CENTRAL bankers may control short-term interest rates, but long-term ones are mostly free to wander. They do not always behave. When Alan Greenspan, then chairman of the Federal Reserve, was raising short rates in 2005, he described a simultaneous decline in long rates as a “conundrum”. His successor-to-be, Ben Bernanke, blamed foreign investments in American assets because of a “global saving glut”.

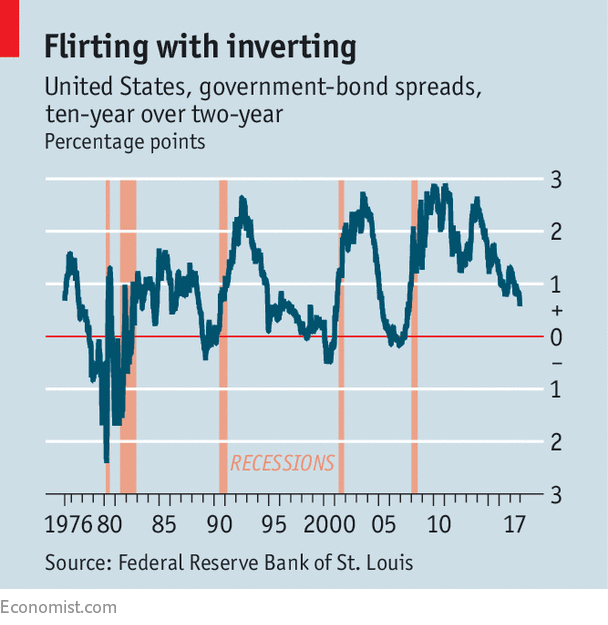

Janet Yellen, today’s (outgoing) Fed chair, faces a similar puzzle. Ms Yellen’s Fed has raised rates twice this year, and will probably make it three times in December. In October the Fed began to reverse quantitative easing (QE), purchases of financial assets with newly created money. Despite all this monetary tightening, yields on ten-year Treasury bonds have fallen from around 2.5% at the start of 2017 to about 2.3% today. As a result, the “yield curve” is flattening. The difference between ten-year and two-year interest rates is at its lowest since November 2007 (see chart).

-

Michael Flynn pleads guilty to lying to the FBI over Russia contacts

-

Republicans grouse about tax models they once supported

-

The 2017 Daily chart advent calendar

-

Sexual politics on stage

-

Evo Morales finds a way to run for re-election

-

Game over for virtual reality?

The yield curve matters. It has inverted—ie, long-term rates have dipped below short-term ones—just before each of the past seven American recessions. Such an inversion remains a long way off, but some rate-setters seem wary of the risk. In October, Robert Kaplan, president of the Dallas Fed, said he did not want the federal-funds rate to nudge up against the ten-year Treasury-bond yield. Likewise, Patrick Harker, his counterpart at the Philadelphia Fed, warned in November that inverting the yield curve would “not be a good thing”.

As the Fed watches the market, so traders study the Fed. The yield curve reflects where markets expect its policy to head—which they might be better able to predict than central bankers themselves. But long-term rates also include the “term premium”—the reward investors require for locking their money away, and for taking the risk that their forecasts are wrong. If inflation is unexpectedly high, long-term bondholders’ returns are reduced, and they cannot profit from the rising short-term rates that an inflation surprise typically provokes. So part of the term premium is compensation for inflation risk.

Falling inflation risk might explain today’s droopy yield curve, according to a recent note by Michael Bauer of the San Francisco Fed. Price rises have been oddly subdued this year. Despite unemployment falling to just 4.1%, inflation (excluding food and energy prices) is only 1.3% by the Fed’s preferred measure. Inflation expectations, as measured by surveys of forecasters, have not fallen. But investors may increasingly see the main risk as too little inflation, rather than too much. If so, the inflation-risk premium should have fallen, and could even turn negative.

Ms Yellen seems sympathetic to such arguments. But they are not all that comforting. The Fed’s justification for tighter monetary policy, in spite of low inflation, is the risk of a sudden surge in wages and prices. This risk should increase as unemployment falls. If bond markets are signalling that the risk is in fact declining, that seems to contradict rate-setters’ thinking.

Other than inflation risk, the term premium is a catch-all for anything that affects yields. It is poorly understood. QE, for example, is supposed to have worked by compressing the term premium. Mr Bernanke’s saving glut may have had the same effect. Both factors may still pertain. The Fed’s balance-sheet has not shrunk much yet. And in recent months, Asian countries have been accumulating large holdings of foreign-exchange reserves. American yields are low, but above those in Europe, Japan and Britain, and may be a magnet for the world’s savings. (That said, the dollar has fallen by about 6.5% this year on a trade-weighted basis.)

The likeliest explanation for a flattening yield curve, however, is the simplest: markets are losing confidence in the Fed’s ability to raise rates without inflation sagging. Given how often the markets have been right and the central bank wrong, rate-setters would be wise to tread carefully.

Source: economist

A flattening yield curve argues against higher interest rates