There comes a time in every presidential administration in which politics and economics become intertwined to the point which the combination of the two creates an inflection point. The action last week in both stocks and bonds suggest that we have arrived at that crucial juncture. The volatility of the last few weeks is directly […]

Read moreAs shares of Macy’s continue to slide on worries about the fate of brick-and-mortar retail, Jim Cramer wondered when the department store chain’s stock would finally be too low to ignore. “That’s kind of a loaded question because in reality, Macy’s has been a value trap for a long time. Every time it starts to […]

Read moreIt became quite clear to Jim Cramer on Monday that the stock market was trading on, well, nothing. “I’ve thought a lot about these periods and I’ve learned that there is such a thing as random movement periodically, and it always gets ascribed to something. The market’s not always logical and the action doesn’t always […]

Read more

As China‘s financial markets mature, major non-Chinese financial firms increasingly want to open funds in the country and tap the multitrillion-dollar institutional investor market there. This summer, UBS Asset Management received a license for private fund management in mainland China, and BlackRock said it plans to set up its first private fund in the country. […]

Read more

Copper prices zoomed 1.7 percent higher on Monday to reach levels not seen in nearly three years as investors bet on further global economic growth. Futures for September delivery reached a high of $3.0015 per pound, their highest since November 2014. The metal has also seen its value surge 3.5 percent this month, putting it […]

Read more

There is an epic fight between the two major types of investors, which may determine whether the bull market can go on. Raymond James explained how value investors, who strictly study fundamentals, and technical analysts, who only look at charts, see the world differently right now. Market “battle lines are generally formed between those who […]

Read moreMajor U.S. averages were barely positive in Monday trading after two straight weeks of losses for the S&P 500, and some strategists say under-the-surface fissures in the market are becoming increasingly apparent. Part of the problem lies in the basic difficulty that the market is “priced to perfection” in terms of valuations, said Gina Sanchez, […]

Read more

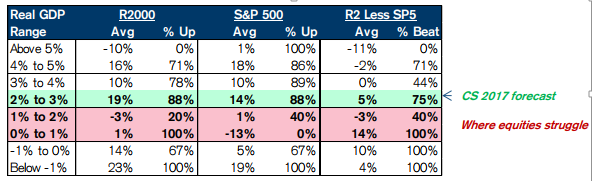

The demise of small-cap stocks is the latest example that the market is starting to lose faith in some of the investing themes that had been driving this year’s rally. As part of the so-called Trump trade, companies at the lower end of the market-cap spectrum were expected to flourish. The idea was that lower […]

Read moreThe U.S. economy and corporate earnings continue to impress, but markets’ positive momentum has been sapped by the political follies of the Trump administration. And from a trading perspective, the U.S. dollar is unlikely to stage much of a comeback unless the tone from Washington becomes decidedly more disciplined. It is no secret that the […]

Read more

Caterpillar shares have been on a tear – rallying more than 35 percent in the past year, but one top technician says the charts are pointing to trouble ahead. The S&P Industrial sector is one of the best-performing groups in the past year, but Carter Worth of Cornerstone Macro noted that many of the industrial […]

Read more