IN February of 2001, Alan Greenspan, then still the chairman of the Federal Reserve, and still called the “Maestro”, testified to the Senate Budget Committee. The committee wanted to get started on the tax cuts George W. Bush had promised during his campaign. Mr Greenspan gave them his qualified blessing, with an argument that now sounds incredible: he was worried that America would pay down its debt too soon.

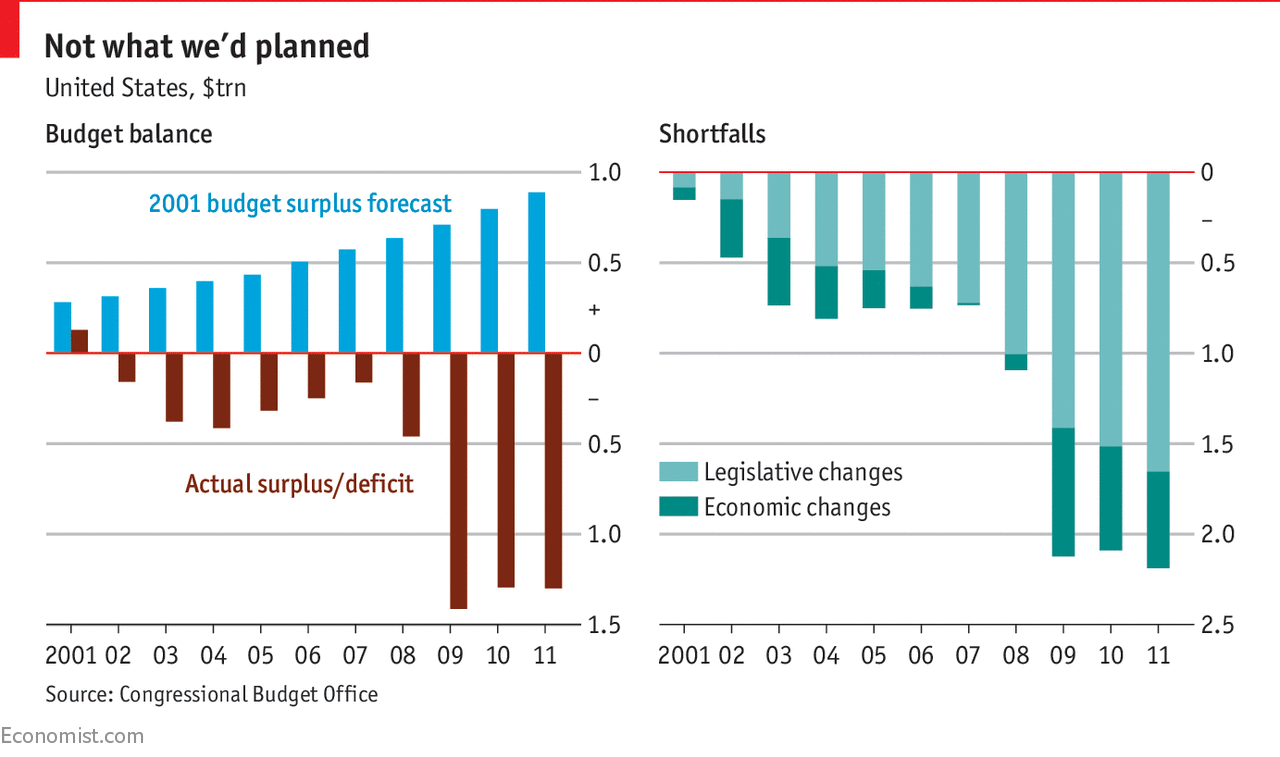

That week the Clinton administration’s Office of Management and Budget had released its final ten-year budget projections. Firms had just completed several years of capital investments in desktop computers, and workers had become more productive. This had increased corporate revenue, and consequently taxes paid to the government. A long bull market in stocks meant that the Treasury was taking in more in capital gains taxes, too. “The experience of the last five to seven years,” said Mr Greenspan, “has truly been without precedent.” The Clinton administration had apparently left Washington with a gift. The annual budget surplus by 2011 would be $889 billion, for a cumulative gain over the decade of $5.6 trillion–exactly the size of the federal debt at the end of 2000.

-

The president haunts the race for governor of Virginia

-

The hubris of ten-year budgets

-

A new biopic of Morrissey, Britain’s controversial music icon

-

Lobbyists know which way the Washington winds are blowing

-

In Ireland’s Jerusalem, calls to forgive are more than a platitude

-

Why so many African presidents are ditching term limits

And so the Fed chairman told Congress he was worried that the federal government might completely pay down its debt, and perhaps even start saving, investing its wealth in private assets. This could distort the efficient allocation of capital, worried Mr Greenspan. Preventing the government from completely squaring its accounts, by cutting taxes, could be a good idea. He cautioned that those cuts should be made contingent on the appearance of actual surplus, but reporters at the time took away a less nuanced message: Alan Greenspan approves of the Bush tax plan.

Then several other things happened. The bubble in technology stocks evaporated, and with the shallow recession that followed, so did some of the forecast tax revenue. Terrorists flew planes into the Pentagon and the World Trade Center, and taxpayers had to fund two wars. Later in the decade, a huge financial crisis and deep recession reduced tax revenues, raised payments for things like unemployment insurance, and scared Congress into two separate stimulus bills. The $5.6 trillion cumulative savings that the Office of Management and Budget predicted in 2001 turned into a $6.1 trillion cumulative deficit. America’s ten-year forecast was off by $11.7 trillion.

Alan Greenspan, one of the great economists of his or any generation, did not see these things coming. We can forgive him for that; few other people did, either. The problem is not that he was wrong, but rather that we have no business thinking we know what’s going to happen over the next ten years.

As members of Congress and the administration start to talk about taxes again, they reckon their sums in ten-year increments. “This will save $400 billion” means “At the end of ten years from now, we will have saved $400 billion.” Two common tricks cavort under this blanket. The first is when the most painful changes–the ones that save the most money–don’t take hold until year seven or even year nine. The second is that today’s Congress can direct future lawmakers to figure out which painful changes to make to meet the ten-year target. Both tricks ultimately fail for the same reason: no Congress likes to make painful changes, and tomorrow’s politicians are no more virtuous than today’s.

But suppose Congress is doing its job honestly, rather than deferring hard choices. Ten-year budget projections are still misleading, for a more fundamental reason: we just aren’t that good at predicting the future. Forecasts often fail catastrophically in the face of some seismic event such as financial collapse or the Euro crisis. There is routine bias, too. A 2011 study by Jeffrey Frankel in the Oxford Review of Economic Policy found, unsurprisingly, that governments tend to be too optimistic.

Ten-year budgeting isn’t universal. The European Union directs its member states to predict budget trends over three years, and that is what most of them do. Europe has hardly been a paragon of conservative prediction since 2000, but the limited three-year horizon does admit some humility. Even a perfect model would omit what economists call “exogenous shocks”. This is a fancy way of saying “stuff we couldn’t possibly have seen coming”. Things like 19 terrorists on four planes. Or the almost total collapse of capital markets.

So during the next six months of fighting over taxes, every time you hear a member of Congress say what she’ll save over the next ten years, wonder what she’ll be willing to sign for next year. Even better, demand that Congress finally heed a bit of overlooked advice that Alan Greenspan offered back in 2001.

As for tax policy over the longer run, most economists believe that it should be directed at setting rates at the levels required to meet spending commitments, while doing so in a manner that minimizes distortions, increases efficiency, and enhances incentives for saving, investment, and work.

Simple advice. Hard to pull off.

Source: economist

The hubris of ten-year budgets