Roku’s startling first day surge made it the best-performing IPO this year, but the good times for the company’s shareholders may not last, according to a fund manager and top technology analysts.

Its stock jumped 68 percent on Thursday, its first day of trading as a public company. The streaming media player maker’s stock soared again the following day, rising another 13 percent Friday.

“Roku’s debut on the NASDAQ popped nearly 70%, representing the highest single day return for a US IPO in 2017,” Dealogic’s Domenico Positano said. “This large pop could inject some much needed confidence back into the IPO market, which has been disappointed by tech flops like Snap and Blue Apron this year.”

Roku priced the deal at $14 per share Wednesday, the high end of the expected range of between $12 per share and $14 per share.

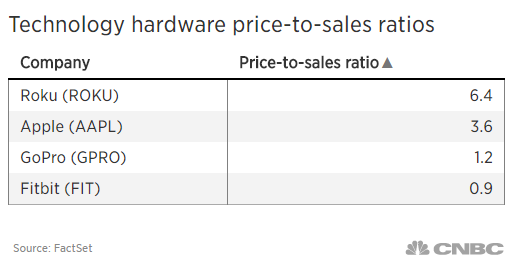

After Roku’s stunning stock move, it is now valued at a much higher price-to-sales multiple than many of its technology hardware peers.

Not everyone is staying on board after the rally. One Wall Street fund manager, who received an allocation of the Roku IPO, subsequently sold the stock following the offering. The investor believes that most of the buying during the first two days of trading are from retail accounts not institutional funds. The source requested anonymity to protect future IPO deal allocations.

“It’s hard to see the stock finding a level of fundamental support close to $30, the landscape is still very competitive and Roku’s path to profitability is unclear,” the person said.

Roku generated $399 million in revenue last year and $320 million in 2015. The company posted losses in both years of $43 million and $41 million respectively. In addition, hardware player sales represented nearly three-quarter of 2016’s sales, according to the company’s prospectus.

The company’s sales concentration in the hardware business has some analysts concerned. The technology industry’s history is littered with early hardware innovators such as Blackberry, Fitbit and GoPro that eventually flamed out after competitors entered the market.

“Roku had first mover advantage, the channels like them and they are a very lean company, all positive,” Patrick Moorhead, principal analyst at Moor Insights & Strategy, wrote in an email. “What concerns me is that the company becomes commoditized as they’re really not bringing anything unique to the table anymore in a rapidly growing market.”

Roku said in its IPO document “Amazon.com, Apple Inc. and Google Inc. offer TV streaming products that compete with our streaming players” in addition to TV manufacturers such as LG, Samsung and Vizio that offer their own built-in streaming solutions.

The company also said it had 15.1 million active accounts as of June 2017 and it is focusing on expanding its non-hardware based sales such as advertising and video subscription revenue share from its platform.

One industry analyst is mixed on whether Roku will be able to transform its business model under the onslaught of larger technology giants with more financial resources.

“Roku seems to be making it work in its transition away from player sales and towards monetizing its audience, but it continues to go up against three of the biggest companies in the consumer technology industry, all of which are increasingly building voice controls and other advanced features into their TV boxes and platforms in a way that may be tough for Roku to counter,” Jan Dawson, founder and chief analyst of Jackdaw Research, wrote in a email.

He added, “on the whole, I think they have a shot but they’re going to have to execute pretty flawlessly to make it work.”

Roku sent the following statement from its chief financial officer Steve Louden when asked for comment for this story:

“We’re a fast growing company. We’re investing a lot into our software platform and building out features that are going to result in more gross profit. We understand that companies should be profitable but we’re still investing today.

The platform business is growing at roughly 100 percent, year over year, and it’s extremely high margin. It has gone from being about a third of total gross profit to over 80 percent of the gross profit in the first half of the year.

We are #1 in the market. We have been competing effectively against Apple, Alphabet and Amazon for many years. Consumers love using Roku devices.”

Source: Tech CNBC

Wall Street, industry experts are skeptical over Roku’s soaring IPO