A decade ago, the real estate market opportunity in China consisted largely of risky speculative development deals because of a lack of availability of stock.

Foreign investors seeking opportunistic returns from the first wave of China funds have been largely disappointed from a toxic combination of delays, cost escalation and implementation problems due to difficulties in enforcing basic contractual law. As a consequence, investor cynicism about China real estate runs high, and so sentiment on Chinese real estate is largely polarized between uber-bulls and perma-bears with not much in between.

The reality on the ground today, however, is that the situation is more nuanced and much improved. Particularly in Beijing and Shanghai, occupational markets in the commercial market are buoyant and investment liquidity is high. According to CBRE, 2016 saw commercial real estate transaction volumes in China surge by 85 percent year on year to 158 billion yuan ($23.18 billion), which is a record high. The outlook in the occupational market is also positive with rents moving higher due to a reduction in the supply of new stock and an expanding economy.

As the market has matured it is now possible to upgrade or reposition completed assets, thereby avoiding the significant risks of ground-up development. Risks around enforcing contracts and the legal system have also diminished in large part due to President Xi Jinping’s ferocious anti-corruption drive, which has managed to improve overall levels of governance, making the market more investable.

While the market environment has improved, the key question remains as to what is the best way of accessing the Asian growth opportunity? Our view is that the most compelling opportunity currently available is in debt and specifically mezzanine lending.

Mezzanine lending is a hybrid of debt and equity financing that gives the lender the right to convert to an ownership or equity interest in case of default. It can be a more high-risk, high-return form of debt that replaces part of the capital that equity investors would otherwise have to provide.

In this case, the investment strategy is underpinned by a liquid residential market driven by a population urbanizing at 1 to 2 percent a year, creating demand for 9 million new homes per annum in China. Urbanization and rising consumption underpin the residential market not just in China but also in the high growth markets of Southeast Asia (Vietnam, Indonesia and the Philippines).

China and Southeast Asia mezzanine deals can provide a cash income return in excess of 15 percent p.a. with equity upside. Despite these high returns, loans are typically at an all-in loan-to-value ratio (including senior debt) of less than 65 percent providing significant downside protection. Our preference is to structure investments using mezzanine structures as it provides favorable investment dynamics when compared to equity due to its high running yield and enhanced tax efficiency. High rates of return and downside protection make mezzanine in Asia a vastly different proposition to mezzanine in the U.S. and Europe.

|

Asia mezzanine (China, SE Asia) |

Developed market mezzanine |

|

|

Macro-economy |

GDP > 5% p.a. |

GDP <2% p.a. |

|

All-in LTV (including senior debt) |

<65% LTV |

>65% LTV |

|

All-in returns |

>15% IRR |

<10% IRR |

Despite these attractive characteristics, in our view it only makes sense to be a mezzanine lender if you have complete visibility and negative control over the underlying project. This means we place our own staff into the borrower to monitor construction and to control bank accounts. The key ingredients to success are boots on the ground, a solid understanding of real estate fundamentals backed up by a rigorous investment process.

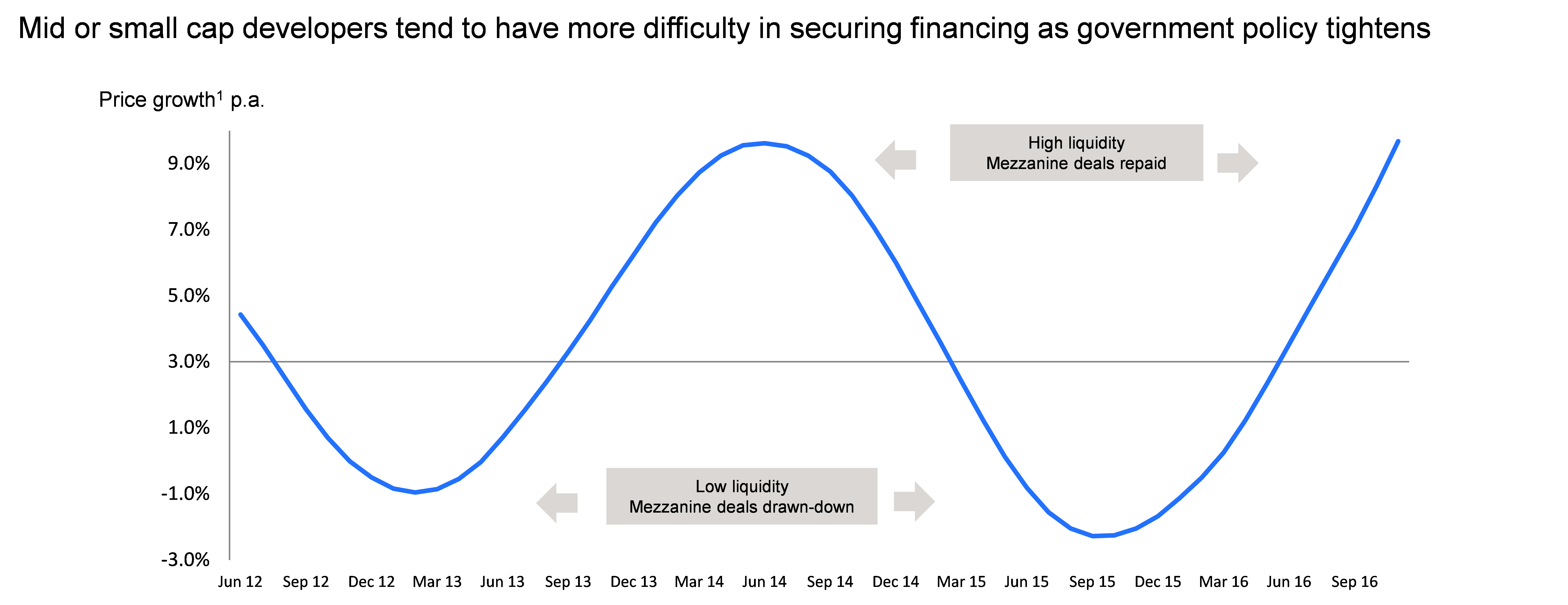

The residential market in China is cyclical, creating attractive windows for mezzanine lending when liquidity tightens due to government policy measures. The predictability of the residential market provides an effective cap and floor on returns, making it highly suitable for mezzanine. The predictability of the market can be seen in the graph below. (Source: Soufun, 12-month year-over-year growth of the 100 major city residential price index)

The residential sector in China, where we have invested around $500 million via mezzanine, is fragmented with an abundance of small and medium-sized developers. At the end of 2016, there were more than 20,000 active real estate developers in China. It is challenging for the vast majority of these developers to raise capital throughout the cycle.

The demand for mezzanine in China is further boosted by lending and pre-sale policy restrictions. In April 2010, the China Banking Regulatory Commission prohibited the use of land as mortgage loan collateral. This blanket restriction on banks lending against land puts pressure on developer’s balance sheets. Policy restrictions require low and medium rise residential buildings to be topped out prior to commencing pre-sales, exacerbating the “capital gap.”

To recap, an Asia mezzanine strategy benefits from plenty of demand from developers due to a fragmented market (particularly in China and Indonesia), limited supply of competing sources of funding from banks and robust market fundamentals driven by high levels of liquidity, urbanization and rising consumption.

Mezzanine debt in China and South East Asia provides exposure to the growth, but with superior risk adjusted returns due to its attractive running yield and downside protection. Call me conservative, but mezzanine makes more sense than layering risk on risk by combining country risk with the dangers of mainstream property development. Investors, when thinking of investing in Asian real estate, would be well advised not to shoot for the stars and rather take a close look at opportunities in mezzanine debt.

Stuart Jackson is the chief executive officer of InfraRed NF Investment Advisers in Hong Kong. InfraRed NF is celebrating its 10th anniversary of its business in Asia with investments totaling $1.4 billion in mainland China since opening in Hong Kong in 2007.

Source: cnbc china

Op-Ed: Why this investing model makes sense for real estate in Asia