Former Treasury Secretary and Obama administration economic advisor Larry Summers said Friday that recent employee bonuses are stunts and not reflective of long-term hopes for prosperity that tax cuts are supposed to bring. “I think it’s a gimmick,” Summers told CNBC’s “Squawk Alley.” “I think in many cases the firms have to raise wages because […]

Read moreThe best hedge fund managers are always looking out for potential downside when they put together a portfolio. Third Point’s Dan Loeb, who nearly doubled the S&P 500′s return for more than two decades, shared his key concerns for the market in a note to clients Monday. “While we remain optimistic about the trajectory of […]

Read moreThe relentless gush of cash into the stock market is sending a powerful “sell” signal, according to a Bank of America Merrill Lynch gauge that has been a reliable indicator in the past. Investors poured $33.2 billion into stock-based funds through the week ended Wednesday, BofAML said in a report. That’s a record both for […]

Read more

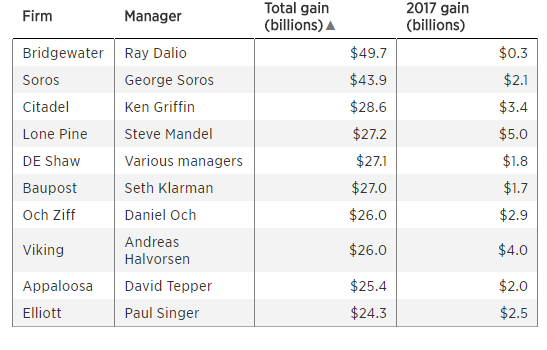

Ray Dalio’s Bridgewater Associates has the biggest cumulative net profit for a hedge fund firm ever, according to data from LCH Investments. Dalio’s firm led the list with a nearly $50 billion gain for its investors since inception through 2017, adding a $300 million profit in 2017 despite mediocre percentage returns. Bridgewater’s Pure Alpha fund […]

Read moreIf you invested $1,000 in Amazon or Apple 10 years ago, that investment would have seriously paid off. According to personal finance website DQYDJ, an initial $1,000 investment in those companies in 2008 would be worth $16,239 and $8,587, respectively, as of January 16. If you invested $1,000 in Google in the same time frame, […]

Read morePresident Donald Trump just made a case for “worldwide trickle down” economics during his Friday speech at the World Economic Forum, said CNBC’s Jim Cramer. “Davos is a conversation about how to get the poor to be rich,” Cramer said on “Squawk on the Street,” shortly after the president’s “America First” speech in Davos, Switzerland. […]

Read moreThe titans of global finance at the World Economic Forum are too optimistic about the stock market and the economy, American billionaire real estate investor Jeff Greene told CNBC on Friday. “There are 2,000 people [here], and I don’t think I’ve met one person who’s been negative,” Greene said on “Worldwide Exchange” in an interview […]

Read moreBill Ackman’s Pershing Square has taken a passive stake in Nike, a source tells CNBC. The activist hedge fund will not pressure the shoe apparel company for changes. CNBC was not able to clarify the size of the hedge fund’s Nike position. Ackman’s position in Nike was earlier reported by Reuters, which said the position […]

Read more

The dollar sell-off sparked by Treasury Secretary Steven Mnuchin‘s surpise comments about a weak greenback creates an opportunity for equities investors, one market watcher says. The weaker U.S. dollar has benefited large multinational companies that derive a large chunk of revenue abroad, said Michael Binger, senior portfolio manager at Gradient Investments. “It’s a tailwind for […]

Read moreJ.P. Morgan Asset Management CEO Mary Erdoes on Friday gave a bullish case for stocks, saying optimism about the booming market isn’t impractical. “Just because people are optimistic doesn’t mean they’re unrealistic,” Erdoes told “Squawk Box” from the World Economic Forum in Davos, Switzerland. Erdoes spoke as U.S. stock futures were higher, with the Dow, […]

Read more