Last week’s market drop on increasing tensions between the U.S. and North Korea, the second-worst weekly performance of the year by the S&P 500, was a great buying opportunity based on a history of past geopolitical events, even ones more serious than this one, says Credit Suisse. “Geopolitical shocks tend to provide a buying opportunity, […]

Read more

As we close in on the end of the summer, one of Wall Street’s longest-running and widely followed prognosticators says the U.S. market is “overdue” for a 5 or more percent drop. But CFRA’s chief investment strategist, Sam Stovall, does not believe stocks are about to enter any sort of bear market. Stovall blames “geopolitical […]

Read more

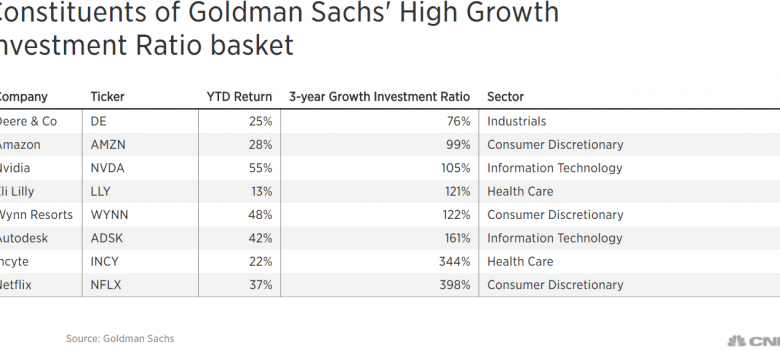

Goldman Sachs encouraged its clients to invest in high-growth stocks, predicting that higher interest rates in 2018 will cause earnings growth to slow and therefore placing a premium valuation on such companies. “The majority of the recent market rally has been driven by higher earnings rather than valuation expansion,” wrote Goldman Sachs chief U.S. equity […]

Read more

Four of this year’s five best-performing large ETFs have something in common. Among all the U.S.-listed exchange-traded funds with more than $2 billion in market value, the top dog is the iShares MSCI China ETF (MCHI), which is up 34 percent through Friday’s close. Following closely behind is the iShares MSCI All Country Asia ex […]

Read moreIt feels like anything but a summer vacation for Wall Street lately. The S&P 500 and the Dow Jones industrial average ended their second-worst week of the year on Friday. The Nasdaq composite fell for the third straight week, marking its longest weekly losing streak since June 2016. Investors and traders were rattled by rising […]

Read moreBill Perkins of energy hedge fund Skylar Capital says the natural gas market could soon rev up. With American exports of natural gas on the rise, while infrastructure “isn’t coming on fast enough,” Perkins makes the point that “we actually have a very tight market now.” “Right now we have the demand-side infrastructure — that […]

Read more

This week’s stock market’s tumble may signal a much bigger downside lies ahead. Technician Scott Redler is noticing an ominous trend in the charts that could temporarily pull the S&P 500 Index down by three to five percent. “We could be at a short-term top,” T3Live.com’s chief strategic officer recently said on “Futures Now.” Redler […]

Read moreJim Cramer has always had the notion that excessive prudence can be one of the most reckless strategies of all. If too much money is invested in safe, risk-free U.S. Treasury bonds, that basically insures a very low return on an investment. So, for those who want to grow their capital, stocks are the only […]

Read morePeople are blaming this week’s market sell-off on rising tensions with North Korea, but it has “nothing to do with North Korea,” Canaccord Genuity’s chief market strategist Tony Dwyer said. “This is all about a market looking for an excuse to sell off with a ‘natural, normal and healthy correction,’ which is only that way […]

Read moreUnless you are born with a silver spoon in your mouth, accruing wealth does not come easily, which is why Jim Cramer is so passionate about helping investors find a viable financial strategy. “Thanks to the magic of compounding, the earlier in your life you start investing in the market, the bigger your long-term gains […]

Read more