The decision by General Electric to cut its dividend in half as the company restructures should be a warning to investors: Don’t count on income from dividends.

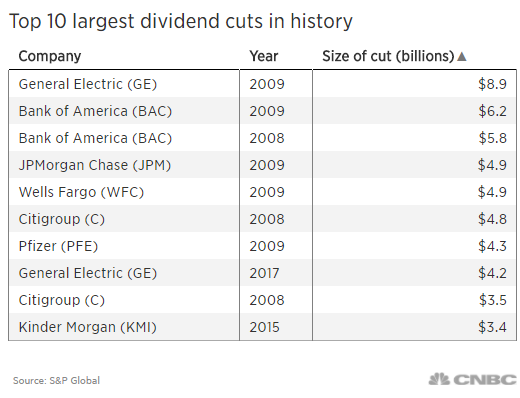

GE’s move reduces its quarterly dividend to 12 cents a share from 24 cents and will give its shareholders $4.1 billion less each year.

Because the company has only cut its dividend twice since 1899, the move may come as a surprise to some shareholders. Yet experts caution that investors need to be ready for such moves when investing in dividend stocks.

“There are no guarantees and the marketplace can change, so you need to be flexible,” said financial advisor Greg Ghodsi, managing director, investments at 360 Wealth Management Group of Raymond James.

Investors who depend on income in retirement or for other needs have gravitated to dividend stocks amid continuing low interest rates. GE’s move highlights how overexposure to dividend stocks can cause real problems, according to Ghodsi.

What happened to bank stocks during the financial crisis is one example, he said, when companies that once paid stable dividends cut them substantially.

“There are a lot of people that suffered significant pain and weren’t able to recover from it,” Ghodsi said.

Investors need to watch out for getting too emotionally attached to a single company, say when they inherit the stock from a parent who worked there for 30 years, Ghodsi said.

They also need to keep their time horizon in mind. A retiree who has plenty of income from a pension and Social Security may be OK holding onto the stock. Someone else who relies on that income could be overexposed, according to Ghodsi.

“It is critical that they know exactly what they own,” Ghodsi said. “Today it’s GE, but in a month or six months it will be another company.”

Individuals looking to invest in dividend stocks should evaluate a few things, according to J.J. Kinahan, chief market strategist at TD Ameritrade.

First, look at the stock price.

“You tend not to get any dividend cuts when the price is stable,” Kinahan said.

Second, for companies that don’t have a long history of paying dividends, look to see where else the company is putting its money. Signs of a strong business model include investing in new products and research and development, Kinahan said.

“Nothing is safe if you don’t regularly review it,” Kinahan said. “Be prepared and do a little homework.”

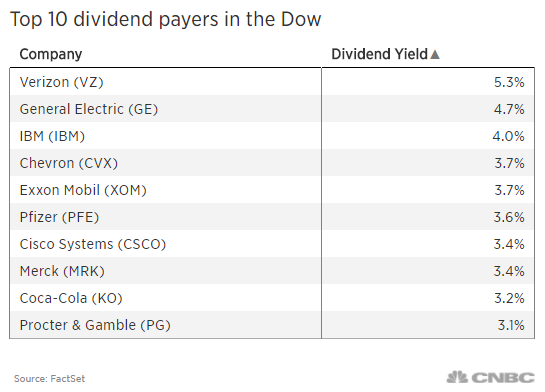

While some financial professionals see opportunity in the GE news, others say it’s another reason to be wary of large dividend-paying companies.

“I think this is the first time I’ve been positive on GE since the 1990s,” said Paul Schatz, president of investment management firm Heritage Capital in Woodbridge, Connecticut.

“I think people are going to mistake GE’s idiosyncratic problems with problems with large-cap dividends,” Schatz said. “There are plenty of really good stories out there in the dividend space that people should not ignore.”

Stephen Aniston, president and chief investment officer of investment advisory firm Black Peak Capital in Fairfield, Connecticut, said he sees other examples of dividend-paying companies that have had declining cash flows, earnings and sales, such as Coca-Cola and Caterpillar.

“They have had steady declines in earnings and cash flows over the last few years. They trade at increasingly higher multiples,” Aniston said. “The fundamentals of their businesses do not support increasing the dividend.”

More from Personal Finance:

Potential Senate tax tweak would curb pretax 401(k) catch-up contributions

Do this if you want to escape the GOP cap on mortgages

4 reasons to check your benefits before open enrollment ends

GE cut highlights danger of relying on income from dividends