In the wake of announcing a major acquisition, stronger comparable sales results in North America and Europe helped fuel Michael Kors‘ profit and revenue to top Street expectations in its fiscal first quarter.

Michael Kors said Tuesday that its net income attributable to the company dropped 15 percent to $125.5 million, or 80 cents per share, from $147.1 million, or 83 cents a share, a year ago. Last year’s figure included one-time costs related to the acquisition of a Greater China licensee. Excluding that charge, Kors had earned 90 cents a share.

While its profits fell, Tuesday’s results outpaced both the company’s and analysts’ expectations. According to Thomson Reuters, analysts on average were predicting Kors would earn 62 cents per share. That was also the midpoint of the company’s own forecast range.

“The numbers are something of a step forward,” GlobalData Retail Managing Director Neil Saunders wrote in an email to clients.

“While the numbers may strengthen [from here], the rest of this fiscal year will essentially be one of rebuilding and refining the brand, as well as closing further excess capacity and investing in channels and stores that have the best forward potential.”

Total revenue for the first quarter came in at $952.4 million, again topping analysts’ estimates for sales of $918.6 million, according to Thomson Reuters. But this was another drop — by 3.6 percent — from last year.

The drop in revenue wasn’t a surprise, Saunders added, but it’s more of a “necessary evil” as Kors gets out of retailers that no longer fit the brand’s fresh strategy. “Reducing ubiquity comes with a price attached.”

Michael Kors’ same-store sales dropped 5.9 percent during the period, coming in better than expected. Analysts surveyed by FactSet had predicted a decline of 9 percent.

Shares of Michael Kors climbed more than 14 percent higher on the news in premarket hours.

“This trend of beating expectations is likely to continue as the top line appears on a path of improvement from here,” Jefferies analyst Randal Konik wrote in a note to clients, saying the “turn [is] taking place.”

Investors appear to be rallying behind the fashion company as it shows early signs that its turnaround efforts are paying off sooner rather than later. Michael Kors raised its sales outlook for the full year.

“We are encouraged by our first quarter performance, although we continue to believe that fiscal 2018 will be a transition year for our company, as we focus on laying the foundation for the future by executing on our strategic plan,” CEO John Idol said in a statement, reiterating his goals of returning to profit growth.

“In addition, we are pleased to have recently announced plans to form a global fashion luxury group,” Idol added.

Earlier this summer, Michael Kors revealed plans to buy London-based shoemaker Jimmy Choo in a deal valued at $1.2 billion.

“This will not be [Michael Kors’] last acquisition,” CEO Idol told CNBC in a phone interview shortly after the acquisition was announced.

Idol has reiterated time and again that Michael Kors is focused on forming a “luxury group.” On Tuesday, he added that a more diverse portfolio will play well as the retailer looks to increase exposure in international markets.

Meantime, Michael Kors has seen its same-store sales drop in recent quarters, with fewer shoppers flocking to brick-and-mortar department stores to ring up big purchases. Additionally, the retailer’s core handbag business has slowed, with competitors rolling out heavier discounts and promotions, enticing women to shop for bargains.

Pressure really hit the retailer in May, when rival Coach agreed to buy Kate Spade in a deal valued at $2.4 billion.

On Tuesday, Michael Kors said that its outlook for the full year doesn’t include any expectations related to acquiring Jimmy Choo, as the deal between the two has yet to be completed. Once finalized, incremental revenue is expected to be about $275 million for the second half of fiscal 2018. And in fiscal 2019, Michael Kors said it expects incremental revenues of $570 million to $580 million.

Not including results from Jimmy Choo, the handbag maker has raised its annual revenue forecast, putting total sales estimates at about $4.28 billion and calling for comparable sales to only decrease in the mid-single digits range. It previously expected sales of $4.25 billion.

“Management guided to both better top and bottom-line metrics for next quarter and the fiscal year, which is key as the market has been afraid of more guidance cuts,” Konik said. “That’s simply not happening.”

Konik added that the “strategic direction is positive” for Kors from here on out.

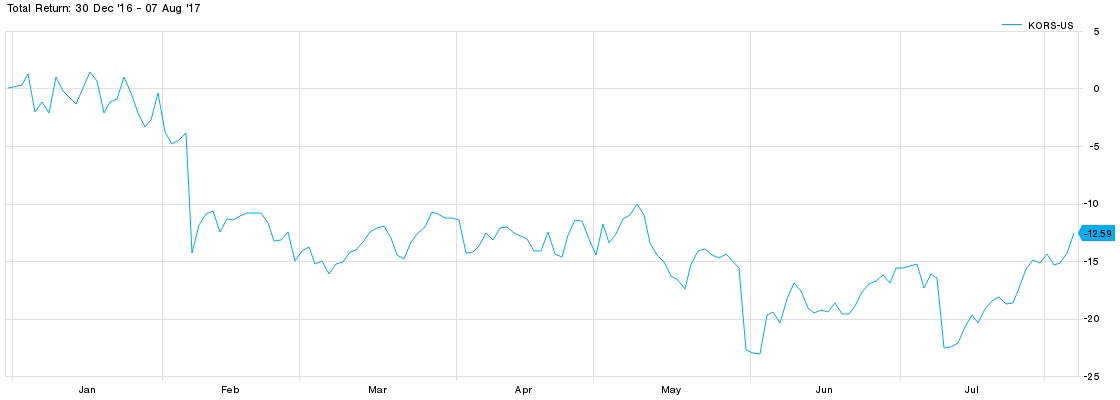

As of Monday’s close, Michael Kors’ stock has dropped about 26 percent over the past 12 months, and shares are down near 13 percent in 2017. In recent weeks, the stock has made somewhat of a comeback, inching up 3.3 percent over the past month.

Source: FactSet

Michael Kors' profit tumbles but tops Street estimates, sending shares soaring