WHEN the deal was struck just over a decade ago, for $1.8bn, 666 Fifth Avenue, a 41-storey Manhattan skyscraper, became the most expensive office building ever sold in America. Now it is in limbo, awaiting billions of dollars of investment to rebuild it and raise it almost twice as high. Across the Hudson River, another hunt for money is under way, to build a property called One Journal Square in Jersey City. In June a property-investing start-up called Cadre attracted financial backing from Silicon Valley luminaries including Andreessen Horowitz, a venture-capital company.

The thread linking these ventures is Jared Kushner, Donald Trump’s senior adviser and son-in-law, whose family business, like that of the president, is in property. Mr Kushner helped conceive all three projects. He has a “passive ownership interest” in Cadre (meaning he is not actively involved in its management). His family co-owns 666 Fifth Avenue and One Journal Square.

-

Climate change might prevent airlines from flying full planes

-

Why yurts are going out of style in Mongolia

-

Conservatives speak louder in secular France than in pious Germany

-

Jordan Spieth′s Open victory illustrates the perils of playing it safe

-

Donald Trump’s spokesman quits

-

Turkey’s growing repression leads to a showdown with Germany

Unlike the president, Mr Kushner is not exempt from federal conflict-of-interest laws. He has taken steps to distance himself from his wide-ranging property business. Kushner Companies, a complex enterprise that is made up of dozens of limited-liability companies, or LLCs, has more than 20,000 flats and 13m square feet (1.2m square metres) of commercial space across six states. Before joining the Trump administration he stepped down as the head of Kushner Companies and sold his stake in several properties, including 666 Fifth Avenue and One Journal Square.

Yet Mr Kushner kept his stake in many of the LLCs that make up the business. He still has a passive ownership interest in about 90% of his holdings in property, worth up to $408m, according to his disclosures. His father, Charles Kushner (photographed with his son, above), has a big role at Kushner Companies. Jared Kushner’s stakes in 666 Fifth Avenue and One Journal Square went into trusts owned by his family. A long list of lenders and partners to the family business could benefit from White House policies.

Property fights

Jared Kushner is the chief architect of Kushner Companies in its current form. His grandfather, Joseph Kushner, a Holocaust survivor, developed garden apartments in New Jersey. Charles Kushner founded the business called Kushner Companies in 1985 and led it until being convicted for tax evasion, illegal campaign donations and tampering with a witness. Jared Kushner was 24 in 2005 when his father went to prison; the next year he bought the New York Observer, a newspaper, and went to work restoring his family’s reputation. But the bigger transformation came later in 2006, when Kushner Companies said it would buy 666 Fifth Avenue.

The financial market quickly plunged and office rents fell with it. The company went on to sell 666 Fifth’s prime retail space to a Spanish firm, Inditex, owner of Zara, and other investors. It also refinanced its debt in a transaction in 2011 that gave a 49.5% stake to Vornado, a real-estate investment trust founded by Steven Roth, a longtime partner of Mr Trump.

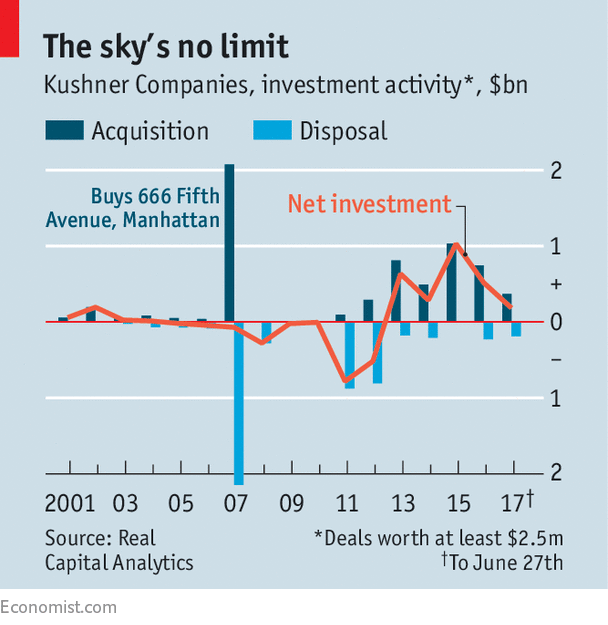

For a while the company’s appetite for big acquisitions declined. But in 2011, with 666 Fifth refinanced, Mr Kushner began buying again (see chart), according to Real Capital Analytics, a data firm. His targets included modest residential buildings in lower Manhattan and in Midwestern cities such as Toledo and Akron. He envisaged bigger developments, too, including One Journal Square and another in Brooklyn, now called Panorama, for its views of the Manhattan skyline.

Now that Mr Kushner is in the White House, two questions preoccupy observers. First, is his family business benefiting financially from his role and from his proximity to the president? Second, is he conflicted despite the steps he has taken to adhere to federal law?

Start with the question of financial benefits. This is a pivotal moment for the firm. It is seeking tenants for Panorama and new loans for a residential building along Jersey City’s waterfront (in both of which Mr Kushner still has a stake). More important, it is also looking for investors for 666 Fifth Avenue and One Journal Square (in which Mr Kushner does not have a stake). But the scrutiny that has accompanied Mr Kushner’s White House role appears to be hindering, not helping.

In January the New York Times reported that Kushner Companies was seeking equity capital for 666 Fifth from Anbang, one of China’s biggest insurers, which has ties to Beijing’s political elite. At the moment 666 Fifth Avenue’s debt—of $1.4bn, according to Vornado’s recent filings—eclipses the value of the office building itself, says Jed Reagan of Green Street, a research firm. That is partly Kushner Companies’ own doing, because of the price it paid and because it is intentionally letting the building slowly empty of its office tenants so it can be rebuilt. The new design, created by Zaha Hadid, an architect who died last year, would include a hotel, luxurious flats, new space for shops and would cost $7.5bn.

The talks with Anbang fell apart in March amid protests from ethics experts and from Democrats, who fretted about conflicts of interest and threats to national security. Another avenue also recently closed. For over two years, Kushner Companies has talked to Sheikh Hamad bin Jassim al-Thani, an eminent Qatari, about investing in 666 Fifth. This month The Intercept, a news site, reported that HBJ, as he is known, had agreed to invest $500m if Mr Kushner could raise other money elsewhere. Kushner Companies confirmed on July 11th that talks had recently ended and that it is reassessing the financing structure of the redevelopment project.

Some speculate that Mr Kushner has looked elsewhere, too. In December he met with the head of a government-owned Russian bank that is subject to American sanctions. Vnesheconombank said it was a business meeting. The White House said that Mr Kushner was “acting in his capacity as a transition official”.

The proposed One Journal Square development has also hit trouble. In May Nicole Meyer, Mr Kushner’s sister, courted Chinese investors as part of America’s “EB-5” visa programme, which offers a path to citizenship for certain investors. In Beijing Ms Meyer touted One Journal Square, explained Mr Kushner’s new role in Washington and said the building “means a lot to me and my entire family”. That sparked accusations that the family was exploiting Mr Kushner’s public role. Kushner Companies apologised “if that mention of her brother was in any way interpreted as an attempt to lure investors”.

On May 7th Jersey City’s mayor, Steven Fulop, said the project would not receive the tax breaks and bonds that Kushner Companies had sought. The city might not have granted them in any circumstance—the Kushners had asked for a particularly generous package. But Mr Fulop, a Democrat, and city councilmen are up for re-election, and Mr Trump received just 14% of the city’s vote in November. Kushner Companies had already lost its anchor tenant, WeWork, a shared-office company.

If Kushner Companies is not yet benefiting from proximity to the presidency, the potential for conflicts remains enormous. Corporate-tax reform would have a sizeable impact on property firms, for example. Mr Trump has said he wants a 15% corporate tax to apply to pass-through entities, which would include the LLCs that comprise much of the Kushner businesses (and Mr Trump’s as well). Loosening of financial regulation, expected under Mr Trump, ought to benefit lenders to Kushner Companies. Citigroup, for example, recently provided $425m to refinance one of its projects in Brooklyn. Blackstone, which lent $375m for Panorama, is raising an infrastructure fund that might be expected to find investment opportunities in Mr Trump’s infrastructure plan. And so on.

Richard Painter, the chief ethics lawyer under President George W. Bush, says that some of this “stinks to high heaven”. That does not mean that Mr Kushner has or is likely to violate any law. The rules governing conflicts of interest bar him from “personally or substantially” participating in matters with a “direct and predictable” effect on his finances. But policies that benefit Mr Kushner’s parents or Kushner Companies’ partners may be allowed, depending on circumstances. “That’s the grey area,” says Larry Noble of the Campaign Legal Centre in Washington, DC.

What seems to have developed, in sum, is a lose-lose situation. Mr Trump’s presidency appears to be doing Kushner Companies as much harm as good. If potential business partners continue to be wary of the scrutiny that comes with involvement with a firm bearing his name, Mr Kushner might end up having to choose between his property interests and his public role.

Yet the list of potential conflicts is so long that public confidence in policymaking is at risk. A White House spokesman says Mr Kushner will recuse himself in any matter with “a direct and predictable effect” on entities in which he retains a financial interest. Those issues include EB-5 financing and affordable housing, he notes. But the White House has not published a complete list of matters in which Mr Kushner would decline to participate. And no such list is planned.

Source: economist

The Trump presidency may not have helped Kushner Companies