“Think breedable Beanie Babies.”

So states the FAQ for CryptoKitties, a new game for collecting, breeding and selling digital cats that is so popular, it is clogging up the network of digital currency ethereum.

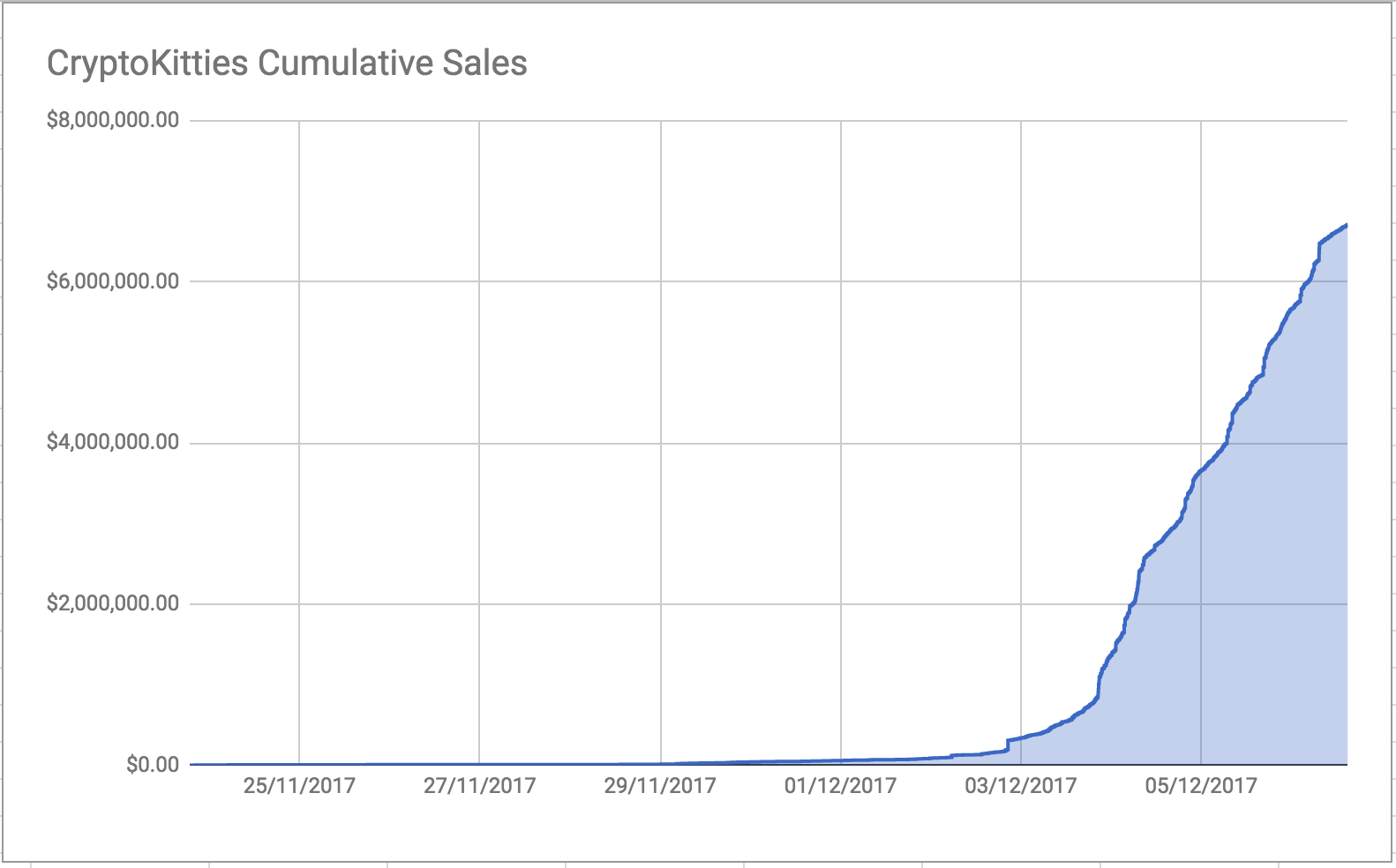

Players have spent the equivalent of $6.7 million and counting buying CryptoKitties, which can sell for as much as $114,481.59, according to third-party research from developer Niel de la Rouviere. The median price of a kitten is $25.04.

Just three days ago, the site had logged about $1.3 million in sales.

“The popularity of virtual cats fits the euphoria we see elsewhere in the crypto-currency space,” Peter Atwater, who studies market sentiment and heads Financial Insyghts, said in an email. “It feels very reminiscent of the Candy Crush craze that helped propel the King Entertainment IPO back at the peak of the ‘Unicorn’ era in mid 2014.”

Source: Niel de la Rouviere

Created by Vancouver-based Axiom Zen, CryptoKitties launched to 200 users on Thanksgiving and was opened to the public last Tuesday. More than 41,000 unique kittens have been sold already, according to de la Rouviere’s data.

But CryptoKitties’ popularity indicates blockchain technology still has a long way to go to reach its hype.

CryptoKitties accounted for about 13.5 percent of power on the ethereum network Wednesday morning, said Benjamin Roberts, co-founder and CEO of Citizen Hex, an ethereum-focused start-up backed by three Canadian venture funds.

“With Cryptokitties every Ethereum user has suddenly taken on the computational overhead of running a mainstream application,” Roberts said in an email. “This overhead affects not only Cryptokitty transactions, but every other transaction on the Ethereum network.”

Blockchain project SophiaTX postponed its token sale by 48 hours this week to Thursday, due to network clogging by CryptoKitties.

CryptoKitties also had to raise its “birthing fee” at least twice due to network congestion. The company tweeted Monday it was raising the fee from 0.002 ETH (about 90 cents) to 0.015 ($6.69).

In response to criticisms that ethereum clearly lacks the scale to handle such demand, ethereum co-founder Joseph Lubin emphasized the quality of the global developer team working on the network’s open-source software.

“With the largest developer community of any blockchain platform by far, the Ethereum blockchain is in an excellent position, especially at this early stage, to be able to deliver on its potential,” Lubin said.

CryptoKitties players buy and sell unique digital kittens using ethereum. With two kittens, players can then breed their own digital kittens and sell them on the marketplace. The starting price is set by the user, and the price goes down until the end of the auction or the kitten is sold. The CryptoKitties team plans to release a new CryptoKitty every 15 minutes until Nov. 2018, whose starting price is set by the average of the last five CryptoKitties that were sold, plus 50 percent.

A 256-bit genome for each kitten means there are 4 billion possible variations, according to the company. The primary distinguishing feature is “cooldown” time, or the time it takes a kitty to recover after breeding. These vary from “fast” at 1 minute to “Catatonic” at 1 week and “will increase each time the Kitty breeds.”

The pricey $114,481.59 CryptoKitty, named Genesis, has a fast, 1-minute cooldown.

Source: CryptoKitties

“From a high level, abstract point of view, this stuff is almost digital artwork, if you will. It doesn’t have any inherent value other than what you think it’s worth,” said Joey Krug, co-chief investment officer at Pantera Capital, one of the earliest investors in bitcoin.

“It does lend weight to the idea that the market is exuberant,’ he said. But “just because a market is exuberant [it] doesn’t mean that market is fraudulent.”

The rapid surge of interest in CryptoKitties mirrors the exuberant growth of cryptoassets overall, which some have compared to the mania around tulip bulbs in the 1600s and the Beanie Babies fad in the 1990s. Enthusiasts of digital currencies and their blockchain technology point out that after the tech stock bubble burst in 2000, companies such as Facebook and Google emerged as giants.

Bitcoin has leaped more than 1,200 percent this year to a record above $12,800, according to CoinDesk. Ethereum has climbed 5,500 percent to $446, and the entire market value of cryptocurrencies has exploded from around $17 billion at the start of this year to nearly $376 billion Wednesday, according to CoinMarketCap.

Ethereum’s version of blockchain technology allows developers to create applications on top of the network, which does not need a centralized, third party to operate. Proponents say the system could transform the world as much as the internet did.

“The tulip mania comparison needs to die,” said Brian Patrick Eha, author of How Money Got Free: Bitcoin and the Fight for the Future of Finance. “Whether or not there is a bubble today in the price of bitcoin and other digital assets, you can’t compare a short-lived fervor for exotic flowers with the rise of an entirely new asset class built on game-changing technology.”

Source: Tech CNBC

Meet CryptoKitties, the 0,000 digital beanie babies epitomizing the cryptocurrency mania