Stock-market bulls have plenty to be proud of after two months of hard-won progress, but they still have a bit more to prove.

The S&P 500 benchmark is up more than 6 percent since early April, chopping sideways and grinding higher through a well-hyped series of ills that threatened to compromise the health of the bull market. But the uptrend was narrowly maintained as trade-policy conflicts, rising bond yields, a tech-regulation panic and an unnerving wobble on global growth.

After Monday’s tidy little rally to extend small gains in May, the S&P is at a nearly three-month high and up 2.7 percent year to date; the Nasdaq Composite and Russell 2000 index are at new all-time records; tech and consumer-cyclical stocks are leading and the Cboe Volatility Index has retreated toward 2018 lows.

None of these developments are bearish, and all are encouraging to the bulls who have been treating the past four months as a corrective reset for the next move higher rather than the start of a deep or lasting decline.

And yet, with all that, the S&P 500 has only just reached the level that needs to be surpassed to more decisively suggest the market’s repair process is mostly through. And it has so far failed to show convincing momentum or prove that it can push higher once it gets to an “overbought” condition — something truly strong markets tend to do.

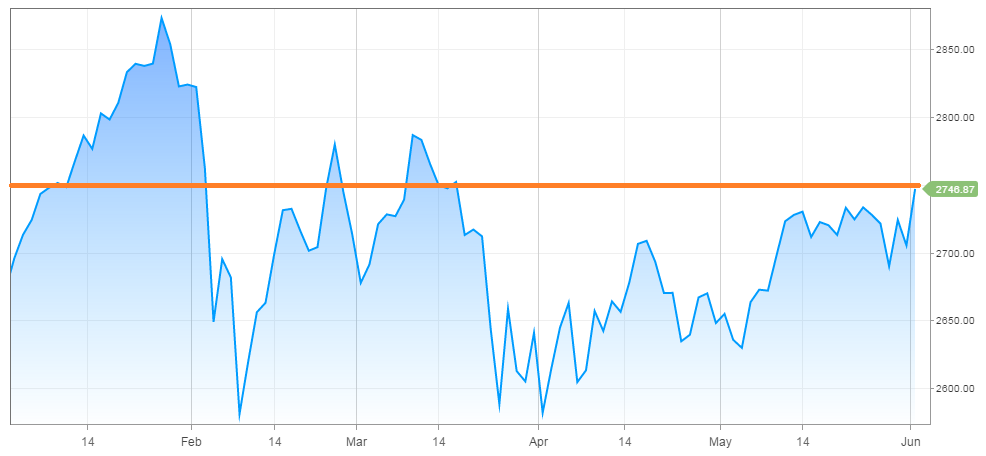

The index is on the verge of 2750, a threshold from which it fell sharply on March 19 — days after President Trump’s tariff threats first rattled investors, the Monday after Facebook’s data-handling controversy rattled the tech sector and just ahead of a Federal Reserve rate hike.

Here’s the S&P 500 year-to-date chart highlighting the 2750 level — which some chart-trusting traders think would be an important hurdle to clear.

It’s fitting the latest run higher, since the middle of last week, came after another quick selloff linked to political and financial instability in Italy and purportedly frightening headlines on new tariffs on U.S. allies and those countries’ retaliation.

When the market has been trudging in a tight range, it often needs a sharp setback to generate a bit of fear and then a slingshot higher when the scare is absorbed and placed in perspective. Or, to use another metaphor, the market needs a small, weakened dose of what it fears might sicken it as an inoculation.

It so happens that the bout of mild global turbulence did a service: pulling Treasury yields down from their highs above 3 percent, where they stayed even after a quite-strong U.S. employment report Friday. Good U.S. growth with global tumult suppressing interest rates, pressuring oil prices, possibly keeping the Fed patient and allowing deflationary Big Tech to power a new rally phase?

Sounds rather like the late-1990s formula, when put that way.

The leadership of tech, and growth stocks more broadly, comes as financial stocks struggle a bit and energy shares pull back hard after a powerful multi-week surge.

Goldman Sachs weighed in Monday that growth stock leadership ought to persist at this stage of the bull market, when doubts about the sustainability of earnings growth among cyclical companies prevails. This even as Bank of America Merrill Lynch quantitative analysts calculate that upward-versus-downward profit-forecast changes for the second quarter are stronger than in all but 7 percent of measured history.

The unevenness (some might say selectivity) of the market strength lately is perhaps one thing the bulls need to prove can support further price gains. Since the last time the S&P 500 traded at 2750 in mid-March, only energy, tech and consumer discretionary have appreciably outpaced the index.

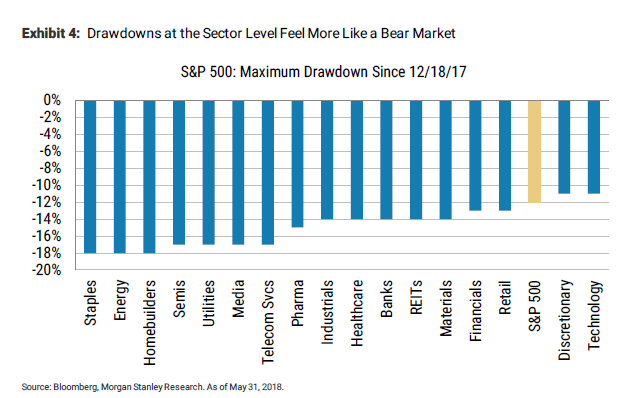

Mike Wilson, strategist at Morgan Stanley points out that all sectors but two have had pullbacks that were deeper than the S&P 500 itself since the market’s price-to-earnings ratio peaked on Dec. 18 (just as the tax-cut passed into law).

A “rolling bear market,” by Wilson’s estimation. Of course, one could also argue that this has been the market’s way of clearing out and burning the underbrush from each area, so that growth might flourish again.

But this phenomenon nonetheless leaves the bulls with the burden of proof that the market advance is not narrowing in a typical late-cycle fashion.

A final key test for this rally would come when (if?) 10-year bond yields again rise back above 3 percent and perhaps push to fresh highs above 3.12 percent or so. Stocks gradually seemed to make their peace with 3 percent bonds in May, but much higher and they’d kick up those equity-valuation headwinds again.

A month ago, it seemed the market’s springtime churn had taken the tape near a decision point, and it looked likelier to break higher rather than fail again. That idea has played out, so far. But the bulls have a bit more work to do as stocks now contend with another logical stall point.

Source: Investment Cnbc

If the S&P 500 can clear this next tough hurdle, it will prove this market comeback is for real