LAST year nearly 3.7bn passengers took to the sky on commercial jets. Few would have given much thought to exactly why their flight was scheduled at the time it was. Even fewer know about the tussles between regulators and airlines over how landing and take-off slots are allocated.

For the past 70 years the business of thrashing out timetables at international airports has been the job of the Slot Conference, a semi-annual meeting of airlines and airport co-ordinators run by the International Air Transport Association (IATA), an airline trade group. The 141st meeting, held last week in Madrid to set next summer’s schedule, attracted over 1,300 representatives from 250 airlines and nearly 300 airports around the world. Sitting around tables (with one for each country’s airports) in a massive hall, airlines negotiate and reschedule their slots to maximise their network’s efficiency. It is like “speed dating for airlines”, says Lara Maughan, the conference organiser.

-

The Trump tax cuts fall far short of Ronald Reagan’s reforms

-

Wine-making existed at least 500 years earlier than previously known

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

-

Why big-wave surfers are heading to Portugal

-

Hybrid models are changing the piano market, too

Although the advent of computers has speeded up the event, the way slots are allocated has changed little since the first conference in 1947. Instead of letting airports decide who would use their runways and when, the system was designed to have schedules hammered out by committees of airlines. In the 1960s, as growing traffic started to fill up some airports, the committees became a way of parcelling out the most prized slots.

Since the 1970s, allocation has been steered in most countries by IATA’s “Worldwide Slot Guidelines”. These state that an airline can keep a given slot from the previous season as long as it used the slot 80% of the time. Any slots freed up under this “use it or lose it” rule are allocated to other applicants. Some places, including the European Union, insist that new entrants must receive half of these. Airlines then swap or adjust the timings among each other at the conference to try to maximise profits. Some countries, such as Britain, allow slots to be traded and sold.

IATA claims the process is fair and open, particularly since the introduction of independent slot co-ordinators in the 1990s. They are supposed to ensure the guidelines are administered impartially, so that airports cannot stitch up deals with the local flag-carrier behind closed doors.

Even so, regulators across the world still think the system coddles incumbents. Britain’s competition watchdog, for instance, has said it “creates rigid incumbent slot holdings”, raising barriers to entry for newer and more efficient airlines. Others are fiercer in their criticism. “It’s like the airlines have been given a grace-and-favour flat that they are allowed to mortgage, sell or swap,” says Andrew Charlton, an aviation consultant and former head of government affairs at IATA. The slot guidelines are a “naked attempt to distort the market”.

Much of the opposition stems from the fact that most airlines were given their slots for no charge. Airport landing and passenger charges for planes generally do not rise at busy times but fares do, notes Nicole Adler of the Hebrew University of Jerusalem. This means the airlines cream off the benefits from the scarcity value of prized slots, like those in the early mornings. The shortage of landing slots in Europe inflates the fares passengers pay by €2.1bn ($2.5bn) a year, according to a recent study. Slot-holders also grab the proceeds of trading. Last year Air France-KLM, a legacy carrier, sold a single daily landing and take-off slot at London Heathrow, Europe’s most congested airport, for $75m.

IATA claims that the system is justified by airlines’ investment in planes and marketing. Behind closed doors airline executives scoff at the idea. One compares the current system to a food-maker saying it has the right to display its products on a supermarket shelf for ever because it bought some TV adverts.

Legacy carriers have another reason to like the system: it in effect freezes new airlines out of their hubs. In 2012 the European Commission estimated that less than 1% of slots at Heathrow, Paris Charles de Gaulle and Paris Orly were being distributed each year under the EU’s new-entrant rule. The situation has not improved since, because incumbents do everything they can to meet the 80% rule. Some use smaller planes and more frequent flights than necessary. Others resort to “ghost” flights: the loss-making flying of empty or near-empty aircraft in and out of major airports, for the sole purpose of holding on to precious slots there.

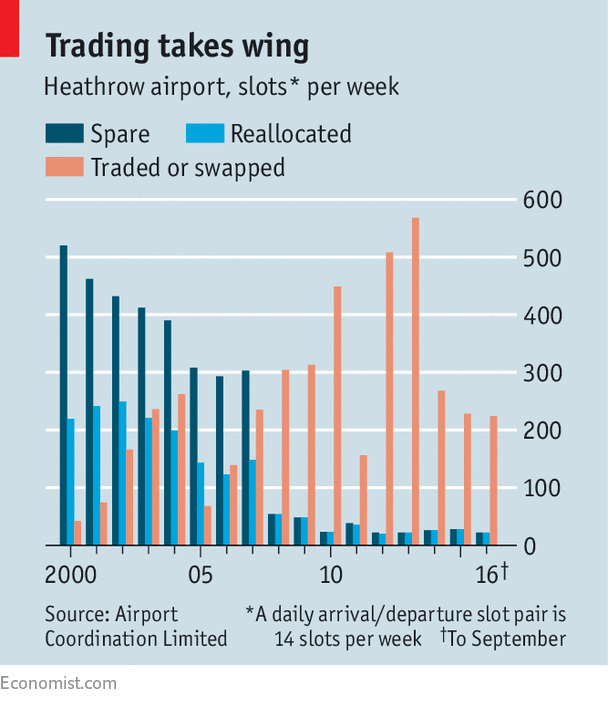

British Airways (BA) has argued that allowing more selling of spare slots could aid new entrants. But allowing trading reduces the number of returned slots handed out to new entrants free. Sales to date have allowed the strong to get stronger. The share of slots at Heathrow owned by BA’s parent has risen from 36% in 1999 to 54%.

Even so, in 2011 the European Commission proposed new rules rolling out slot trading across the EU. These included measures to force carriers to use their existing capacity better, such as raising the “use it or lose it” level from 80% to 85%. But the changes were put on ice in 2012, partly due to lobbying by airlines.

Other countries are trying more radical solutions. In 2008 America’s aviation regulator proposed auctioning slots at New York’s airports. This would reduce the rent airlines gain from their slots’ scarcity value. But the idea was dropped after airlines challenged it in court. Last year China experimented with a slot auction at Guangzhou and a slot lottery at Shanghai.

Sky’s limit

IATA claims that auctions do not help new entrants, which may not be able to afford big upfront slot fees. A better idea, says Ms Adler, is congestion pricing for runways—where airlines are charged more to use slots at busy times. London’s Gatwick airport, which has made steps in this direction, has seen 50% growth in passengers since 2010, as the changes have encouraged airlines to make fuller use of their slots and to release underused ones to new entrants. Unlike auctions, no upfront fees are payable, reducing barriers to entry.

One idea is to put the money raised from congestion pricing in a central pot, outside the control of airports, to fund improvements in aviation infrastructure. Without expansion beyond that already planned, 19 of Europe’s biggest airports will by 2035 be as congested as Heathrow today, which operates at full capacity, says Olivier Jankovec of ACI Europe, a trade group. Although greens and locals oppose building new runways, there are other ways to increase capacity, says David O’Brien of Ryanair, a big budget airline. Limits on aircraft movement at Paris Orly, for instance, mean it runs at just 60% of runway capacity. Improved transport links to secondary airports could help, too.

Airlines want governments to pick up the cost of such measures. But in an era of record airline profits, the industry faces increasing pressure to pay its share. The slot system is a good place to start.

Source: economist

The rules on allocating take-off and landing slots favour incumbents