One of Wall Street’s most bullish firms is back at the drawing board—in the process of revising its price target on the S&P 500 Index. However, it’s taking a lot longer than expected. Back on June 26 on “Trading Nation,” Oppenheimer Asset Management’s John Stoltzfus said to expect a new price target within the “next […]

Read moreSometimes, even the best stocks get hit hard by broader market sell-offs, and it’s natural to wonder why, Jim Cramer said. But most of the time, it’s not because of some underlying weakness in the stock that investors didn’t catch. Nowadays, market sell-offs can happen because of index futures rather than actual fundamentals, an action […]

Read moreExchange-traded funds, better known as ETFs, have seen a surge in popularity recently, but Jim Cramer is not as taken with the trend as the rest of the market. Proponents argue that ETFs guard against “single-stock risk,” or the damage an individual stock could do to your portfolio. They say it lets you play an […]

Read moreMetrics have the power to make or break your portfolio, and Jim Cramer says they are often the key to understanding why stocks move the way they do. “Sometimes the key metrics that control the entire market suddenly change, and you have to change with them,” otherwise you’ll never understand why your stocks are suddenly […]

Read moreWhen Jim Cramer first started trading, a stock’s value was based on two simple factors: the underlying company’s fundamentals and the sector’s performance. But when indexes like the S&P 500 gathered enough power to sway stocks regardless of those factors, everything changed. Now, market sell-offs can happen because of index futures rather than actual fundamentals, […]

Read more

U.S. oil prices surged toward the key $50-a-barrel level this week, but the rally likely has little gas left in the tank, analysts say. West Texas Intermediate crude futures tacked on about $4 a barrel, or 8.6 percent, this week to $49.71 for their best weekly performance all year. International benchmark Brent crude rose about […]

Read more

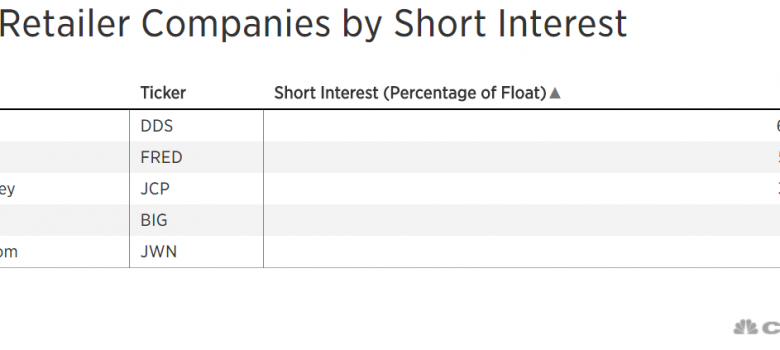

Of all the industry groups that make up the stock market, retail is the most hated based on the amount of money hedge funds and other investors are betting against the stocks. Bespoke Investment Group highlighted “the most hated stocks in the world” in a report published this week analyzing the names being sold short […]

Read moreEarnings are humming along, with gains of more than 10 percent now expected for the S&P 500 in the second quarter. There’s one potential fly in the ointment: Big Oil. ExxonMobil, Chevron and other Big Oil names will begin reporting on Friday. Something unusual is happening: because oil never rallied in the second quarter as […]

Read moreStrong second-quarter earnings, along with falling rates and a weak dollar, will continue to drive stocks higher, according to Jefferies, which raised its year-end price forecast for the S&P 500 on Thursday. “The bottom line is that equity bull markets don’t die of old age,” wrote Jefferies Chief Global Equity Strategist Sean Darby in Thursday’s […]

Read moreRobert Shiller is well-known for his views on valuation, volatility, dividends and bubbles. But when asked what currently worries him most, the Yale professor of economics turned to another subject entirely. “A theme that I have been coming back to is that the big worry that’s on people’s minds — I don’t know how active […]

Read more