Passive investing is taking a bigger share of the stock market, helping to drive gains.

Exchange-traded funds, or ETFs, owned nearly 6 percent of the U.S. stock market as of the end of the first quarter, their greatest share on record, according to analysis by Goldman Sachs.

Known as passive investments, ETFs are baskets of stocks tracking various market indexes and have grown in popularity for their relatively low fees. In contrast, mutual funds that involve higher-cost active stock picking have declined in popularity, and their ownership of the U.S. stock market has fallen to 24 percent, the lowest since 2004.

ETFs purchased $98 billion worth of stocks in the first quarter, putting them on pace to buy $390 billion of stock this year, more than the last two years’ combined total of $362 billion, according to the Friday note by a group of analysts led by Goldman’s Chief U.S. Equity Strategist David Kostin. Goldman based its analysis on the Federal Reserve Board’s June 8 report on first quarter U.S. financial accounts.

ETF ownership of equities is at the highest level on record, as of the first quarter

Source: Federal Reserve Board and Goldman Sachs Global Investment Research.

Analysts said the growth of ETFs can help explain why stocks have gained this year despite delays in passing the Trump administration’s pro-growth proposals and increased geopolitical worries.

“I agree that ETFs have been a big driver,” Ilya Feygin, managing director and senior strategist at WallachBeth Capital told CNBC in an email. “The market has often made strong gains in weeks of strong inflows even in the face of bearish macro news. It has paused when there is not much inflow or the inflow went to international ETFs instead of U.S.”

In a sixth-straight quarter of gains, the S&P 500 climbed 5.5 percent in the first quarter to record highs. The index is tracking for gains of more than 3.5 percent this quarter.

Corporate buybacks and foreign investors have also driven demand for U.S. stocks.

Share buybacks were still the largest source of demand for stocks in the first quarter at $136 billion, or 46.6 percent of purchases, the Goldman report said, while the first quarter marked the second time in the last eight quarters that foreigners bought more U.S. stocks than they sold.

That said, Kostin doesn’t expect the strong demand for U.S. stocks in the first quarter to hold.

Goldman’s year-end target for the S&P 500 is 2,300, about 5.7 percent below Friday’s close of 2,438. U.S. stocks traded slightly higher Monday, with the S&P near its record high hit on June 19.

Expectations for a slight decline in U.S. stocks should lead to “a modest deceleration in ETF purchases” in the second half of the year, the report said, while a switch to passive management will add to mutual fund withdrawals.

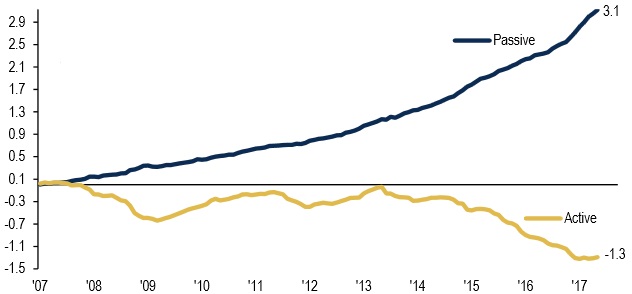

Since 2007, $3.1 trillion has flowed into passive bond and stock funds, while $1.3 trillion has flowed out of actively managed bond and stock funds, according to a Bank of America Merrill Lynch report Thursday.

Cumulative active vs. passive flows to bond & equity funds ($ trillions)

Source: BofA Merrill Lynch Global Investment Strategy, EPFR Global

Stock buybacks are also on the decline and should weigh on market returns. Kostin cut his forecast for corporate buyback growth this year to 2 percent from 11 percent.

“Our new estimate excludes any boost from tax reform in 2017 and also accounts for weaker activity in 1Q,” Kostin said in the report. He previously expected tax reform this year to result in firms bringing back cash from overseas and using those funds to buy back shares.

Over the 12 months ending March 2017, buybacks for S&P 500 companies declined 13.8 percent from a record high the same period a year ago, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

On the other hand, improved growth in Europe and the rest of the world should benefit stocks outside the U.S.

Goldman expects the Europe STOXX 600 to gain 6 percent over the next six months in local currency terms, Japan’s TOPIX to climb 2 percent and the MSCI Asia-Pacific ex-Japan Index to rise 1 percent.

“Higher return potential in major non-US equity markets vs. the US and a political stalemate in Washington D.C. suggest foreign investors will be net sellers of US stocks in 2H,” Kostin said in the report.

Kostin also expects better returns overseas to attract U.S. buyers, who already bought $83 billion in foreign equities in the first quarter, reversing a trend in five of the last six quarters of selling more foreign stocks than buying.

Source: Investment Cnbc

Goldman says there's one major force behind the market's gains this year: ETFs