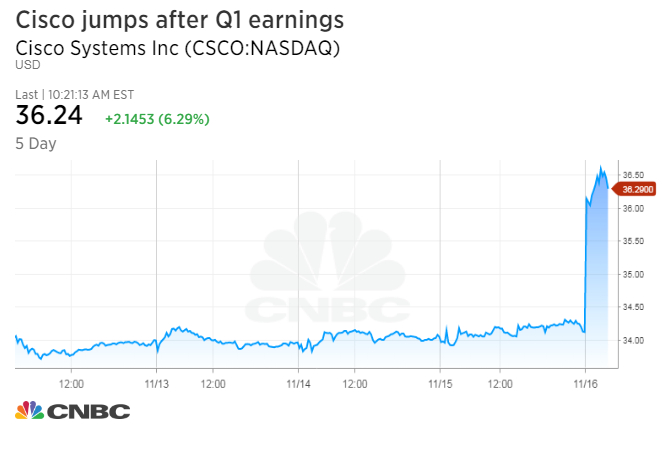

Shares of Cisco rallied on Thursday after the enterprise technology giant wowed Wall Street with better-than-expected earnings.

The stock rose about 6 percent Thursday morning after about a dozen Wall Street analysts listed in FactSet raised their earnings expectations for Cisco going forward.

- Adjusted EPS: 61 cents per share, excluding items, vs. 60 cents per share expected by a Thomson Reuters consensus estimate

- Revenue: $12.14 billion vs. $12.11 billion expected by a Thomson Reuters consensus estimate.

That’s the same earnings-per-share figure as Cisco reported this time last year, although last year’s first-quarter revenue was higher, at $12.4 billion.

Cisco’s profit margins were pressured by higher pricing and legal settlements, but sales were boosted by the company’s growing security business and subscription software. The company is investing in long-term growth and profits, Chief Financial Officer Kelly Kramer said in a statement. Cisco has made several recent acquisitions and is working on a hybrid cloud project with Google.

Daniel Ives, chief strategy officer and head of technology research at GBH Insights, said he expects Cisco to make more significant acquisitions in emerging businesses like security and cloud.

“You’ve seen the transition there, more of a subscription-model, software approach,” Ives told CNBC’s “Closing Bell” on Wednesday evening, after the earnings report was released. “They’re starting to make that shift to a more software-centric model …. That sort of transformation starting to happen, I think investors have something to hang their hat on here.”

Source: Tech CNBC

Cisco stock pops 6% as earnings beat, solidifying a transformation toward the cloud