The US economy is running at close to capacity, with only 3.8 percent unemployment. Finally, after years of unrequited anticipation, we are seeing some reasonable wage growth.

Despite the 2.7 percent year-over-year current reading, this gain falls short of the close to 4 percent nominal increases seen historically during periods of low unemployment.

This suggests it might be worth exploring whether specific structural changes today might persist in the future to hold down income growth to below 3 percent annually. Studies have carefully examined how labor is less unionized, with limited bargaining power; is less interested in moving geographically; is less productive somehow (maybe that three plus hours a day staring at our cellphones?); and includes a large pool of workers sitting on the sidelines, who are technically not workforce “participants” since they are not officially seeking a job.

All these elements may contribute to wage stagnation, inhibiting the traditional response of higher pay to the shortage of workers. However, the last point, suggesting that the real unemployment rate has been higher than “officially” stated, best explains why employers have not needed to offer much higher wages to induce new workers in many sectors.

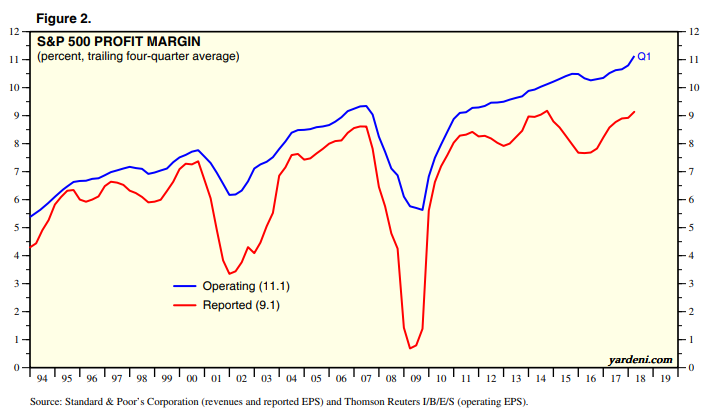

It is also clear that the private sector cannot blame weak profits for the lack of wage growth to its employees. As the chart below illustrates, operating and reported margins have doubled since 1994, at least for the S&P 500 companies.

Total wages account for a 57 percent of total revenue today compared to 65 percent in 1975. While the US economy has expanded over the past decades, the portion earmarked for workers has declined.

One group has defied that trend: CEO’s. The compensation for top executives at the 350 largest US corporations has skyrocketed, with the average CEO in 1978 earning 30 times the salary of a typical worker versus a hair-raising 271 times today. If these firms were representative of the entire domestic workforce, we would see a spread between the gains experienced by management versus rank and file employees.

However, the S&P 500 block of companies only accounts for 17 percent of domestic workers, with the majority employed by small to medium sized entities. That explains why the average real wage increase for non-supervisory workers over the past decade (plus 0.8 percent), exceeded that for the total worker pool (plus 0.6 percent), including managers. While the numbers are large at the biggest corporations, their impact on the total labor market is small.

Is it possible there are other cost categories that have grown dramatically at the expense of “earnings” and might continue to crowd out employees? Consider health care insurance premiums, which have climbed from 5.5 percent of total private industry compensation in 1997 to 7.6 percent today.

When the Bureau of Labor Statistics announces its monthly wage growth, health care premiums and benefits are excluded from those numbers. At my company, we pay approximately $25,000 a year for each employee who has a family plan. Our premiums have expanded at a rate two to three times that of inflation, which is likely true for most organizations.

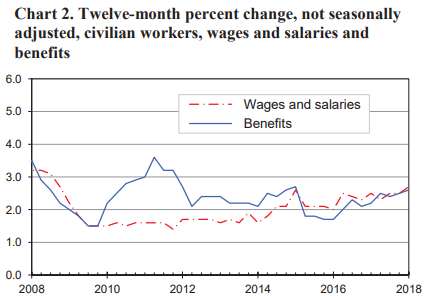

It could be possible that increased benefit packages, such as health care, flexible time, parental leave, etc., which are not included in “wages”, could be causing income sluggishness. However, when we observe the growth rate of wages compared to that of benefits, outside the post-Recession period of heavy-severance payouts, the two charts closely coincide.

Finally, I looked at human resource department spending, in an effort to quantify whether programs that relate to harassment, education, training, and safety policies might be so expensive that wage gains are a casualty. Despite the high profile nature of HR initiatives in the wake of the #MeToo movement, HR staffing currently represents 1.4 full time equivalent for every one hundred workers, up slightly over the prior five years . Staffing, of course, is not a perfect proxy for total cost of new corporate initiatives, but there is no evidence that wage growth is restricted by sensitivity training.

Therefore, I would conclude that the ubiquitous “Help Wanted” signs I see in multiple storefronts and restaurants, and articles about industries such as trucking, airlines, nursing, and IT will force employees, faced with labor shortages, to ultimately pay more. After the recession, millions of people who lost jobs became self-employed or under-employed – Uber drivers, person trainers, dog walkers, home relocation experts, etc., and they were simply not in the data set.

Offer them enough, and many will come back to the labor force. Meanwhile, I’ve lost my dog walker. She’s back working for a digital advertising company.

Commentary by Karen Firestone, chairman and CEO, Aureus Asset Management.

Source: cnbc economy

Companies have no choice now but to raise wages