THEY have been at this a long time. In 1994 Republicans, newly in charge of Congress, held hearings on what would come to be called “dynamic scoring”. Bills, they said, should be evaluated using the predictive power of macroeconomic models. If the model predicts more GDP growth, then it could be inferred that the growth would produce more tax revenue. During the hearings, however, came an awkward moment. Alan Greenspan, then in charge of the Federal Reserve, told Congress that macroeconomic models were “deficient”. That is, their predictive power, though interesting, was not good enough to rely on. Last year, after the election of Donald Trump, your blogger contacted Mr Greenspan to see whether the models were good enough yet. Mr Greenspan, his office responded, had not yet changed his opinion.

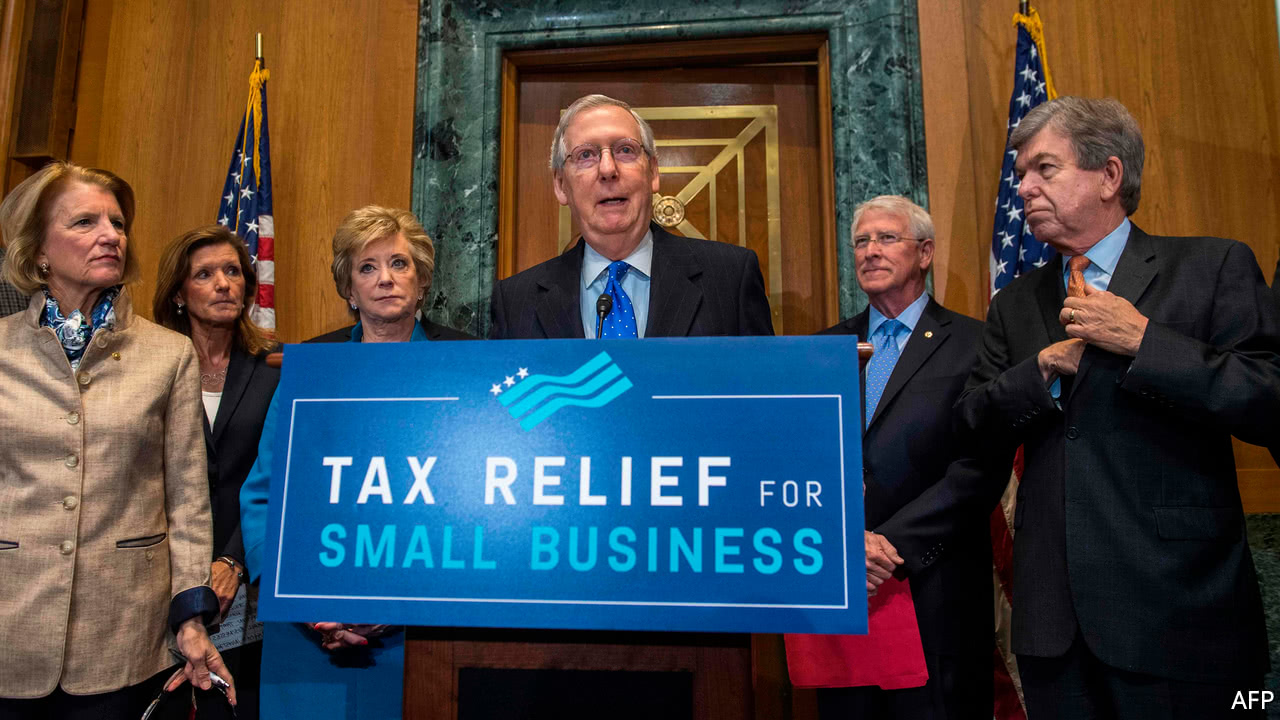

Neither have Republicans. Over the past two decades, in and out of control of Congress, the party has nudged dynamic scoring successively closer to the official policy process until we arrived, yesterday evening, at as dramatic a moment as macroeconomic analysis ever gets. The Joint Committee on Taxation, the nonpartisan Congressional body responsible for evaluating tax proposals, hurried its study (PDF) out on a Thursday afternoon as the Senate was preparing to approve a tax cut. That cut, using the dynamic scoring method Republicans had championed since the age of Newt Gingrich, would still cost $1trn.

-

Michael Flynn pleads guilty to lying to the FBI over Russia contacts

-

Republicans grouse about tax models they once supported

-

The 2017 Daily chart advent calendar

-

Sexual politics on stage

-

Evo Morales finds a way to run for re-election

-

Game over for virtual reality?

As of Friday morning, the future of that tax bill remained uncertain. It is now up to American conservatives to decide whether their economic policies are social science or market magic.

Lurk near PhD economists online or at conferences, and you will hear them talk about “crisis in macro”. They mean that the models and assumptions most dominant among macroeconomists have failed repeatedly since 2007 to predict or even describe what’s happening. A defence, popular among academics, goes like this: we did get it wrong, but as responsible social scientists, we’re busy and fascinated right now, trying to figure out what was broken and how to fix it. It is a fair defence. In particular young macroeconomists have been using bigger datasets and faster computers to more accurately predict human behaviour. Economists are more likely to accept now, for example, that people with and without access to credit or wealth react differently to the same policy, an idea that is slowly working its way into models at central banks and even at the Joint Committee on Taxation.

This progress is unfortunate for Republicans. In the 1990s social science was on their side. Because data and computing power were harder to come by, macroeconomic models relied on thought experiments. The seminal model showing the ideal capital-gains tax rate as zero, for example, dates to 1986. It assumes that the economy consists of only one person. Also, she is immortal. The Wonder Woman economy, if you will. That model is now interesting only for a lecture on the history of economic thought. We’ve moved on, macroeconomists protest. But economists have. And Republicans haven’t.

It’s still worth asking whether a country should rely on macroeconomic models at all. It’s not completely clear how well they work. To strap yourself into one for predictions ten years in the future is a little like climbing into an experimental airplane. Perhaps fine for a test pilot without a family, but you wouldn’t recommend it for 300 commercial passengers. Or, in this case, 330m citizens.

But if you are going to insist on modeling the future and then planning around it, you have to do it right. The economists at the Joint Committee on Taxation are thoughtful. They read the most recent research. They examine their own models and, when they can, update them—conservatively. If, as Republicans have been insisting for 20 years, we have to assess our tax policies with dynamic scoring, there is no better way to do it than through the JCT. Unfortunately, as modeling has improved, it has not improved in the direction Republicans prefer, which leaves them where they are now. They wanted social science in policy-making, and they got it, in the form of a $1trn tax bill.

So when this bill comes to a vote in the full Senate, we’ll have an answer. If it becomes law, we’ll know that dynamic scoring was never about economics. It was about tax cuts. There’s a huge difference. It is the difference between social science and magic.

Source: economist

Republicans grouse about tax models they once supported