America’s budget deficit and unemployment rate are heading in opposite directions — something that’s never happened during post World War II peacetime and could cause a significant jump in interest rates.

Goldman Sachs projects, for instance, that the 10-year Treasury note could be yielding 3.6 percent next year.

The deficit increase is coming due to the recent barrage of fiscal stimulus from Congress, including a $1.5 trillion tax cut approved in December 2017 and a $1.3 trillion spending bill aimed at keeping the government operating through the end of the fiscal year.

Normally such moves would come as in the early stages of an economic recovery. The U.S. economy, though, is in the eighth year of its post-financial crisis expansion, middling as it has been.

The unemployment rate is now at 3.9 percent and falling, while the budget deficit was at $668 billion in 2017 and is expected, according to the Congressional Budget Office, to top $1 trillion by 2020. That’s a dual phenomenon that is highly uncommon in the U.S., according to Goldman economists.

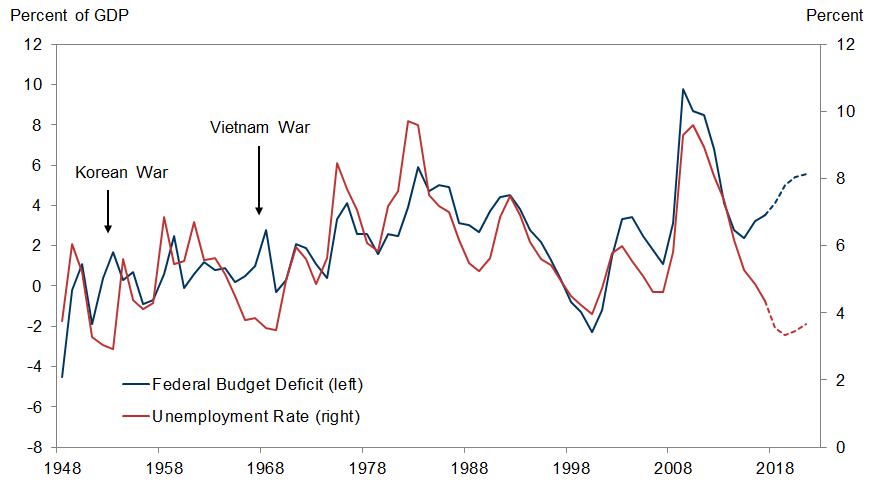

The chart below shows that the only time since World War II that the deficit has risen while unemployment has fallen was during the Korean and Vietnam wars. An expanding economy normally would help drive down the deficit, but that hasn’t been the case as government borrowing continues to grow.

Source: Department of Labor, Office of Management and Budget, Goldman Sachs Global Investment Research

To meet the growing debt load, the U.S. will have to issue more bonds at a time when the Federal Reserve is no longer a player in the market.

More supply and fewer buyers will mean the government will have to pay investors more to buy U.S. debt. And that will mean higher interest rates.

Goldman specifically projects the benchmark U.S. Treasury note will be yielding 3.6 percent by the end of 2019, up from a shade below 3 percent where it’s trading now and at a point where it could start applying pressure to economic growth.

“The sizeable demand boost provided by the recent deficit-increasing tax cuts and spending cap increases at a time when the economy is already somewhat beyond full employment is a striking departure from historical norms that is likely to contribute to further overheating this year and next and tighter monetary policy in response,” Goldman economists Daan Struyven and David Mericle said in a report for clients.

Indeed, the Fed is expected to continue hiking interest rates, in part a response to expanding economic growth as evidenced by the drop in unemployment, and to head off overheating and inflation.

While Fed officials profess to focusing on full employment and price stability, they’ve also been public with their fears about the deteriorating fiscal situation.

Goldman estimates that the fiscal stimulus will boost the level of debt to GDP from 4 percent currently to 5.5 percent by fiscal year 2021. The economy is actually coming off its best month ever, with a surplus in April of $218 billion, according to the CBO. However, the deficit otherwise has been growing and is up to $382 billion in fiscal 2018, a 10.7 percent year-over-year gain.

“The unusual increase in the deficit is even more surprising because it comes at a time when the federal debt-to-GDP ratio is already approaching historical highs,” the economists wrote. “The resulting increase in Treasury issuance will require the public to absorb considerably more government debt in coming years.”

The rising deficits likely will be responsible for 30 of the 60 basis point rise that Goldman is predicting.

In Fed terms, that’s the equivalent of more than one quarter-point hike, at a time when the central bank is projecting a total of three increases both in 2018 and 2019.

Cleveland Fed President Loretta Mester, in an interview with CNBC’s Joumanna Bercetche, said the U.S. needs to pay attention to its growing debt load — at $21 trillion and counting — before it gets “out of hand.”

WATCH: A congressman counts up the deficit toll.

Goldman: Something strange is happening with the US economy that could cause interest rates to jump