Stocks could see more bumpy trading ahead, after the S&P 500 and Nasdaq each suffered their first three-day string of losses since August.

But the seasonal tailwinds of December could take over and send stocks higher after more rocky trading, technicians and strategists say.

“When you have a reversal like you had [Monday] traditionally you have anywhere from two to seven choppy trading days after it,” said Art Cashin, director of floor operations at UBS. “Like today, there will be some up, some down, but they can’t really make progress.”

The S&P 500 fell 9 points Tuesday to 2,629, while the Nasdaq fell 13 points to 6,762. The Dow, which was positive Monday, lost 109 points to 24,180. The small cap Russell 2000 was hardest hit, losing 1 percent to 1,516.

Stocks tried to rally but failed Tuesday. The tax rotation trade of the last week slowed. Tech, which had been pounded, was the only S&P sector to end with a gain, albeit just 0.2 percent. Investors have been moving money out of technology, since it will not benefit as much as other sectors from tax legislation, and it may even be hurt if a corporate AMT element stays in the bill.

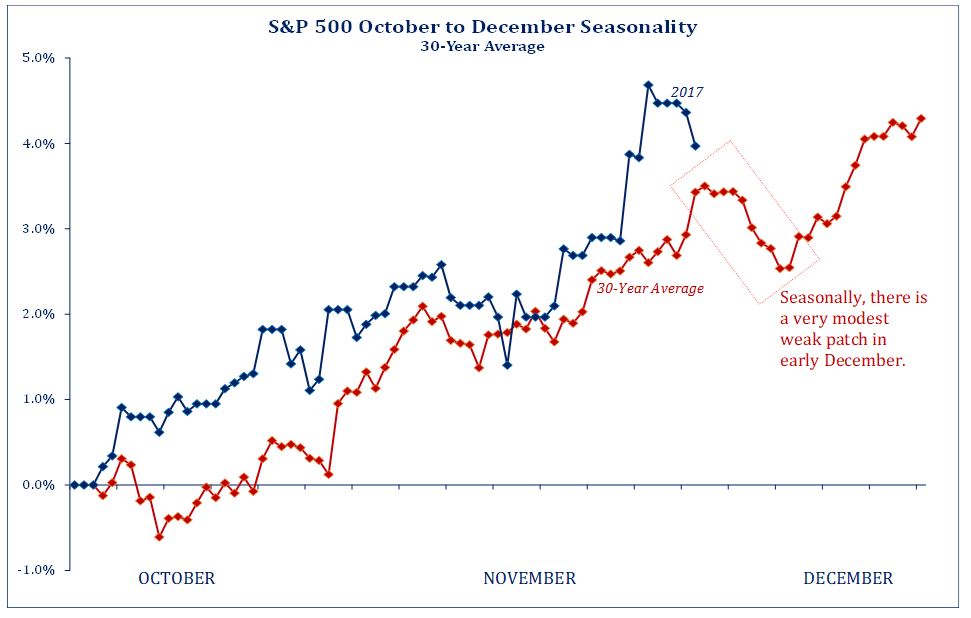

“For that sector especially, ultimately, we’ll get a signal that it’s washed out. Today’s action is reaffirming there’s more room to come in, before ultimately sounding the all clear,” said Todd Sohn, technical analyst with Strategas Research. “Around the first two weeks of December, when you look historically at the seasonality, there is a mild bout of weakness in usually the first 10 days of December. Then you get the rally after that.”

Sohn said the volatility could be a warning of market behavior in the new year.

Oppenheimer technician Ari Wald says he’s not concerned about the shakeout, adding that he thinks it is not likely to be the prelude to a big sell-off.

“Let’s talk tech in particular, which is down in the last few sessions. Taking a step back, there’s no damage done” technically, he said. “It’s simply just a function of the terrific rally going into the most recent pull back. …The market is battling some near-term overbought conditions, so some sideways consolidation would be reasonable.”

Wald said timing the choppy period is difficult, but he believes the trend is higher and dips should be bought.

“Seasonally, December is a good time for stocks. Santa rallies are the last five trading days of the year and the first two of the new year. December is usually positive for stocks. It’s never been the worst performing month of the year going back to 1928. …There’s a tailwind. We’re not expecting a big pullback,” said Wald.

Scott Redler, partner with T3Live.com, said after Tuesday’s trading, he was more convinced that Monday set the high for the year in the S&P 500.

“The gap up today was sold again. It was basically more methodical,” he said. “I think the market is more vulnerable versus being in a rush to buy here. …It seems like traders are less in a rush to put bigger amounts of money to work.”

Redler said the market could calm down later in the month.

“The question is, does a bid show up closer to Christmas or not?” he said.

Source: Investment Cnbc

Stocks are still in for bumpy times, but Santa could save the day