ONE of the more persistent beliefs about the global economy is that Asians are more frugal than others. Explanations have drawn on culture (the self-discipline of Confucianism), history (memories of privation) and public policy (flimsy social safety-nets forcing people to save). For Lee Kuan Yew, the founding father of Singapore, and other theorists of “Asian values”, thrift was one of them. Whatever the true reason, data long supported the basic claim that Asian households were indeed careful with their cash. But over the past few years consumers across the region have done their best to prove that prudence was perhaps just a passing phase.

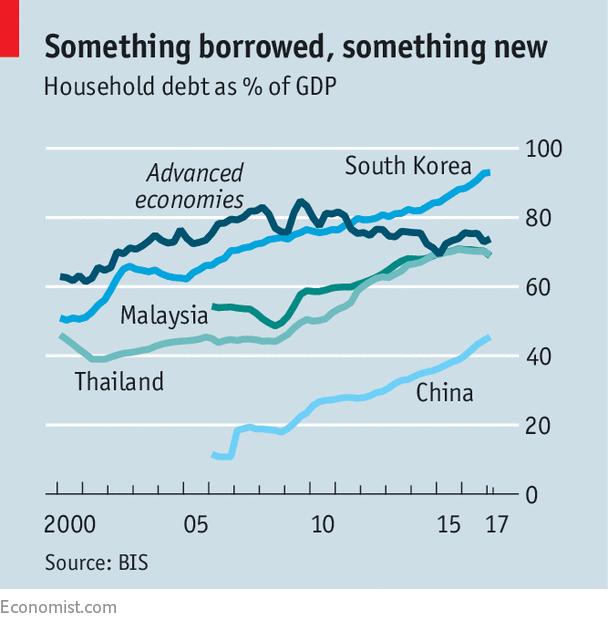

Household debt in advanced economies has generally declined as a percentage of GDP since the 2008 global financial crisis, according to the Bank for International Settlements. In a number of Asian countries, however, it has been going in the opposite direction (see chart). The biggest increase has been in China, where households have borrowed about $4.5trn over the past decade. But Chinese households were starting from an extremely low base. Relative to income levels, South Korea, Thailand and Malaysia have reached much loftier heights. Over the same period, consumer borrowing has also risen in Hong Kong and Singapore.

-

The making of the “Psycho” shower scene

-

Donald Trump dominates Virginia’s tight governor race

-

Interest rates rise in Britain for the first time in a decade

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

Why QR codes are on the rise

The increase in debt is, to a certain extent, healthy. An oft-heard criticism of Asian economies is that, in terms of global growth, they have been punching below their weight. They produce lots of stuff but rely on profligate Westerners to buy it. The rise in debt has, so far at least, helped change that dynamic, fuelling more consumption. Retail spending in Asia, excluding Japan, has grown by about 10% a year over the past half-decade. Greater access to credit has made it easier to buy homes, cars and clothes.

But debt can also be dangerous. A recent paper by the IMF observed that, in the short term, an increase in household borrowing props up economic growth and keeps unemployment down. After a while, though, these gains are reversed. The IMF study found that a five-percentage-point increase in the household debt-to-GDP ratio over three years tends to result in a 1.25-percentage-point decline in real growth three years in the future. And an increase of a single percentage point in household debt increases the likelihood of a banking crisis by a similar percentage.

In Asia financial fragility is not the main worry. Even if households have been indulging themselves more freely, most regulators have remained prudent. In South Korea they mandate that mortgages cannot exceed 70% of a property’s value. Singaporean homebuyers who borrow from banks must make downpayments of at least 20%—and potentially much more if they already have outstanding loans. Asian banks are also reluctant to pursue the kind of subprime lending that made consumer debt so toxic in America a decade ago.

The bigger risk in Asia is interest rates, says Frederic Neumann, co-head of Asian economic research at HSBC. He notes that fixed long-term rates are rare in the region. Most consumer loans have shorter durations, so if central banks start to increase rates, debt-servicing costs for households will quickly rise. That will eat into incomes and act as a drag on consumption.

It is already possible to detect headwinds. Mortgage payments in China have reached about 4.5% of total annual household income, up from 3.6% in 2015, according to Ernan Cui of Gavekal Dragonomics, a research firm. That, in turn, is beginning to weigh on consumption. For the government this entails a trade-off. The increase in mortgages has helped reduce a glut of unsold homes, which posed a graver danger to the economy than does consumer debt.

There is also an uglier side to the rise in household borrowing. As in other parts of the world, unscrupulous lenders prey on the most vulnerable. In South Korea the share of low-income households struggling under heavy debt burdens has been creeping up. Choi Pae-kun, an economist at Konkuk University in Seoul, points out that poorer people may have no choice other than to borrow to cover living and medical costs. In China online lenders have been involved in a series of scandals. Some have demanded exorbitant interest rates and, in a number of cases, forced students to post as collateral naked selfies, with the threat they could be distributed if dues are not paid. Debt can undermine Asian values in more ways than one.

Source: economist

Asian households binge on debt