The stock market has been stuck in low gear—in the best possible way.

Think about it: Driving in low gear is no good for going fast, but is great for climbing. And when the declines come, staying in low gear makes the descent more controlled and safer.

This pretty well captures the way the S&P 500 index has moved to a 10 percent gain this year in what’s arguably been the calmest market of all time.

We are one year removed from the last five-percent pullback, and it’s been nearly nine months since even a three-percent dip. The majority of times in its history the CBOE S&P 500 Volatility index has settled below 10 have come in the past few months.

While the overall breadth of the market has been sturdy, with more stocks rising than falling on a consistent basis, sectors have moved in and out of leadership in a kind of “immaculate rotation” that has refreshed and supported the broad indexes while keeping strong segments from getting over-extended and preventing weak areas from buckling the tape.

This has been the market’s character and will remain so until these patterns shift. The market, for many investors, has been too quiet to trust fully, yet too strong to fight with much conviction.

Stocks appear well-supported by benign economic conditions, strong credit markets and rising corporate earnings. Deflationary technological disruption combined with near-full employment, short-term interest rates below the inflation rate with average weekly earnings rising faster than consumer prices—all this seems to form something like today’s version of a “Goldilocks” backdrop for financial assets.

Yet with all this, stocks’ ability to ignore potential threats could be tested come August by two potential impediments, as seasonal headwinds and elevated investor sentiment come together.

Might these bring the first notable pullback in nearly a year—or just another opportunity for the bull market to earn the benefit of the doubt?

Two things are undeniable: History says that August tends to bring a tougher path for stocks, and the current market has not obeyed seasonal patterns much at all.

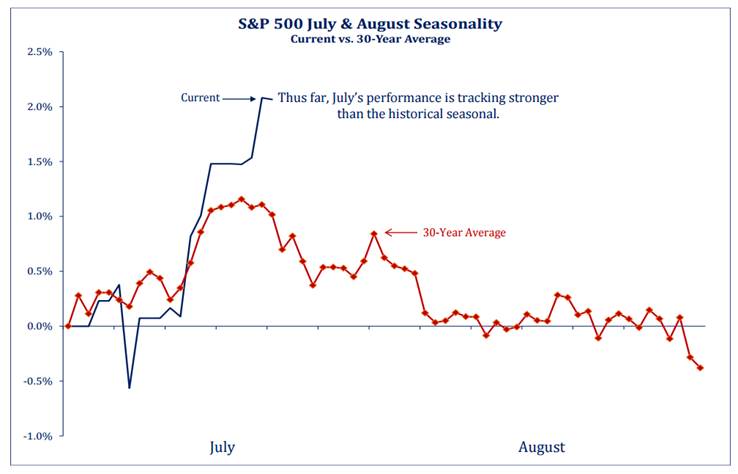

The nearby chart from Strategas Research shows the S&P 500 far outperforming the “typical” track, and any closing of the gap would mean a long-delayed setback for the index. Others are pointing to broader patterns involving the four-year election cycle and a high incidence of market accidents or peaks (coincidental or not) in years ending in 7.

Source: Strategas

Two years ago we entered late July with the same sort of resilient, low-volatility action—that one far more dominated by a handful of tech stocks than today’s market is—and hit turbulence in late summer that started a brutal correction. But that required an oil collapse, global industrial downturn and “earnings recession,” none of those evident right now.

The bottom line is, seasonal risk is something to bear in mind. Yet February was “supposed” to be weak and this year was strong; May has a tough reputation and this year the market barely hiccuped.

The market’s humbling of the bears has pulled many converts into the bullish crowd. Even those strategists who have correctly been positive on the market are flagging some surveys of professional investors that show optimism rising toward levels that can be a restraint on further short-term upside.

Jeff deGraaf of Renaissance Macro says: “The latest Investors’ Intelligence and Consensus Inc. [survey] figures show 90-100th percentile readings in bull categories. Simply put, this shows that there are more bulls than bears in the market right now. With the market showing green lights across the board, this represents one of the few headwinds.”

Other gauges of mood, such as options activity and low cash levels in retail and institutional brokerage accounts, also support the idea that folks are generally positioned for further record highs.

And, sure, there are elements of the rally that arguably smell of “culmination” rather than a fresh, peppy departure for more distant points higher.

The S&P 500 seems to have a date with the 2500 level, up just another 1 percent, a nice round number that’s two-thirds higher than the 1500 mark that capped the market for 13 years. The tech sector just reclaimed its year-2000 high. The Nasdaq just completed a rare 10-day win streak.

S&P 500, 1 year

But none of this flashes brightly as a sign of rampant speculation or headlong euphoria, and is countered by abiding signs of caution: Wall Street strategists’ targets remain muted, retail inflows to stocks are inconsistent, and Friday saw the third-highest volume in five years for options bets that the VIX will rise (implicitly a bet on more market turbulence with a downside tilt).

This is no longer a hated bull market, and it doesn’t necessarily owe investors much more, but the sentiment setup right now argues more for a pause or that long-awaited pullback than a serious peak. Markets tend to weaken and get jumpy before they make a top, and this one hasn’t yet.

European stocks, consensus darlings right now, have shed more than 4 percent from recent highs as the euro has surged. And stock reactions to U.S. earnings results so far has been skewed toward “sell the news” so far this reporting season.

These are things to monitor for a potential change in market character. It’s far too early to say that one is truly at hand. But the approach of August, with investors feeling more comfortable, is the time to start listening for the gears starting to slip on this low-gear market.

Source: Investment Cnbc

Two big forces could thwart this clockwork stock market rally come August