U.S. companies on balance already are paying well below the 20 percent tax level targeted in the Republican reform plan, according to an analysis by Yardeni Research.

In fact, the typical effective tax rate — the amount paid minus deductions — could be as low as 13 percent over the past years, Yardeni concluded when looking at a cleaner number of how much the government is really collecting.

That’s well below other estimates that sought to clarify the impact of the tax reform proposal that would take the current nominal rate from 35 percent to 20 percent. Multiple firms have concluded the benefits will tilt to specific sectors and provide a limited aggregate windfall.

The Institution on Taxation and Economic Policy, for instance, looked at 258 Fortune 500 companies that were “consistently profitable” from 2008 to 2015 and found they paid an effective rate of 21.2 percent.

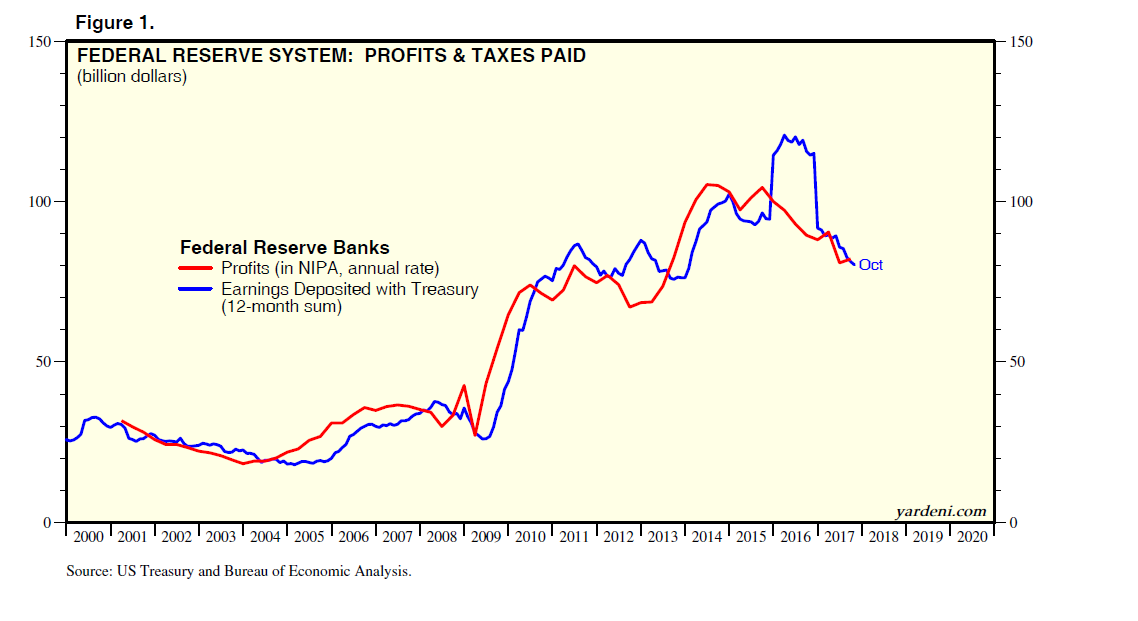

But Yardeni found those estimates may be overstating what the government is actually getting from corporations. For instance, the Bureau of Economic Analysis, which compiles quarterly GDP reports, includes taxes collected from state and federal governments as well as the hundreds of billions the Fed remits to the Treasury each quarter from its $4.5 trillion bond portfolio.

The Fed’s profits from the bonds it bought during three rounds of quantitative easing swelled from $27 billion at the beginning of 2009 to a record $105 billion in the second quarter of 2014.

The bureau uses something called the National Income and Product Accounts that Yardeni said could be distorting the corporate tax picture by including the state and local as well as the Fed receipts.

“The obvious conclusion is that measuring the average effective federal corporate tax rate using the NIPA data will overstate it by the amount of ‘taxes’ collected from the Fed and by the amount of taxes paid to taxing authorities other than the IRS,” Ed Yardeni, founder of Yardeni Research, said in a note.

Still, even using the NIPA-based data yields an effective rate below 25 percent since 2008, and 20.7 percent over the past four quarters. Excluding the Fed’s contribution to that data set takes the effective rate all the way down to 13 percent, Yardeni said.

Yardeni concedes that there could be some holes in his method, such as the small business contribution, but he sees on whole the numbers are right.

He addressed one other issue in his research: that big companies are skating around their obligations by using deductions to slash their tax bills, while smaller ones are tasked with making up the difference. His firm’s research found that the effective rate on S&P 500 companies was 26.4 percent in 2016, suggesting that the lower effective rates could be skewed to smaller businesses.

That conflicts with the Institution on Taxation and Economic Policy numbers, and Yardeni said that may be due to the S&P 500 data including taxes paid to state and local government as well as foreign authorities.

“The bottom line is that getting to the bottom line when it comes to matters of taxation is a very taxing exercise,” Yardeni said. “We’ll keep at it, but our conclusions so far are that corporations, on balance, may actually be paying less than the 20.0% statutory rate that the Republicans are aiming to enact, and large corporations may not be free-loading at the expense of small ones.”

Yardeni is not the first to point out that the effective tax rate is close to the 20 percent GOP proposal.

Goldman Sachs, for instance, said tax cuts likely will contribute only about 0.3 percentage points to GDP growth over the next two years.

“While the corporate tax changes are likely to result in a net tax reduction in corporate tax liabilities, the size of the tax cut actually looks fairly small,” Jan Hatzius, Goldman’s chief economist, said in a recent note. “Compared to current policy, the compromise legislation we expect to emerge from the conference committee would reduce the effective corporate tax rate by only a couple of percentage points.”

Also, recent research from S&P Global Indexes and other firms indicates that effective tax rates differ sharply by sector, with tech and health-care companies paying well below the top current rate while large retail and transportation firms are paying closer to the 35 percent level.

The firm’s analysis indicates “that many companies in certain sectors would have very little impact on effective tax rates from the lower statutory tax rates primarily due to the offset of deductions they get today.”

WATCH: Sen. Toomey touts growth from tax reform plan.

Companies are already paying a tax rate as low as 13%, economist Yardeni estimates