FORGET the “resource curse”. Australia is blessed with the stuff. For more than a quarter of a century it has not had a recession, thanks largely to Chinese demand for its raw materials. It is only a few years since the end of one such China-led boom, in base metals such as iron ore. A new speculative flurry has started in minerals such as lithium, cobalt and nickel to feed another China-related craze—making batteries for electric vehicles (EVs).

Ken Brinsden, an Australian mining engineer, says he pinches himself over these remarkable turns of fortune. Until 2015 he was a boss at Atlas Iron, which shipped low-grade iron ore to China. In 2011, at the height of the China-led supercycle, it had a valuation of A$3.5bn ($3.8bn). This has now shrunk to A$167m. But he now heads Pilbara Minerals, whose Pilgangoora lithium mine in the outback of Western Australia lies so close to two of Atlas’s former iron-ore mines that he can see them from the top of the dusty-red escarpment.

-

Doctors have a rosier view of male than of female surgeons

-

What is sexual harassment and how prevalent is it?

-

The incredible inventiveness of Hedy Lamarr

-

Measuring the effects of partisanship on pie-eating

-

Retail sales, producer prices, wages and exchange rates

-

Why Test cricket is struggling

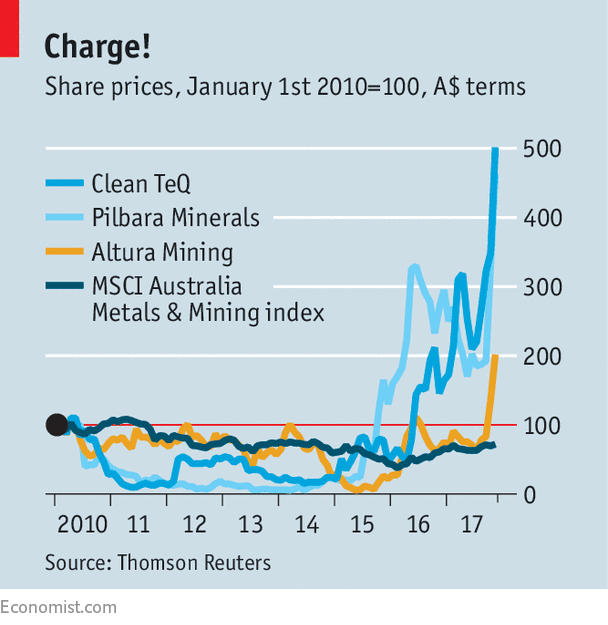

Since 2015 Pilbara Minerals’ market capitalisation has jumped from A$25m to A$1.5bn, as the soaring price of battery-grade lithium has made the economics of producing it from Australia’s spodumene, or “hard rock” reserves, more attractive. Great Wall Motor, a Chinese carmaker, recently bought a small stake in the firm and agreed to take a large share of its spodumene concentrate. Altura Mining, another favourite of speculative investors, is also developing a lithium mine in Pilgangoora, with much of its production already earmarked for China.

Clean TeQ, whose big shareholders are Robert Friedland, an American-Canadian billionaire, and Pengxin International Mining, a Chinese firm, is also on a battery-powered roll (see chart). Its value has soared by 240% this year to A$838m, based on its plans to produce nickel and cobalt sulphates, both key raw materials (along with lithium) for lithium-ion battery cathodes.

In most of the world cobalt is extracted as a by-product of copper and nickel, but it has recently become more valuable than nickel because of its scarcity. Such is the anticipated demand for it in the lithium-ion battery industry that shortages are expected within a few years. Clean TeQ says that at today’s prices of $27 a pound (compared with $10 a pound in 2016) cobalt would be a bigger source of revenue from its mine in New South Wales than nickel.

In each case, the companies argue that they offer a more secure source of raw materials for Chinese battery manufacturers than foreign competitors. First, consider lithium. Although the raw material can be produced more cheaply from brine in South America, political, business and legal risks are lower in Australia. Moreover, Mr Brinsden argues that spodumene can be processed directly into lithium hydroxide, which is preferred by battery-makers to the lithium carbonate that comes from lithium chloride in brine.

Phil Thick, boss of Tianqi Lithium Australia, the majority-owner of Greenbushes, a lithium mine in Western Australia that is the world’s largest, foresees no shortage of lithium itself—especially metal that is lower grade than that mined from Greenbushes. But he says there is a lack of processing capacity, so Tianqi, which is Chinese-owned, and its American partner, Albermarle, have plans to lift production of lithium hydroxide in Western Australia for export to China.

As for cobalt, Clean TeQ says that its production will have none of the ethical issues associated with the Democratic Republic of Congo (DRC), from where 60% of today’s supply comes. DRC cobalt is partly produced by “artisanal” miners that often use children with pickaxes to produce the metal. (This week it emerged that the London Metal Exchange has launched an inquiry into whether cobalt mined with child labour is trading on its exchange.) Ben Stockdale, the mining firm’s chief financial officer, quips that the biggest risk with Clean TeQ is that its miners “die of boredom”—the mine is on flat, featureless land.

In fact, the biggest risk for all these projects is price, which in turn hinges on whether car firms make good on their plans for a big increase in investment in electric vehicles. That is still an open question. Though Mr Brinsden is convinced China will “surprise the world” with its role in the battery revolution, he also says Chinese carmakers such as Great Wall and Geely see hybrid vehicles as a stepping stone towards EVs, implying that full electrification will still take time to develop.

Another risk is that mining giants such as Rio Tinto will muscle in. Rio was recently rumoured to be contemplating a bid for SQM, Chile’s biggest lithium producer, which the rest of the lithium brigade is uneasy about. Mr Thick, though, is confident: “It’s a tough business. Even Rio with its huge chequebook won’t find it easy.”

Source: economist

Australia is the new frontier for battery minerals