Investors this week got their first taste of market pandemonium in a long while.

If they want a place to shelter from the storm, these securities have a track record of rising during times of market tumult:

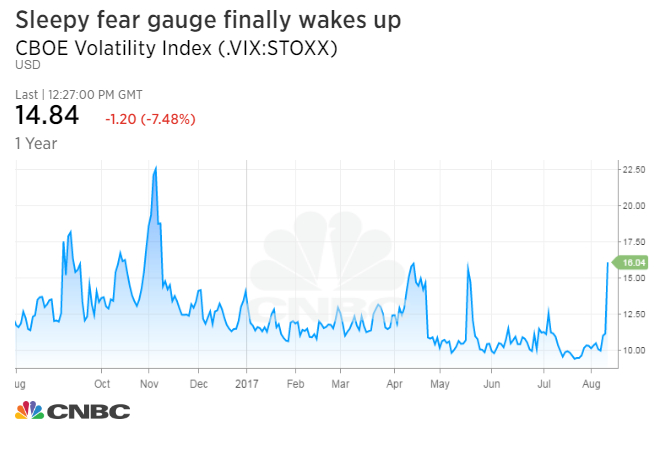

The Dow Jones industrial average dropped more than 200 points, and the CBOE volatility index, or VIX, jumped more than 40 percent Thursday to its highest level since the election as a war of words broke out between President Donald Trump and North Korea.

The market’s fear gauge had been unusually dormant, staying mostly below 12 for the last four months and even diving last month to its lowest level ever.

Sophisticated investors scrambled to place bets on what will happen next on the geopolitical front with a record amount of options contracts tied to the VIX trading on Thursday. The high volume continued on Friday.

Traders and investors including Jeffrey Gundlach believe the volatility measure could jump to 20 as geopolitical tensions rise and more thoughts of overvalued tech stocks sink in next week. It was hovering around the 15 level on Friday.

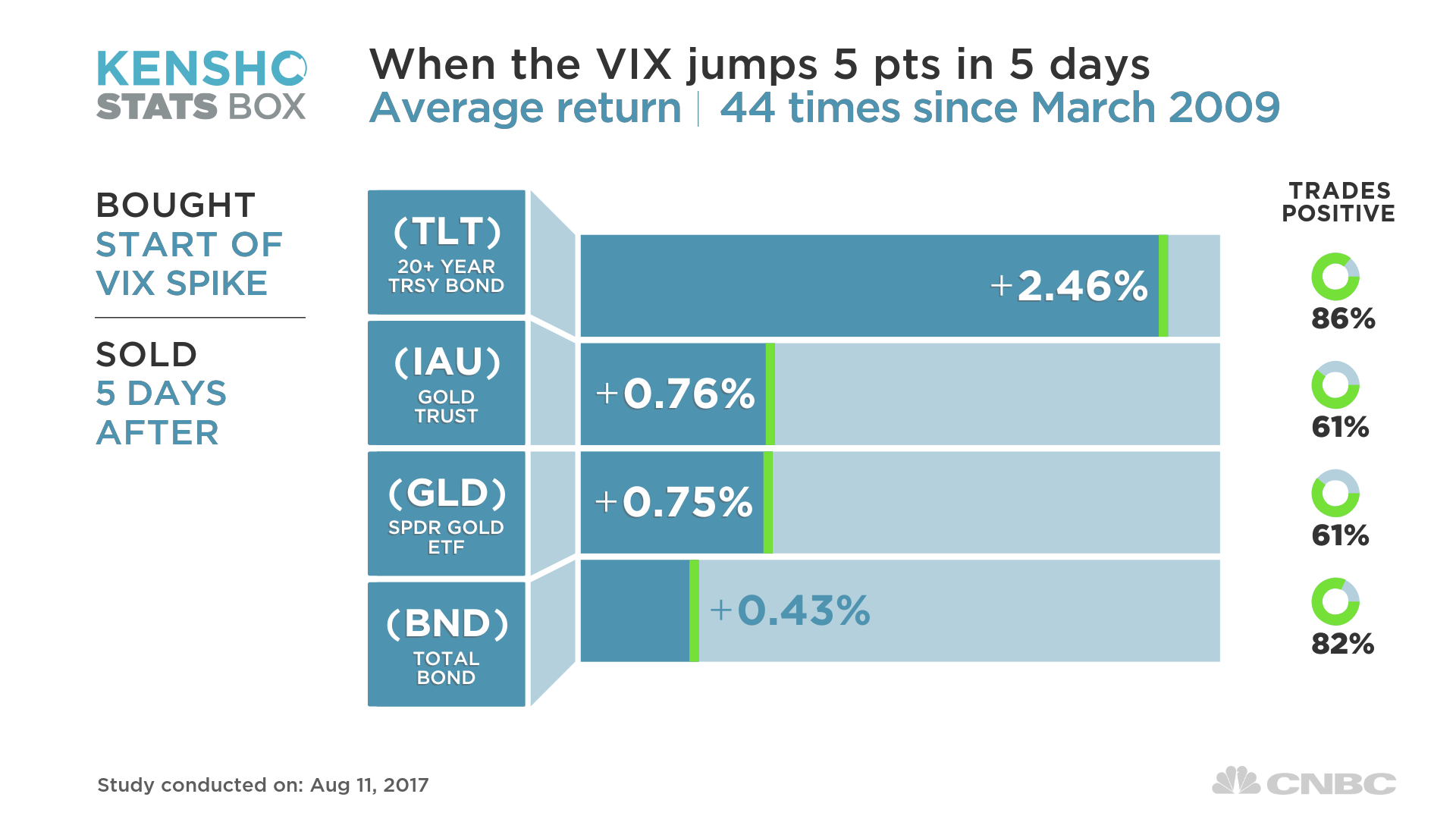

Using Kensho, an analytics tool deployed by hedge funds, CNBC found 44 times when the VIX popped 5 points in a span of five days since this bull market began in 2009. A search of a group of highly liquid ETFs found a few that rose during those volatile time periods, on average.

The iShares 20+ Year Treasury Bond ETF, largely tracking the U.S. government debt market, is the top performer, on average, as investors huddle there for safety. Next was the Vanguard Total Bond Market ETF, which follows highly rated government and corporate debt.

And no surprise on the list are gold-related securities. The iShares Gold Trust and the SPDR Gold Shares seek to track the price of gold, the oldest safe haven out there.

Disclosure: CNBC’s parent NBCUniversal is a minority investor in Kensho.

Source: Investment Cnbc

When all hell breaks loose in the markets, these securities go higher