Former Fortress hedge fund manager Michael Novogratz said Monday that bitcoin can multiply more than four times in roughly the next 13 months.

“Bitcoin could be at $40,000 at the end of 2018. It easily could,” Michael Novogratz said Monday on CNBC’s “Fast Money.” “Ethereum, which I think just touched $500 or is getting close, could be triple where it is as well.”

Bitcoin was trading near $9,656 late Monday afternoon, after hitting a record high above $9,700 earlier in the day, according to CoinDesk. Ethereum hit a record high of $493.40 Monday, according to CoinMarketCap, and last traded near $482.

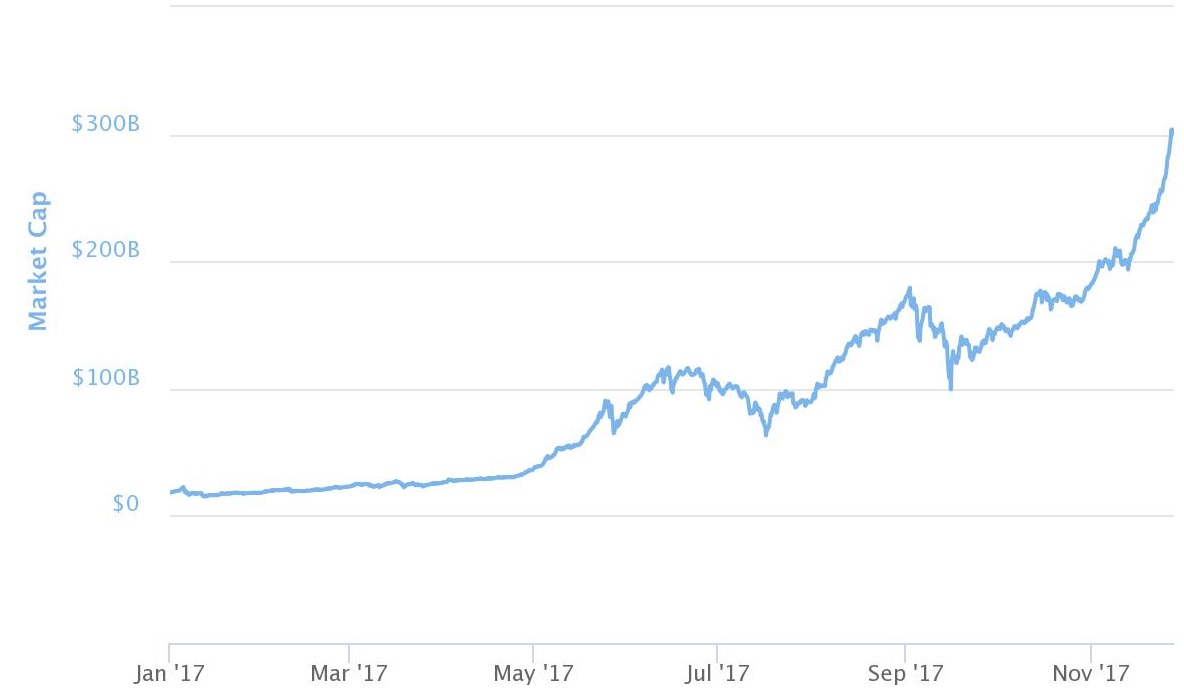

The total market capitalization of all digital coins on CoinMarketCap hit $304 billion Monday. Novogratz said he expects that could increase by about six times to $2 trillion at the end of next year.

Market capitalization of all digital coins (year to date change)

Source: CoinMarketCap

“There’s a big wave of money coming, not just here but all around the world,” said Novogratz, formerly a macro hedge fund manager at Fortress Investment Group. He is planning to launch a $500 million digital assets fund through his new firm, Galaxy Investment Partners.

Demand from Asia has contributed to bitcoin’s gains. Japanese yen trading in bitcoin dominates trading volume at about 62 percent, according to CryptoCompare. U.S. dollar-bitcoin trading accounts for about 21 percent, and trading in South Korean won accounts for about 9 percent.

“What’s different about these coins than other commodities … there is no supply response here,” Novogratz said. “So it’s a speculator’s dream in that as buying happens there’s no new supply response that comes up. So every price move gets exaggerated. It’s going to get exaggerated on the way up. There will be 50 percent corrections. It will get exaggerated on the way down.”

In contrast to oil and renewable energy products, Novogratz pointed out companies cannot produce more bitcoin in order to meet demand since the digital currency’s supply is limited to 21 million coins.

Novogratz said Monday that “probably over 20 percent” or “maybe even 30 percent” of his net worth is in cryptocurrencies. He said he’s split roughly in half between bitcoin and ethereum.

But Novogratz doesn’t recommend retail investors put any more than 1 to 3 percent of their net worth in cryptocurrencies, or wealthier investors to put more than 5 to 10 percent.

Back on Oct. 10, Novogratz said on CNBC’s “Fast Money” that he expects bitcoin will top $10,000 in the next six to 10 months. Bitcoin traded near $4,874 that day.

During a mid-November plunge of more than 20 percent in bitcoin’s price, Novogratz said he bought $15 million to $20 million worth of the digital currency, according to Reuters. Bitcoin has since more than recovered to an all-time high of $9,732.76 Monday, according to CoinDesk. At that level, the digital currency was up more than 10 times in price for the year and about 50 percent for November.

Last Wednesday, Fundstrat’s Tom Lee raised his mid-2018 price target for bitcoin to $11,500 from $6,000. That followed a similar upgrade last Monday by Standpoint Research’s Ronnie Moas, who raised his 2018 price target for bitcoin to $14,000 from $11,000.

CNBC also reported that Novogratz agreed on Oct. 4 to join the board of advisors for a new token-exchange project based on digital currency ethereum.

Source: Tech CNBC

Bitcoin could 'easily' reach ,000 by the end of 2018, hedge fund legend Novogratz says