There is one good reason to buy the bonds of emerging market countries and corporations. They pay well. In an environment where the 10-year U.S. Treasury bond yield is struggling to hold 3 percent and the average return on long-term investment grade corporate bonds is barely above 4 percent, the more than 6 percent average […]

Read moreAuto stocks rose Tuesday after China said it will slash tariffs on some car parts and vehicles as part of ongoing trade negotiations with the United States. The Chinese Finance Ministry said tariffs on certain vehicles will come down to 15 percent from as much as 25 percent while levies on some parts will be […]

Read more

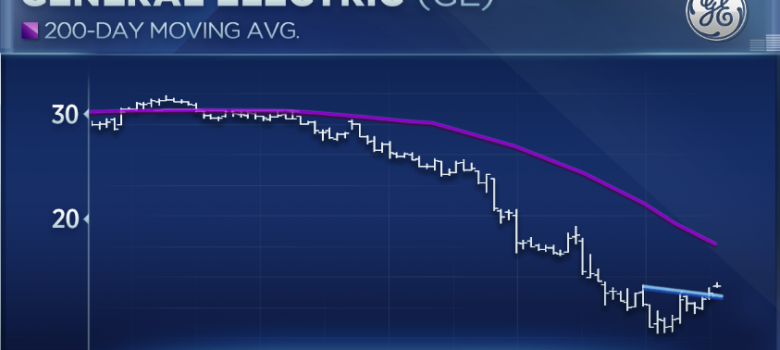

Calling a bottom in General Electric has been among the more painful and fruitless endeavors on Wall Street over the past decade. With shares now touching a three-month high, many are hoping the worst is finally behind the ailing industrial giant. A top technical analyst has a simple message: Don’t hold your breath. “The stock […]

Read moreMacy’s stock will rise on improving consumer spending and apparel sales, according to one Wall Street firm. Susquehanna raised its rating to positive from neutral for Macy’s shares, predicting the retailer will report earnings above expectations this fiscal year. “We now believe that Macy’s has upside potential to conservative earnings guidance as the fundamental strength […]

Read moreCheck out the companies making headlines before the bell: Kohl’s – The retailer beat Street forecasts by 14 cents a share, with adjusted quarterly profit of 64 cents per share. Revenue beat estimates, as well. Comparable-store sales were up 3.6 percent, better than the Thomson Reuters consensus estimate of a 2.7 percent gain. Kohl’s also […]

Read moreA concerning disconnect may be emerging between equities and the market’s measure of volatility, according to one portfolio manager. Dennis Davitt of Harvest Volatility Management told CNBC’s “Trading Nation” he’s carefully watching the Cboe Volatility Index, widely considered the market’s “fear gauge” as it measures equities’ expected volatility over 30 days. Here are his reasons […]

Read moreThe bond market is signaling an upcoming correction and investors should sell their shares in listed companies, a strategist told CNBC Tuesday. Borrowing costs have gone up over the last few weeks, with the yield on both the 10-year U.S. Treasury note and the two-year bond reaching multiyear highs last Friday. Higher yields, which move […]

Read moreWall Street analysts are cheering General Electric’s move to start splitting itself up after poor shareholder returns in the past year. On Monday the industrial conglomerate announced a deal to merge its transportation business with Wabtec in a transaction valued at $11.1 billion. General Electric will receive $2.9 billion in cash at the merger’s close. […]

Read more

Dow stocks Apple, Exxon Mobil, Chevron and General Electric are trading well above their 50-day moving averages. They have something else in common — one technician sees more upside for each. “There’s a misperception out there that because a stock is overbought that that is bad,” Craig Johnson, chief market technician at Piper Jaffray, told […]

Read more

U.S. interest rates have shot up to levels not seen in years recently, giving stock investors a new concern. But a Goldman Sachs strategist says it’s not time to worry just yet. David Kostin, Goldman’s chief U.S. equity strategist, wrote in a note Friday investors should not worry about rising borrowing costs and their effect […]

Read more