Bitcoin doesn’t show textbook signs of a bubble yet, but there are other reasons not to buy it, says investing expert William J. Bernstein.

The digital currency has “no intrinsic value,” Bernstein said in a phone interview with CNBC.com. It’s “awfully suspicious on that criteria alone.”

The “fact the price keeps rising, that’s a very bad sign,” he said.

Bernstein is a neurologist who began writing about investing in the 1990s, soon becoming a best-selling author and drawing the admiration of legends such as Vanguard’s Jack Bogle for his clear and rational analysis. He is best known for books such as “The Intelligent Asset Allocator” and “The Four Pillars of Investing” that show independent investors how to manage their money for the long term. He is currently retired as a doctor, but co-principal at Efficient Frontier Advisors, a money management firm for the very wealthy.

“Bitcoin is not something I want to waste my time on,” Bernstein told CNBC. “Unless [you are] an expert on blockchain technology and bitcoin, stay away. Don’t invest in things [you] don’t understand.”

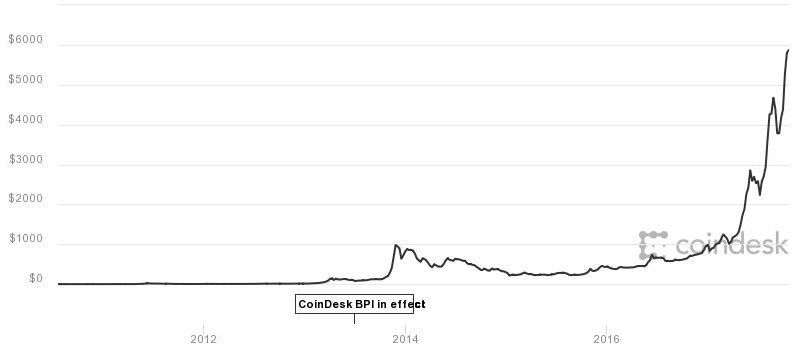

Bitcoin topped $6,100 this weekend to hit a record high and has a market capitalization of close to $100 billion, larger than Goldman Sachs’ $94 billion. The digital currency is created through a “mining” process in which computers solve a complex mathematical equation and receive bitcoin in reward. Although use in commercial transactions is limited, bitcoin can be traded on exchanges around the world. A surge of interest in bitcoin from investors, including some institutional investors, has helped the digital currency multiply six times in value this year.

Bitcoin (2010-2017)

Source: CoinDesk

Despite those gains, bitcoin doesn’t quite fulfill all four criteria of a bubble, Bernstein said.

First, the digital currency hasn’t yet become the primary topic of social gatherings, he told CNBC.

And second, most people aren’t quitting well-paying jobs to speculate in bitcoin.

Also, skeptics of bitcoin aren’t yet met with anger.

The only sign of bitcoin being in a bubble that Bernstein can see are some “whiffs” of extreme price predictions.

The most outspoken digital currency proponents forecast bitcoin at least quadrupling in the next five years.

Digital currency investors may benefit from understanding how bubbles have played out over the centuries.

The “most important” chapter, as Bernstein says in his 2002 book “The Four Pillars of Investing,” is a history of manias. He roams in his book as far back as 1687, to a proliferation of worthless stock issues for diving companies after one New England sea captain salvaged 32 tons of silver from a wrecked Spanish pirate ship.

“Of the four key areas of investment knowledge —theory, history, psychology, and investment industry practices — the lack of historical knowledge is the one that causes the most damage,” Bernstein writes. “In finance, there is no controversy: the same speculative follies play out with almost clock-like regularity about once a generation.”

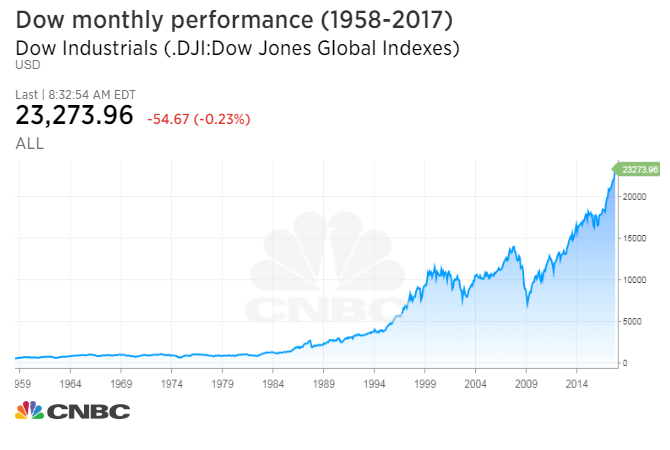

The largest group of Americans alive today — 26-year-olds, according to Deutsche Bank — have never been full-time working adults during a bear market, or a stock drop of at least 20 percent from a recent high. However, most have a clear impression of the financial crisis, during which the Dow Jones industrial average fell about 54 percent from October 2007 to March 2009.

Perhaps as a result, younger Americans are more inclined to invest in bitcoin than stocks, polls indicate.

Bernstein suggests the young learn about what happened in the aftermath of the 1973 to 1974 stock market crash. The stock market became so unloved that, as he quotes in “Pillars,” BusinessWeek ran a cover story in August 1979 entitled “The Death of Equities.” Younger investors were avoiding stocks, then too, while those above age 65 were still holding them.

Then Bernstein gives his analysis, no emphasis added:

Did the elderly stick with stocks in 1979 because they were out of step, inattentive, or senile? No! They were the only ones who still remembered how to value stocks by traditional criteria, which told them that stocks were cheap, cheap, cheap. They were the only investors with experience enough to know that severe bear markets are usually followed by powerful bull markets.

To avoid the stock market would be to miss out. The Dow has climbed about 254 percent to record highs since the financial crisis.

Bernstein told CNBC he recommends young investors buy stocks through a “target retirement fund that is fully indexed” with an expense ratio of less than 17 basis points.

His book offers a final mantra Bernstein says investors should repeat to themselves “at least a few times per year”:

“The market is much smarter than I will ever be. There are millions of other investors who are much better equipped than I, all searching for the financial Fountain of Youth.

My chances of being the first to find it are not that good. If I can’t beat the market, then the very best I can hope to do is to join it as cheaply and efficiently as possible.”

Source: Tech CNBC

Bitcoin is not a classic bubble, but still be 'suspicious,' says investing expert William Bernstein