Cambria Investment Management’s Meb Faber shared his views on the market, cryptocurrencies and quantitative investing in an exclusive interview for CNBC PRO with Mike Santoli. On investor behavior: “Chasing and herding is one of the most time tested terrible things that people do …We remember the 90s dotcom (bubble) and then people getting fascinated with […]

Read moreThe family office of Steven Cohen, the billionaire banned from running a hedge fund in the US, has run into a regulatory roadblock in the UK. Point72, which manages about $11bn of Mr Cohen’s personal fortune, has been told in recent months that it would not receive regulatory approval in the UK by the Financial […]

Read moreThe global financial meltdown that led to the Great Recession could have been mitigated if the Federal Reserve had “slashed rates more dramatically” at the time, CNBC’s Jim Cramer said, reflecting on his famous 2007 “they know nothing” Fed rant. Cramer recalled on Thursday, 10 years to the day, that he didn’t plan it. “The […]

Read moreAndy Hall, a trader nicknamed the “God” of the oil and energy markets, is reportedly closing down his main hedge fund, Astenbeck Capital Management. The hedge fund posted large losses in the first half of the year, according to a Bloomberg report. The flagship fund, Astenbeck Master Commodities Fund II, has tanked nearly 30 percent […]

Read moreActivist hedge fund manager Dan Loeb, who’s more than doubled the S&P 500’s return over the last two decades, is beating the market again this year while most of his big-name peers are struggling. But the Wall Street titan admitted Thursday his strong performance was partly due to good fortune. Earlier this year the manager […]

Read more

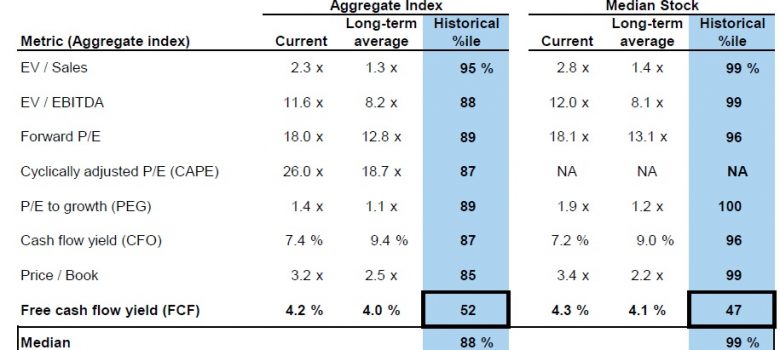

Thanks to a recent decline in companies’ capital investments, the record high stock market may still be one to buy, Goldman Sachs said. The “S&P 500 is expensive according to most valuation metrics, but appears attractively valued on free cash flow yield due to reduced capex investment,” David Kostin, chief U.S. equity strategist at Goldman […]

Read more

The Dow Jones industrial average is on a tear – surging past 22,000 on Wednesday propelled by strong earnings, but the oldest index component has been the biggest laggard. On the road to Dow 22,000, Boeing, McDonald’s, UnitedHealth and Apple were the biggest contributors, while IBM, Goldman Sachs and GE dragged down the index. While […]

Read moreShares of Teva Pharmaceutical fell more than 18 percent in morning trading Thursday after the company reported lower-than-expected second-quarter earnings. Teva missed estimates for both earnings per share and revenue, and interim CEO Yitzhak Peterburg blamed the poor performance on a saturation of the U.S. generic drug market. “[Teva] experienced … greater competition as a […]

Read moreThe Dow Jones industrial average will reach 24,000 by the end of this year if President Donald Trump and the Republicans who control the House and Senate deliver on corporate tax reform, Wharton School finance professor Jeremy Siegel told CNBC on Thursday. “I would love to see personal tax reform and lower those personal rates […]

Read moreSome recent economic data have proven to be rather meager: wage growth is tepid, auto sales are weak and personal income did not budge month over month in its most recent reading. But according to the latest wide-ranging consumer sentiment survey from Bespoke Investment Group, responses when it came to views on the economy, personal […]

Read more