CENTRAL bankers and economists have spilled much ink in recent years on the question of why wages have not grown more. The average unemployment rate in advanced economies is 5.3%, lower than before the financial crisis. Yet even in America, the hottest rich-world economy, pay is growing by less than 3% annually. This month the European Central Bank devoted much of its annual shindig in Sintra, Portugal to discussing the wage puzzle.

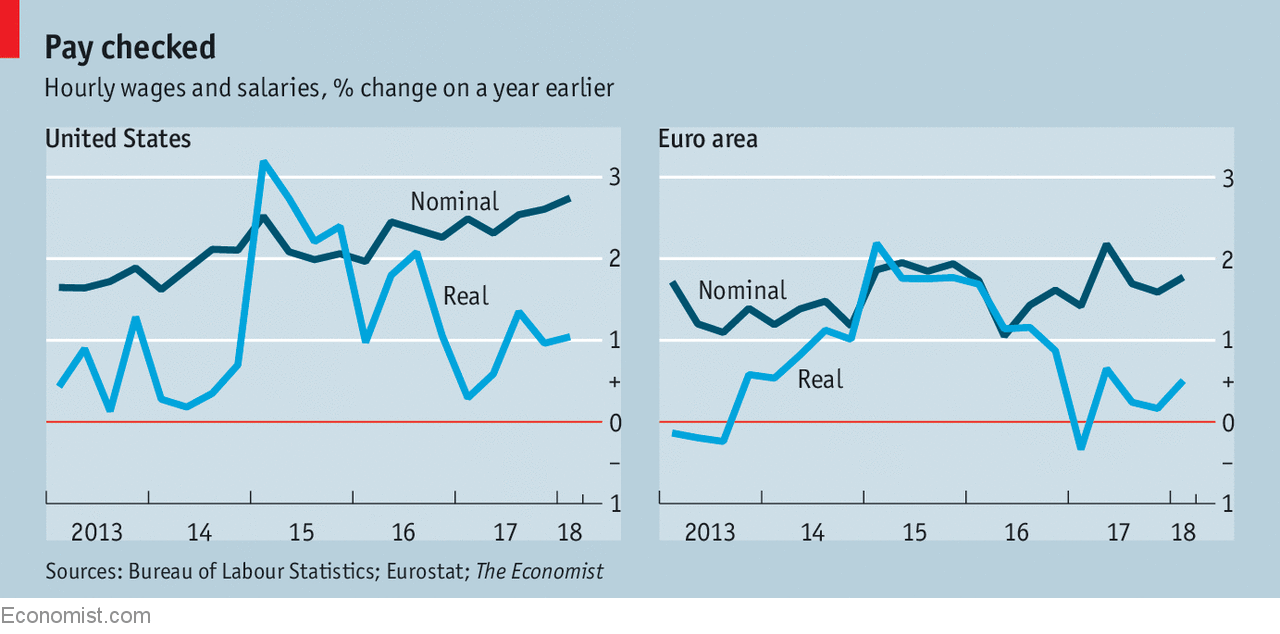

Recent data show, however, that the problem rich countries face is not that nominal wage growth has failed to respond to economic conditions. It is that inflation is eating up pay increases and that real—that is, inflation-adjusted—wages are therefore stagnant. Real wages in America and the euro zone, for example, are growing more slowly even as the world economy, and headline pay, have both picked up (see chart).

-

Angela Merkel’s European negotiations put her on the front foot in Berlin

-

Britain’s future king faces up to Jerusalem’s religious politics

-

Penalty shoot-outs are basically still crap-shoots

-

The Burmese army invades the big screen

-

The EU argues till dawn on migration, and achieves little

-

The EU argues till dawn on migration, and achieves little

The proximate cause is the oil price. As the price of Brent crude oil, a benchmark, fell from over $110 a barrel in mid-2014 to under $30 a barrel by January 2016, inflation tumbled, even turning negative in Europe. That sparked justified worries about a global deflationary slump. But it was an immediate boon for workers, who saw nominal pay increases of around 2% translate into real wage gains of about the same size. (An exception was Japan, where a rise in the sales tax from 5% to 8% in 2014 squeezed wallets.)

Since then, nominal wage growth has gradually picked up as labour markets have tightened, roughly in line with the predictions of economists who use broader measures of slack than just the unemployment rate. But inflation has risen in tandem with wages, as the oil price has recovered to close to $75 a barrel. That means many workers are yet to feel the benefit of the global economic upswing that began during 2017. In America and Europe, real wages are growing barely faster than they were five years ago, when unemployment was much higher.

In the long run, changes in real wages are linked to changes in workers’ productivity, which has grown slowly everywhere since the financial crisis. In the year to the first quarter of 2018, for example, American productivity grew by only 0.4%. But some spy a rebound. For current forecasts of blazing economic growth in America to bear out, productivity must grow faster. In the second half of 2017, productivity in Britain grew at the fastest rate since 2005. The Bank of Japan thinks that firms there are investing heavily to boost productivity so that they do not have to pay for higher wages by raising prices.

Yet even a recovery in productivity would not guarantee good times for workers. In recent decades the share of GDP going to labour, rather than to capital, has fallen because real pay has increased more slowly than productivity. In advanced economies labour’s share fell from almost 55% to about 51% between 1970 and 2015, according to researchers at the IMF. A widely heard explanation is that a fall in union membership, combined with rising offshoring and outsourcing, has eroded workers’ bargaining power. More recently, economists have suggested that labour’s falling share could be linked to the rise of “superstar” firms such as Google that dominate their markets and have low labour costs relative to their enormous profits.

Reversing the fall in labour’s share of GDP would require real wages to grow faster than productivity, weighing on firms’ profit margins. Continued tightening in labour markets might yet boost workers’ bargaining power enough for that to happen, as was the case during the late 1990s and late 2000s, two unusual periods in which labour’s share of GDP rose across the rich world. There is still room for improvement. For instance, even where unemployment rates are low, the number of part-time workers who want full-time jobs remains unusually high. This continues to weigh on wage growth, according to an analysis by the IMF late last year.

Some countries, such as Italy, still suffer from unemployment rates that are far higher than they were before the financial crisis. Such pockets of slack might constrain wages everywhere now that goods are produced in international supply chains and sold on global markets. In a recent working paper, Kristin Forbes of the Massachusetts Institute of Technology concluded that the influence on inflation of global slack and commodity prices has grown in the past decade, while local economic conditions have become less important. Philip Lowe, the governor of Australia’s central bank, told the audience in Sintra that when he asks firms that are struggling to find workers why they do not pay more, they “look at me as if I’m completely mad” and deliver a lecture on how competitive the world has become.

If slack were eliminated everywhere, pay might rise faster. The question is whether inflation continues to rise in tandem as companies find that, when push comes to shove, they can pass higher costs onto their customers. If they can, there is little hope for much improving workers’ lot in real terms. The Federal Reserve has been raising interest rates in response to a perceived inflationary threat. The European Central Bank, too, is tightening, saying that it will probably stop asset purchases at the end of the year. Mario Draghi, its president, points to growth in hourly pay of 1.8% as a justification for the move.

That seems a little hasty, given workers’ lamentable fortunes in recent decades. But hawks think there is little room to boost real wages by running labour markets hotter. If they are proved right, it will be hard to refute the argument that structural changes in the economy, rather than weak demand alone, have stacked the deck against workers. Governments will then have to find novel ways to respond—or hope for another crash in the oil price.

Source: economist

The rich world needs higher real wage growth