IN MAY 1945 John Maynard Keynes wrote a memo on the post-war economy. In it he argued that Britain should seek to be in the mainstream of global commerce. It would suit finance as well as industry to have the whole world as a playground, he wrote. “We built up the pre-war sterling area because we were bankers amiable to treat with and having a long record of honouring our cheques.”

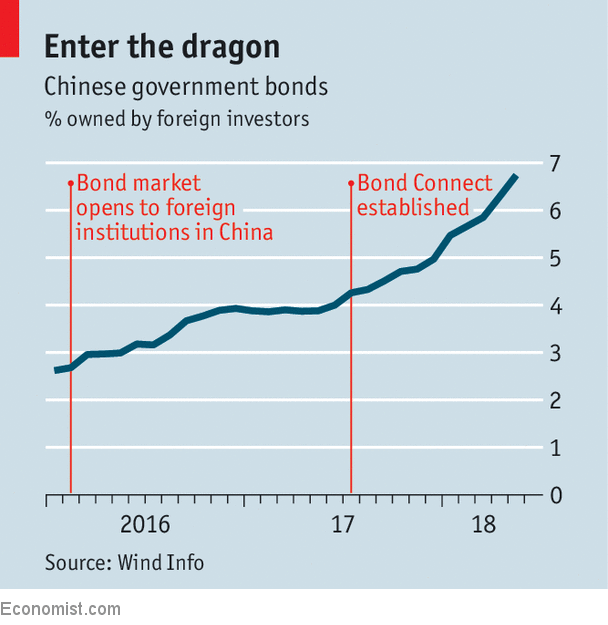

He passed over how Britain’s economic muscle had helped sterling’s dominance—perhaps because by then that muscle was wasting. Yet it is implacable economic might that leads many today to conclude that the yuan, China’s currency, will supplant the dollar, just as sterling gave way to the dollar after 1945. The yuan is already one of five constituents of the Special Drawing Right, a basket of reserve currencies created by the IMF. And China is opening up to capital flows. This year foreigners have been the biggest buyers of Chinese government bonds.

-

The dangers of Cameroon’s war of words

-

Bullshit jobs and the yoke of managerial feudalism

-

Madeleine Albright on fascism

-

The Trump administration wants to expand immigrant family detention

-

How smog affects spending in China

-

Retail sales, producer prices, wages and exchange rates

It is tempting to see this as another milestone on the way to the yuan’s preordained supremacy. But it is an error to interpret current events in the light of an imagined future. Foreign buyers of Chinese bonds are not swept along by an unseen law of history. Rather they are spurred by more prosaic considerations.

To start with, it has become a lot easier to buy the bonds. Foreign institutional investors with a presence in China have been allowed to buy them for more than two years (see chart). Last July Beijing established a bond-trading link between Hong Kong and the mainland. Since then the number of foreign asset managers with trading accounts in Hong Kong has mushroomed. In March Bloomberg-Barclays said it would add China to its main bond index next year.

The bonds have intrinsic merits, too. A year ago the yield on a ten-year Chinese government bond was around 1.5 percentage points higher than the yield on an equivalent US Treasury bond. The spread has since narrowed. Yet at 3.6% yields are still attractive, especially in comparison with the yields of under 1% offered by the safest European bonds.

Chinese bonds have many other useful qualities, notes Jan Dehn of Ashmore, a fund manager. Prices have been less volatile than those of other emerging-market bonds. Chinese bonds are valuable to portfolio managers because they tend not to move in synch with other assets. They are thus prized as diversifiers. And—yes—China’s scale is a draw. Given the size of the market, the world’s third-largest, foreigners still own rather few of its bonds.

Safety first

Still, there are dangers for the unwary. The ratio of debt to GDP in China has risen to 260%, from 160% in 2008. In other places, such a surge in credit has led to souring loans and, sometimes, financial crisis. There is a natural suspicion that China is opening its bond market so that foreigners can share in the inevitable losses. Yet so far, foreign buyers have trodden carefully, mostly buying government bonds and steering clear of riskier municipal and corporate bonds, says Zhenbo Hou of BlueBay Asset Management. The raciest bets that foreigners have made are on the bonds of policy banks, such as the China Development Bank, and on short-term paper issued by biggish provincial banks. It is telling that foreigners hold less than 2% of the overall market, but 7% of the stock of safer government bonds.

The gradual opening of the bond market is part of a step-by-step approach to financial reform. China is thus proving a little more amiable to foreign capital. And by letting foreign money in, albeit still with some hurdles, it might hope to let some domestic money out and still keep the yuan stable. The big test will be whether China will always honour its cheques—can foreigners get their money out when they want to? It has kept control of both its exchange rate and its domestic monetary policy through capital controls. But if it allows foreign bondholders to move capital in and out more freely, it must either lose control of the yuan or use interest-rate policy to support it and not the economy. Faced with this trilemma, most rich countries let the currency float freely. A volatile yuan would be a marked change—for China and its bondholders.

Perhaps in a decade or two historians will look back and point to this policy or that event as the turning-point in China’s emergence as a financial hegemon. If so, they will be kidding themselves. China is likely to open up in fits and starts. There will be mistakes, accidents and reversals. In the meantime, investors will, as always, respond to incentives. For a growing number, for now at least, the case for buying China’s bonds seems to add up.

Source: economist

Why foreigners are keen buyers of Chinese government bonds