Investors frequently ask Jim Cramer what to do with a stock after it has had a hideous decline. His first response is always to ask why they bought the stock in the first place. One of Cramer’s cardinal rules is to never turn a trade into an investment. If there is one thing he wants […]

Read moreWhen Jim Cramer first started trading, he didn’t like rules. He believed they either weren’t helpful or would cut into his upside and prevent him from making more money. After getting burned too many times, he learned the value of discipline. “The rules protect you against your own bad judgment about what’s going on at […]

Read more

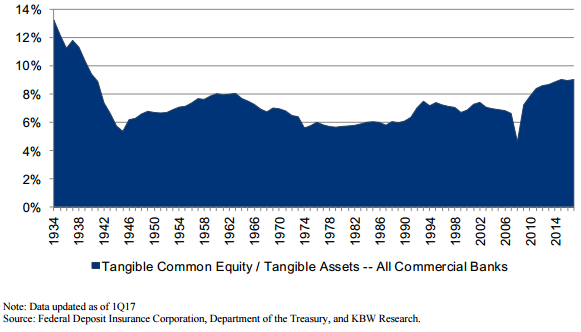

With banks showing they’re at perhaps their best health since the financial crisis and ready to return heaps of cash to investors, it would be natural to expect a little more market enthusiasm. Instead, the sector has stumbled through the year, the luster of its “Trump trade” status wearing thin and even the prospect of […]

Read more

A group of “classic” Dow stocks is surging this year, but a top technician warns that the rally in one name in particular is about to stall. While everyone has been focused on the FANG group, a number of classic Dow stocks have been on a stealth rally. Boeing and McDonald’s are leading the pack, […]

Read moreSeaWorld‘s stock fell 6 percent on Monday, three days after the company announced two federal investigations into public statements and trading in the company’s securities after the premier of the documentary “Blackfish.” SeaWorld received subpoenas earlier this month from the U.S. Department of Justice and the Securities and Exchange Commission “concerning disclosures and public statements […]

Read more

To some degree, Wall Street economists and strategists are tasked with telling the future. Predictions are often based on historical research and analysis, and their firms (and clients) hope they’re on the mark. But according to Deutsche Bank’s chief international economist, Torsten Slok, forecasts for one of the economy’s benchmark measurements, the rate on the […]

Read moreRobert Soros, the eldest son of George Soros, is stepping down as deputy chairman and president of Soros Fund Management, a spokesman for the fund told Reuters. Soros, 53, who will remain an owner at the firm, will set up Soros Capital to look at illiquid investments, including venture capital, the spokesman said. David Milich, […]

Read moreDrugstore stocks jumped on Monday as Rite Aid‘s merger with Walgreens appeared to be closer to gaining approval. Shares of Rite Aid are up over 11 percent on Monday on high-volume trading. The Federal Trade Commission has to approve the merger, and doubts about that approval are easing, giving a boost to drug shares. Fred’s […]

Read more

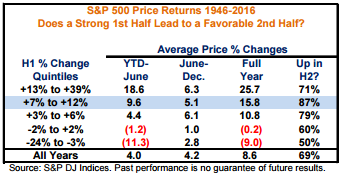

The S&P 500’s strong 8.9 percent rise since January bodes well for the second half of the year, if history is any guide. The nearly 9 percent boost represents more than twice the average increase during the first six months of all years since 1946 and more gains typically follow such a strong start to […]

Read more

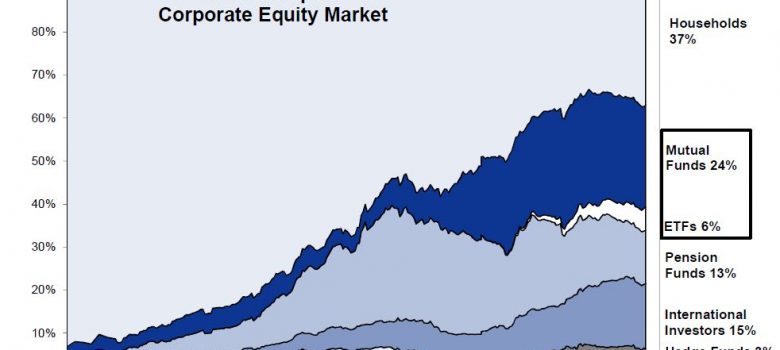

Passive investing is taking a bigger share of the stock market, helping to drive gains. Exchange-traded funds, or ETFs, owned nearly 6 percent of the U.S. stock market as of the end of the first quarter, their greatest share on record, according to analysis by Goldman Sachs. Known as passive investments, ETFs are baskets of […]

Read more