller”.

-

India’s new aviation policies are breathing life into a once-ailing sector

-

The first data from a repository of living human brain cells

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

Why is the Dutch football team struggling?

-

Zaryadye Park in Moscow is an architectural triumph

Will it remain so? Retirement, after all, flattens incomes not by redistributing from rich seniors to poor, but by transferring money to old people from younger, working taxpayers. There will be fewer of them around in the future for every retired person, reducing the role of redistributive public pensions.

One logical response to the diminishing number of workers per pensioner is to raise the retirement age. But that will exacerbate old-age inequality, if mildly. Longer careers will give richer workers more time to compound their advantages. And when retirement eventually arrives, the poor, who die earlier, will have less time to enjoy their pensions.

Today’s youngsters may resent having to provide for more pensioners, not least because they feel that older generations have it easier than them. The OECD provides qualified support for this complaint. Baby-boomers (mostly born in the 1950s) have accumulated far more wealth (property, shares and other savings) than Generation X (mostly in the 1970s) and millennials (the 1980s and after).

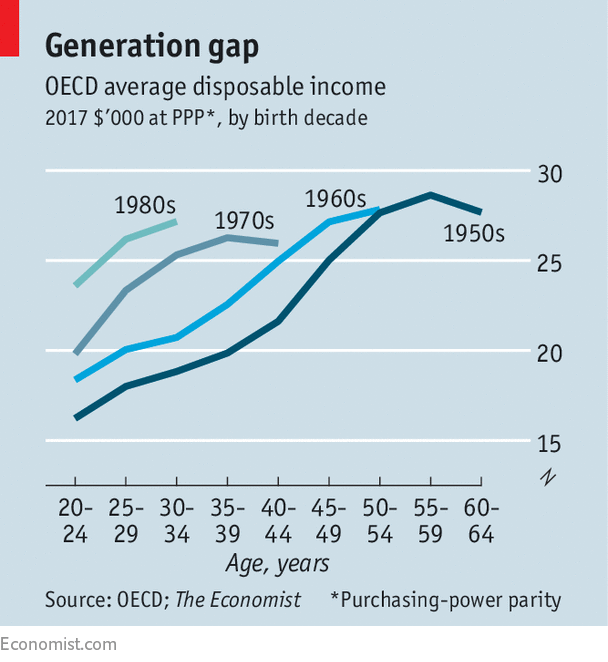

But that is partly because they have had more time to do so. Comparing generations at a similar stage of life paints a different picture. Today’s young adults have a significantly higher disposable income than previous generations had at the same age. OECD citizens now in their early 30s have 7% more than members of Generation X had at that age and over 40% more than boomers enjoyed when they were similarly short in the tooth (see chart). Youngsters may sigh with impatience when an old codger tells them how life was tougher “when I was your age”. But it was.

This millennial privilege is, however, smaller in America, which tends to set the tone for the generation wars. (Indeed Americans in their early 30s are slightly worse off than the preceding generation was at a similar age.) The gap also appears to close as the later generations get older. Gen-Xers were far more comfortable in their 30s than the people born a decade or two before them. But now they are in their 40s, their incomes have stopped rising, whereas their seniors enjoyed strong gains at the same age.

This may reflect the lingering influence of the global financial crisis. But if this trajectory persists, a time may soon come when old folk sigh with impatience as youngsters tell them how much easier life was “when you were my age”.

Source: economist

Millennials are doing better than the baby-boomers did at their age