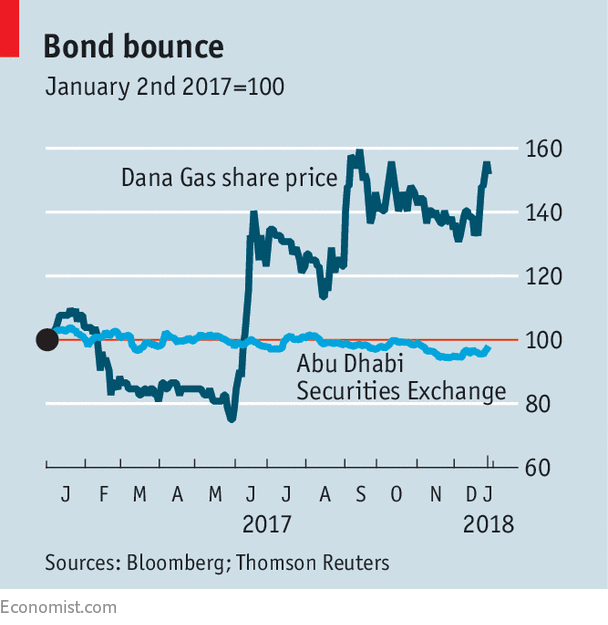

STOCKMARKETS in the Gulf do not observe Christian holidays, but still had a generally quiet day on December 25th. Shares in Dana Gas, an exploration business listed in Abu Dhabi, however, did make some noise, leaping by 13.2% on Christmas Day, to complete a buoyant six months for the stock (see chart). The surge may owe something to the company’s recent arbitration victory against the regional government of Iraqi Kurdistan, over $2bn it and its consortium partners are owed in overdue payments. But it also hints at shareholders’ belief that Dana will not be forced soon to satisfy its own creditors. They have been up in arms since the firm refused to honour a $700m Islamic bond, or sukuk, that matured in October.

-

Will Donald Trump’s pro-coal policies put miners’ lives at risk?

-

Two security flaws in modern chips cause big headaches for the tech business

-

Are America’s airports the worst in the world?

-

Is the bubble only starting?

-

Retail sales, producer prices, wages and exchange rates

-

Foreign reserves

Dana says it has received legal advice that the security no longer complies with sharia, the body of Koranic law, and so the bond is “unlawful” in the United Arab Emirates (UAE). In July, facing liquidity difficulties, it stopped redeeming coupons (to “distribute profits”—the sukuk equivalent of interest payments). In November a British court ruled that the company had to pay. The judges said that, because the bond was issued under English law, it had to be viewed on its merits under that law alone. The risk of non-compliance in the UAE, they argued, must fall squarely on Dana.

The Islamic-finance industry cheered this ruling. Since sharia forbids the receipt of interest, sukuk are backed by assets. Investors get paid an agreed share of profits, before being returned the principal at maturity. Yet there is a host of possible arrangements, and no final authority for deciding which bonds are sharia-compliant. Issuers instead rely on the opinions of scholars, who do not always agree. Dana’s refusal to pay had led investors to fear struggling issuers would start using such squabbles as an excuse to renege on dues. After the ruling the industry feels “70% comfortable”, says Mohammed Khnifer of the Islamic Development Bank, a multilateral lender based in Saudi Arabia.

The victory, however, may prove pyrrhic. To get hold of Dana’s domestic assets, creditors need a new ruling from the UAE courts. The outcome is unpredictable. A first hearing on the legality of the transaction was due to be held on December 25th itself, but adjourned until May. Seizing Dana’s overseas assets, located in Egypt, Kurdistan and Bahrain, may be just as hard. Egypt is locked in a legal dispute with the company. Iraq and Bahrain are not known as easy places to enforce court rulings.

Time is on Dana’s side. The company has said it will appeal against the British judgment. The losing party in the UAE ruling, whenever that comes, will probably do the same. Proceedings could thus take years. The legal fees incurred by the creditors, led by BlackRock and Goldman Sachs, will soon mount. Stuart Ure of Clifford Chance, a law firm, suspects sukuk holders will eventually be forced to the negotiating table. Precedent suggests they will probably have to accept some loss on the bond’s face value. The fear among analysts in the UAE is that if other delinquent issuers start using Islamic and local law as a “shield” the whole sukuk market might shrivel.

For now, overall demand for sukuk remains strong. But appetite for non-rated or sub-investment-grade issuers in emerging markets could easily weaken. In recent months, the industry has reacted to the Dana case by tightening the language of sukuk contracts, notably through clauses that waive borrowers’ rights to challenge an arrangement’s sharia compliance. David Miles of Covington & Burling, a law firm, welcomes such provisions, but says they do not solve the enforcement problem. Nor will it be possible for all new sukuk to be governed solely by English law. Some will be backed by tangible assets, such as property, located in other jurisdictions. The Dana saga is a reminder not just that Islamic finance still lacks shared standards, but also that court judgments help creditors only when they are enforceable.

Source: economist

A bond dispute threatens the future of Islamic finance