A well-respected Wall Street stock strategist is increasing his bets on bitcoin.

Fundstrat’s Tom Lee told clients in a Wednesday report that the Bitcoin Investment Trust, trading under the GBTC ticker, is an “attractive” buy.

The move is a risky one for a strategist like Lee. The bitcoin trust is traded over-the-counter, rather than in a formal venue like the New York Stock Exchange. NYSE Arca, a leading exchange for exchange-traded funds, also withdrew in late September its application with the U.S. Securities and Exchange Commission to list the bitcoin trust.

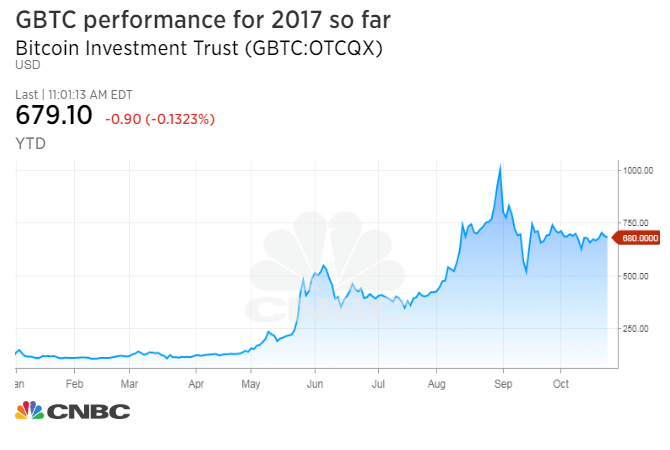

The security is volatile too with nine days this year where it has plunged more than 10 percent in a single session.

Lee remains the only major Wall Street strategist to have issued recommendations on bitcoin, the volatile digital currency that has briefly multiplied more than six times in price this year.

In July, he forecast bitcoin could rise roughly ten times or more over the next five years. In August, he established a mid-2018 price target of $6,000. Then earlier this month, Lee and his team announced five reference indexes for digital currencies. He was JPMorgan Chase’s chief equity strategist from 2007 to 2014 before co-founding Fundstrat Global Advisors, where he is managing partner and head of research.

Lee said Wednesday he sees GBTC rising nearly 250 percent or more by 2022 if bitcoin reaches his $25,000 target for that date. Bitcoin traded little changed on the day around $5,524 Wednesday, according to CoinDesk.

“The bitcoin investment trust, GBTC, is essentially the only ‘game in town’ if a U.S.-based investor wants to gain exposure to bitcoin via an exchange-listed instrument (there are ETNs in Europe as well),” Lee wrote Wednesday. “Investors have underestimated [net asset value] because they overlook the $31 worth of bitcoin cash (BCH) and $22 worth of bitcoin gold (BTG) held by GBTC.”

Bitcoin cash and bitcoin gold are alternative versions of bitcoin that split off from the original in August and October, respectively. Bitcoin is also scheduled to split again next month into bitcoin and bitcoin SegWit2x. Investors at the time of a split technically receive the same number of the offshoot coin as their bitcoin holdings, but digital currency exchanges and storage websites have been slow to support the new currencies.

It’s not clear whether Bitcoin Investment Trust’s sponsor Grayscale Investments will support the bitcoin offshoots. The company’s latest press release on bitcoin cash gives no date for a “possible” distribution. Information on other splits was not available on Grayscale’s website, and a representative declined to comment, citing federal securities laws.

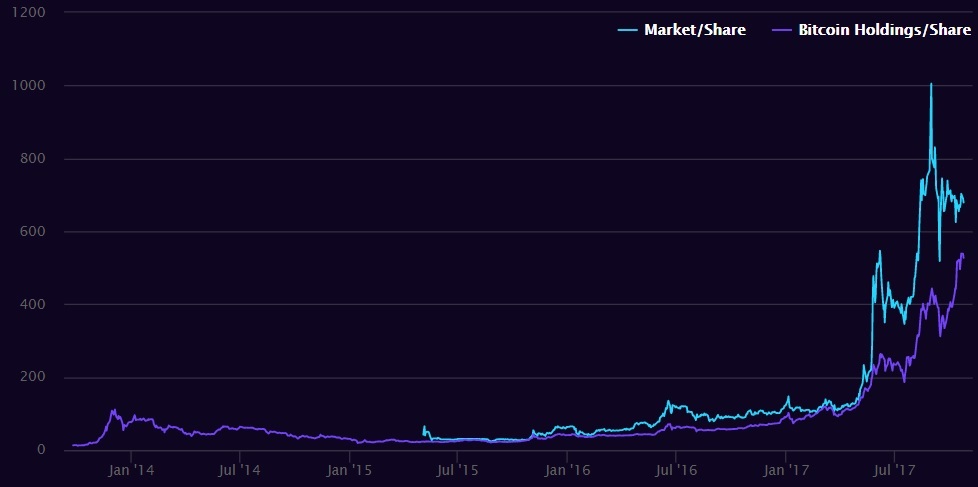

Bitcoin Investment Trust market price vs. bitcoin price since 2013

Source: Grayscale Investments

Bitcoin Investment Trust launched in September 2013 and has a high annual fee of 2 percent. Assets under management were $713 million with nearly 1.9 million shares outstanding as of September 30, according to Grayscale’s website. The site also shows that each share tracks about 0.092 bitcoin, worth about $527 with a market value of $679 as of Tuesday’s close.

That roughly 20 percent gap, or premium, marks a sharp drop from an average 45 percent since 2015, Fundstrat’s Lee pointed out. That decline “means that GBTC is an attractive and liquid proxy for bitcoin,” he said.

Bitcoin Investment Trust is the fifth-largest holding in ARK Invest’s Innovation ETF (ARKK) at 4.24 percent, just behind Twitter. Tesla is the top holding in the ETF with a weighting of 5.99 percent as of Tuesday’s close, according to a document on ARK’s website.

Source: Tech CNBC

Wall Street strategist Tom Lee recommends risky over-the-counter bitcoin trust